Coles and Woolworths questioned about pricing and landbanking in Senate committee, ASX falls — as it happened

The local share market lost ground after inflation and jobless claims data slightly eased expectations of a US rate cut.

Coles and Woolworths faced a Senate committee, while Tesla unveiled its self-driving 'robotaxi'.

Follow the day's financial news and insights from our specialist business reporters on our live blog.

Disclaimer: this blog is not intended as investment advice.

Live updates

Market snapshot

- ASX 200: -0.1% to 8,214 points (live values below)

- Australian dollar: flat at 67.40 US cents

- S&P 500: -0.2% to 5,780 points

- Nasdaq: -0.1% to 18,282 points

- FTSE: -0.1% to 7,237 points

- EuroStoxx: -0.2% to 519 points

- Spot gold: +0.6% to $US2,644/ounce

- Brent crude: -0.3% to $US79.20/barrel

- Iron ore: +1.2% to $US106.10/tonne

- Bitcoin: +1.6% to $US60,678

Prices current around 4:15pm AEDT.

Live updates on the major ASX indices:

Down day but a positive week for ASX

The ASX 200 closed 0.1 per cent lower on Friday, but over the week it was positive — gaining 0.7 per cent.

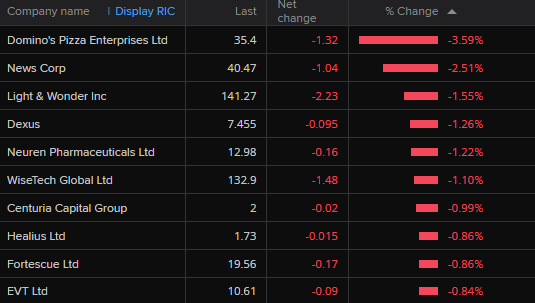

Here are the best and worst performers from Friday's session:

That's all from the team today, but you can catch Close of Business on the ABC News Channel and iView over the weekend, and read analysis from our team on the ABC News website.

In the meantime, enjoy your Friday!

New Zealand could slash rates by 75bp next month

The Reserve Bank of New Zealand (RBNZ) cut its official cash rate by 50 basis points earlier this week - as expected.

Capital Economics looked at New Zealand's breakdown of national accounts data, released yesterday, and says it shows a 0.9% decline in household net disposable income in Q2, partly due to a 6% drop in entrepreneurial income.

Small businesses are struggling, and company liquidations have surged by nearly 40% year-on-year, reaching a 13-year high, signalling continued weakness in entrepreneurial income moving forward.

While that's expected to remain weak, overall disposable income may recover due to July's tax cuts.

Given the fragile state of the economy, there's a possibility that the RBNZ will pull the trigger on a 75bp rate cut in November.

Tesla wraps up the show

Musk is off the stage after unveiling a fleet of fully autonomous robotaxis.

Here are some screenshots of the new cars.

We can't check out how the announcement has affected Tesla stock just yet (it's almost midnight in New York) but one of its competitors is trading currently.

Shares in Chinese EV company Build Your Dreams (BYD) are down about -2.5% although that could be due to a variety of factors, including the fact the stock has surged nearly 20 per cent in the past month.

Asian markets pull back ahead of Saturday's China stimulus reveal

It's not the first time this week markets have been playing a waiting game for further details of China's plans to stimulate its flagging economy.

On Tuesday, traders were left disappointed after a briefing by the country's economic planner contained very little to go on.

Now, all eyes are on a briefing from China's ministry of finance scheduled for lunchtime tomorrow (Saturday), with details of fiscal stimulus expected.

Midway through Friday's session, Asian markets are mixed — the Hang Seng is up 3 per cent, while the Shanghai Composite is down 1 per cent.

"Markets will be focused on the composition and size of the fiscal package," CBA economist Kristina Clifton wrote in a note focused on the potential currency market reaction.

"Measures to boost construction and infrastructure will support iron ore prices and AUD/USD, while measures to support consumer spending will support NZD/USD.

"There could be a large reaction in currency markets in early Asian trading on Monday morning when liquidity is this."

Musk announces his robotaxis will sell for $30,000

Musk said his fleet of robotaxis will sell for about US$30,000 per car.

Someone yelled from the crowd: "When will it be available?"

Great question ... because Musk has a track record of not delivering products to the market on time.

(The Cybertruck was delayed by 5 years)

Musk admitted he "tends to be optimistic with time frames" but said fully autonomous taxis will roll out in Texas and California next year (model 3 and model Y) and the "Cybercab" will be ready by 2026.

"Before 2027 let me put it that way."

He did say that regulators need to approve the use of fully autonomous self-driving before they can be shipped overseas.

Tesla's We, Robot event kicks off

Elon Musk has rocked up to his event in a robotaxi called the "Cybercab" (because it's a Cyber Truck)

"There's 20 more where that came from," he said, as the cars drove on the stage with no one inside (to an enormous roar of Musk and Tesla fans in the crowd).

"We have 50 fully autonomous cars here tonight."

Both Model Y robotaxis and Cybercabs are being unveiled. Musk said the cars have no steering wheel or pedals.

"So I hope this goes well... we'll find out."

Speaking of Tesla .. earlier this week I reported on the spying powers of modern cars - Tesla hoarded the most data out of Australia's top 10 car brands.

Check it out (shameless plug, I know):

Tesla's We, Robot announcement delayed

We're eagerly awaiting Tesla's long-awaited Robotaxi event that was meant to kick off at 1pm AEDT.

But Elon Musk has just tweeted that there was a medical emergency in the crowd so the live stream has been delayed ...

Back to the supermarkets ...

Let's get back to the senate committee on the cost of living.

As I said earlier, Coles and Woolworths are once again being questioned by senators.

In a slightly heated exchange, Greens Senator Nick McKim challenged Coles public affairs head Adam Fitzgibbons on the competitiveness of Australia's supermarket sector.

While Mr Fitzgibbons claimed Australia's supermarket environment was highly competitive, Senator McKim countered, citing the ACCC's description of the sector as an "oligopoly."

Mr Fitzgibbon acknowledged the sector's concentration but argued that this does not necessarily equate to low competition, referencing the ACCC’s 2008 report which called the sector "workably competitive".

Senator McKim pressed on, highlighting the ACCC's view that such concentrated markets are "typically not conducive to vigorous competition".

Senator McKim: "Why are your views so diametrically opposed to the ACCC?"

Mr Fitzgibbons said there was obviously no consensus around the issue and that other competition experts held alternative views.

Senator McKim: "So your view, Mr Fitzgibbons, is that the ACCC is wrong to describe the supermarket sector in Australia as an oligopoly?"

Mr Fitzgibbons: "No I don’t think that it's wrong to describe it that way. I think the purpose of the interim report is to enable commentary on some of the issues that they have put forward and that is what we will do when we provide our submission."

The same question was thrown at chief commercial officer at Woolworths Paul Harker.

Mr Harker: "The actual report says a concentrated supermarket sector is not in itself determinative of a lack of competition. The report also says that more consumers are comparing prices and 70% of consumers are visiting two to three stores in a typical week."

Senator McKim pushed him on whether he agreed Australia's supermarket sector was an oligopoly.

Mr Harker: "I accept the fact we are a concentrated supermarket sector and that is not determinative of a lack of competition."

Stay tuned!

Aussie lobster to return to China's shores

After a four-year ban, Australian rock lobster will soon be exported to China.

China announced the lift yesterday after a meeting between Prime Minister Anthony Albanese and Chinese Premier Li Qiang on the sidelines of the ASEAN summit in Vietnam.

Exports are expected to resume by the end of the year, in time for Chinese New Year in 2025.

Rock lobster exports to China were worth about $700 million a year before Beijing enforced the ban in 2020 after a diplomatic fight during the height of the pandemic.

ABC reporter Blake Kagi explains what it means for Australia:

ANZ last of the big four to drop rates below 6%

I'll have more on the supermarkets soon but first - rates!

ANZ has cut its fixed home loan rates by up to 0.60 percentage points for owner-occupiers, and up to 0.70 points for investors.

It brings ANZ's lowest fixed rate to 5.99% for 2- and 3-year terms and makes it the last of the big four to offer rates below 6%.

ANZ's 5.99% rate remains slightly higher than its competitors.

CBA and Westpac offer rates starting at 5.89%.

The lowest rate available is from SWS Bank at 4.99% for a 3-year fixed term.

According to RateCity, over 70 lenders now offer at least one fixed rate under 6%, with more cuts expected.

The next RBA meeting is November 4.

Coles and Woolies questioned about landbanking

Individual senators have started questioning Coles and Woolworths. First up is Labor Senator Jana Stewart who got straight to the point and asked why the supermarkets were holding onto sites and when they would commence building.

A bit of background: The ACCC is investigating potential land banking practices by the major supermarkets. Land banking involves purchasing land without quickly developing it, potentially blocking competitors.

In a recent interim report from the ACCC, Woolworths is said to hold 110 sites, while Coles has 42, compared to Aldi's 13 undeveloped sites.

Mr Harker kicked it off and said Woolworths had 110 sites attributed to the company but 46 sites were not actually owned by the company, they were owned by external developers. Woolworths had agreements with those developers to build a supermarket.

"They are multi-tenancy shopping centres so the timing of those is not within our control, it's within the developers," he said. "We will be one of many tenants."

Mr Harker also said of the 64 sites Woolworths did own, 43 were either built or "in stages of planning and delivery".

And when it comes to sites that are sitting pretty, he said they are located on greenfield sites and: "we won't open a supermarket before the population is there".

Mr Fitzgibbons said 99% of Coles sites are leased to the company — not owned and that a number of the sites are under construction.

"We are waiting for the population to grow [in some areas]. Some [sites] are earmarked for sale, some are tenanted."

Why are Tim Tams cheaper in the UK than Australia?

G'day! Rachel Clayton here with you to take you through the rest of the day, we'll start with the Senate Select Committee on the cost of living.

Coles and Woolworths are first up this morning — and have been asked why the Aussie favourite Tim Tams are cheaper in UK supermarkets.

Senator Jane Hume raised concerns that a 200g pack of Tim Tams costs $6 in Australia at full price, while in the UK, Tesco sells them for £2.50 ($4.86), despite the 17,000km distance between the two countries.

Paul Harker, chief commercial officer at Woolies, said the pricing is set by Arnott's, the manufacturer and that Woolworths follows Arnott's recommended retail price, then builds promotional programs around that.

But the actual cost of goods is determined by Arnott's margins, he said, and the lower price in the UK was a question for Arnott's.

Adam Fitzgibbons, head of public relations at Coles, essentially echoed Woolies and said he didn't know the specifics of Arnott's commercial arrangements with UK supermarkets.

Senator Hume said it was difficult to get every supplier to appear before the committee but noted it had previously questioned Nestlé, which had thrown responsibility for pricing at the supermarkets.

"So it does seem we go a little bit back and forth," she said.

Retailers under scrutiny amid cost of living crunch

Just so it’s clear, parliament is holding an inquiry into big box retailers that provide consumers what they want and at lower prices than competitors? During a cost of living crisis? And politicians are supposed to be taken seriously?

- Alex

Thanks Alex for your comment on the parliamentary inquiry into whether big retailers have too much power.

I guess the concern is if alternative players are squeezed out of every sector, leaving just a powerful few, then they have all the price-setting power in the long run and people will have fewer options.

But as the Roy Morgan survey showed, customers seem pretty happy with the likes of Bunnings, Aldi and Kmart at the moment amid the cost of living crisis.

They're not so happy with the big supermarkets though — this from Roy Morgan:

Over the last year we have witnessed high-profile brands, including Australia’s two most well-known supermarkets, Woolworths and Coles, lose their positions as the country’s most trusted brands.

The decline in trust, combined with sharp increases in distrust, has fundamentally altered public perceptions of these brands.

While these brands have installed new leadership to restore trust in these brands – this process is likely to take several years.

Executives from Coles and Woolworths are appearing before a Senate committee examining cost of living today — our reporter Rachel Clayton, who will be joining you on the blog shortly, will bring you the latest.

Market snapshot

- ASX 200: -0.2% to 8,210 points (live values below)

- Australian dollar: flat at 67.39 US cents

- S&P 500: -0.2% to 5,780 points

- Nasdaq: -0.1% to 18,282 points

- FTSE: -0.1% to 7,237 points

- EuroStoxx: -0.2% to 519 points

- Spot gold: +0.1% to $US2,631/ounce

- Brent crude: +3.3% to $US79.12/barrel

- Iron ore: +1.2% to $US106.10/tonne

- Bitcoin: +0.8% to $US60,180

Prices current around 10:25am AEDT.

Live updates on the major ASX indices:

ASX modestly lower in early trade, energy stocks up

The local session is underway for Friday and the ASX 200 is down 0.1 per cent at 10:20am AEDT.

Most sectors are in the red, with consumer and real estate stocks faring the worst so far.

However, the energy sector is up 0.9 per cent after the overnight gains in oil prices.

Here are the best and worst performing stocks on the benchmark index so far:

Rio bets on lithium future despite slowing EV sales

Shares in Arcadium Lithium have edged up in early trade, as investors continue to digest the news that Rio Tinto will acquire the lithium player.

Senior investment adviser at Bell Potter Securities Giuliano Sala Tenna told David Chau on The Business that the takeover of Arcadium has benefits for both parties, with Rio acquiring "one of the best portfolios of lithium reserves in the world".

Watch the full interview here:

Loading...Oil prices jump on US hurricane, Middle East fears

The local energy sector will be one to watch today, after oil prices jumped overnight, up about 4 per cent.

There were a few factors behind the latest price spike, including more fuel being consumed as people prepared for Hurricane Milton.

Here are some detail from Reuters:

In the US, the world's largest oil producer and consumer, Hurricane Milton barreled across Florida, where about a quarter of fuel stations sold out of gasoline and where the storm also knocked out power to more than 3.4 million homes and businesses.

"Closures of several product terminals, delayed tanker truck deliveries and disrupted pipeline movement will likely be affecting supplies well into next week given broad based power outages," analysts at energy advisory firm Ritterbusch and Associates said in a note.

"This vast uncertainty across Florida petroleum infrastructure generally has supported gasoline values," Ritterbusch said.

And the ongoing conflict in the Middle East also has traders on edge.

"Crude surged as traders focussed on the risks surrounding Israel’s potential retaliation for the recent Iranian missile strikes as IDF Minister Gallant warned that the strikes 'will be deadly, precise and above all surprising'. Iran also warned that it is prepared to launch 'hundreds and thousands of missiles … and target security military and economic centres'," Westpac economist Jameson Coombs wrote in a note.

"Increased supply remains a focus in the background after the deal between the two governments in Libya back on September 27 saw a new central bank governor appointed paving the way for a resumption in oil production back to circa 1m barrels per day from the recent lows at 450k barrels per day. "

Rivals eye off market share from dominant Nvidia

Overnight, Advanced Micro Devices (AMD) has revealed plans to start mass production of a new version of its artificial intelligence chip this year, as it tries to take ground from Nvidia.

However, the details of the chips unveiled by the AMD boss in San Francisco, including increased memory capacity, failed to cheer investors.

AMD shares closed 4 per cent lower, while Nvidia shares rose 1.6 per cent.

Analysts say the stock had already rallied in anticipation of the event, plus the firm didn't reveal any new customers for its chips.

But with plenty of demand for the technology from the likes of Microsoft and Meta, it's unlikely to have trouble finding a market.

ICYMI: Bunnings, Petstock among big retailers under scrutiny

So-called "big box" retailers are facing the scrutiny of a parliamentary inquiry, which will investigate whether the likes of Bunnings, Petstock, Chemist Warehouse and Ikea have too much market power.

Small, independent retailers say they are struggling to compete with the big players that have the scale to offer exclusive brands and price-beating offers.

If you missed The Business last night, you can catch up on the story from our reporter Emilia Terzon here:

Loading...While smaller competitors aren't their number one fans, a Roy Morgan release reveals consumers have loyalty to the big brands — Bunnings has been named the most trusted brand for 2024, with Aldi and Kmart taking out the supermarket and department store categories.