ASX closes higher after US rate cut, flight delays in Sydney as Qantas makes emergency landing — as it happened

The ASX 200 closed higher on Friday as global markets continued to react to a new Trump administration and a US interest rate cut.

Sydney flight delays are expected into the afternoon after an emergency landing by a Qantas flight bound for Brisbane.

Follow the day's financial news and insights from our specialist business reporters on our live blog.

Disclaimer: this blog is not intended as investment advice.

Submit a comment or question

Live updates

Market snapshot

ASX 200: +0.8% to 8,295.1 points

- Australian dollar: -0.4% at 67 US cents

- S&P 500: +0.7% to 5,973.1 points

- Dow Jones: flat at 43,729.34 points

- Nasdaq: +1.5% at 19,269.46 points

- Europe: FTSE (-0.3%), DAX (+1.7%), EuroStoxx (+1%)

- Spot gold: -0.4% at $US2,695.8/ounce

- Brent crude: -0.5% to $US75.21/barrel

- Iron ore: -1.6% to $US103.75/tonne

- Bitcoin: +0.2% to $US76,111.25

Prices current around 4.35pm AEDT.

ABC Embed

https://www.abc.net.au/news/business/embed/quote-list?abcnewsembedheight=1000

That's all for today, thanks for being with us

That's all from the business team today.

Thanks for being with us.

Wishing you all a very enjoyable and restful weekend.

See you the same time next week!

ASX closes higher

The S&P/ASX200 closed higher on Friday, gaining 68.80 points or 0.84 per cent to close at 8,295.10.

The ASX200 Index crossed above its 20-day moving average.

The top performing stocks in the index were Neuren Pharmaceuticals and Sigma Healthcare, up 14.72 per cent and 5.35 per cent respectively.

Markets have continued reacting to the Trump election win, and the impact his proposed tariffs will have on Australia. Much will depend on the severity of those tariffs.

Meanwhile, there was some cash rate relief overseas with Federal Reserve chair Jerome Powell delivering Trump's yet to be formed administration a gift in the form of a 0.25 percentage point interest rate cut.

After the interest rate decision Powell said he was sticking around to serve out his term and the president-elect could not remove him as it was "not permitted under law".

Also at the top of Trump's agenda will be bringing back maximum pressure sanctions on Iran and reducing the volume of Iranian oil barrels on the market.

RBC Capital Markets head of global commodity strategy, Helima Croft, says these sanctions "mandate significant reductions of Iranian imports and essentially force foreign entities to choose between doing business with Tehran and accessing US capital markets".

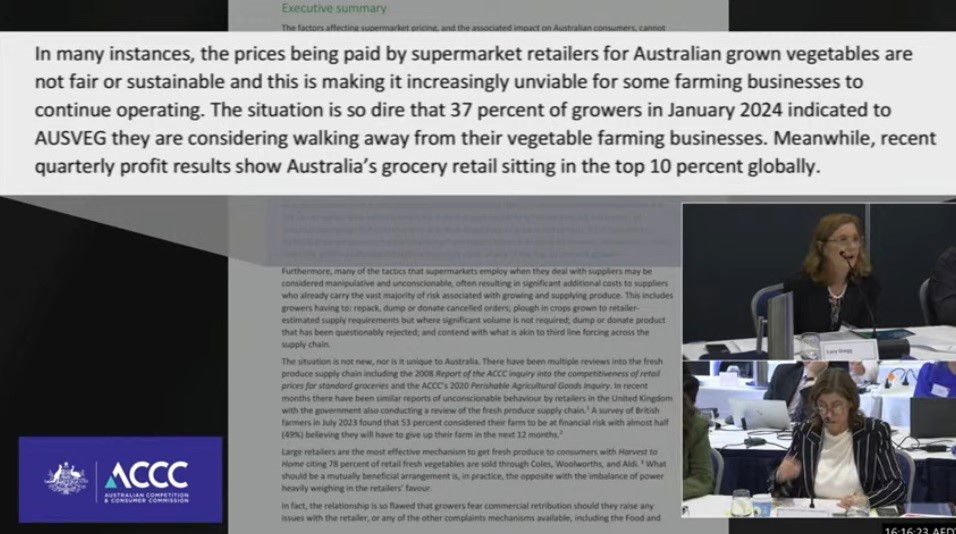

Supermarket prices 'unviable' for some farmers, ACCC inquiry hears

The second day of the ACCC's inquiry into supermarkets is close to wrapping up.

It's been a long day of testimony by a Victorian grower, Peter Hall, and two industry representatives.

The inquiry's heard allegations about how the big two, Coles and Woolworths, have contracts with growers that leave them in the dark about pricing, supply and enforced discounts.

The situation was just summed up in this slide.

"The industry is going through a tough time at the moment," Lucy Gregg from AUSVEG said.

This is our last post for the day on the ACCC inquiry, if you'd like to keep watching you can do so here.

Trump tariffs will have a 'negligible impact' on Australia: Capital Economics

Many commentators believe that Donald Trump's win and threat of high tariffs on Australia's major trading partners will have a damaging impact on Australia.

I posted earlier about how NAB's senior economist Greg Burg says the impact on China will be slower growth, and that will undoubtedly, in his view, impact Australia.

But Capital Economics' Australia and New Zealand economist Abhijit Surya argues a new tariff war would have a negligible impact on domestic inflation in Australia, and that any drag on economic activity from weaker external demand will probably be modest.

He says the direct impact of US tariffs will be minimal, as less than 4 per cent of Australia's exports go to the United States.

"We suspect second-round effects for Asian economies, where more than 80 per cent of Australian exports go, will also be contained," he says in a research note.

"For one thing, we expect US tariffs to knock off less than 0.5%-pts from China's GDP growth in 2025, reflecting, among other things, domestic policy support and tariff evasion.

"What's more, China's travails need not spread across the region. To the contrary, we think Trump 2.0 could prove beneficial for countries like Vietnam and Indonesia."

He argues Australia will also likely be "shielded somewhat by inelastic demand for its high quality mineral exports".

ANZ cuts executive bonuses

ANZ chief executive Shayne Elliott has had his bonus docked due to issues in the bank's markets business, according to the company's annual report.

The big bank boss was given a $1.3 million short term incentive, cutting his maximum bonus from $2.4 million last year.

"While the bank has a track record of prudently managing financial risk, we are still building capability in the management of non-financial risk," the company said in its annual report.

"This has been emphasised by the Australian Prudential Regulation Authority (APRA) requiring ANZ to hold an additional operational risk capital overlay, due to concerns about our progress in this space, including issues within our markets business.

"As shareholders would expect, the Board has also taken these matters into account when assessing the performance of our Chief Executive Officer, Shayne Elliott, and the executive team this year."

The report noted that on average ANZ executives had their bonuses cut by 29 per cent due to the same issues.

Fed Chair Jerome Powell is defying Donald Trump from day one

Federal Reserve chairman Jerome Powell, just hours after delivering Trump's yet to be formed administration a gift in the form of a 0.25 percentage point interest rate cut, declared he was sticking around to serve out his term and the president-elect could not remove him.

"Not permitted under law," Mr Powell told reporters at a press conference after the interest rate decision.

When asked if he would step down if asked by the incoming president, he replied with a terse: "No."

With a contract due to run until May 2026, there appears to be plenty of opportunity for an eventual showdown between the pair.

Read more in Ian Verrender's analysis of the potential for a showdown between two of the world's most powerful men.

ABC journalist Mark Willacy shares what it was like to be on QF520 today

Mark Willacy is an incredible journalist who has been through his fair share of hairy experiences during his career.

So, of course, within a couple of hours of being safely deposited back at Sydney Airport he has written up his account of what happened on Qantas flight QF520.

Not directly business-related, but well worth a read.

Big Four banks deliver cash earnings of $30.7 billion

Despite the 2024 financial year being one of the best results for the Big Four banks, the impact of 13 interest rate rises since May 2022 has hit their margins.

PwC analysis finds that their cash earnings fell to $30.7 billion, down 5.4 per cent from the record high of $32.4 billion last financial year.

Return on Equity declined to 11.1 per cent, down 79 basis points from the prior year, reflecting the drop in earnings and elevated capital levels.

"Two and a half years since the first rate hike, major bank margins are only marginally higher than their record low of 1.75 per cent just prior to the tightening," says Sam Garland, banking and capital markets leader at PwC Australia.

But the fall in margins for the year was almost offset by credit growth.

Excluding the impact of acquisitions, lending grew 3.4 per cent for the year.

"This was a mixed story for the majors, who saw market share in mortgages fall slightly over the year but stronger-than-market growth in business lending," Ms Garland said.

Operating costs grew 6.5 per cent to a record high of $43.2 billion, weighing on the results. This was driven by general inflation and increased technology spend as banks continue to invest to modernise.

Timeline of Qantas emergency landing

My colleague Millie Roberts is running the ABC News blog on today's emergency and ongoing disruptions at Sydney Airport.

She's just posted a handy timeline of events.

- 12:15pm: Qantas flight 520 is scheduled to depart for Brisbane

- 12:30pm: Pilot tells passengers there is a "major problem" with the right engine, according to Mark Willacy who is on board

- 1pm: QF520 makes an emergency landing at Sydney Airport

- 1:10pm: Fire and Rescue NSW says it is assisting to extinguish a grass fire that "ignited next to the third runway"

- 2pm: The same agency says the fire is now under control

Five flights have been diverted from Sydney and will arrive later today, while there have been many other flight disruptions due to the closure of one of the two main runways.

Sydney Airport says departure delays are averaging about 45 minutes with 11 domestic departures cancelled.

Passengers can check the status of their flights on the airport's website.

You can follow more live updates on the Sydney Airport situation via that blog.

How Magnamail's 'attention grabbing promotions' allegedly misled consumers

Magnamail is owned by Direct Group, which claims on its website it is "one of Australia's leading direct to consumer retailers".

It states that through online, print, television and digital publishing, it provides products and services to "the growing, high spending senior demographic (45+ age group) which is often neglected and not effectively reached by traditional retail and e-commerce players".

The ACCC alleges that hundreds of thousands of consumers were misled after being sent Magnamail's "attention-grabbing promotional materials", which included letters, envelopes, catalogues, and scratch cards, that promised them prizes they would never be eligible to win.

The ACCC mounted legal action after being contacted by many consumers who received this promotional material and complained about their experience.

As promised, more detail on this story here:

A moment of silence at the ACCC supermarket inquiry

After hours of testimony at this ACCC inquiry about the difficulty that growers have locking down certainty on price and take with supermarkets, we've had the issues distilled into one question.

ACCC's Mick Keogh: Do you know another industry where a purchase order doesn't mean what's written on the purchase order?

Panel: (long silence) No.

There you have it!

(Although I've heard similar issues about uncertain contracts being raised in inquiries about the hardware industry.)

Qantas investors shrug off safety incident

Qantas shares are trading higher on the day, although seem to have taken a dip around the time an apparent engine failure occurred on one of its planes taking-off from Sydney Airport.

Shortly after 2:30pm AEDT the airline's share price was 1 cent higher at $8.38.

However, Qantas shares were trading as high as $8.49 around midday.

QF520 to Brisbane landed safely in Sydney shortly after 1:00pm, after one of its engines failed on take-off, forcing it to circling the airport before returning.

You can stay up to date with the latest developments on the ABC News live blog.

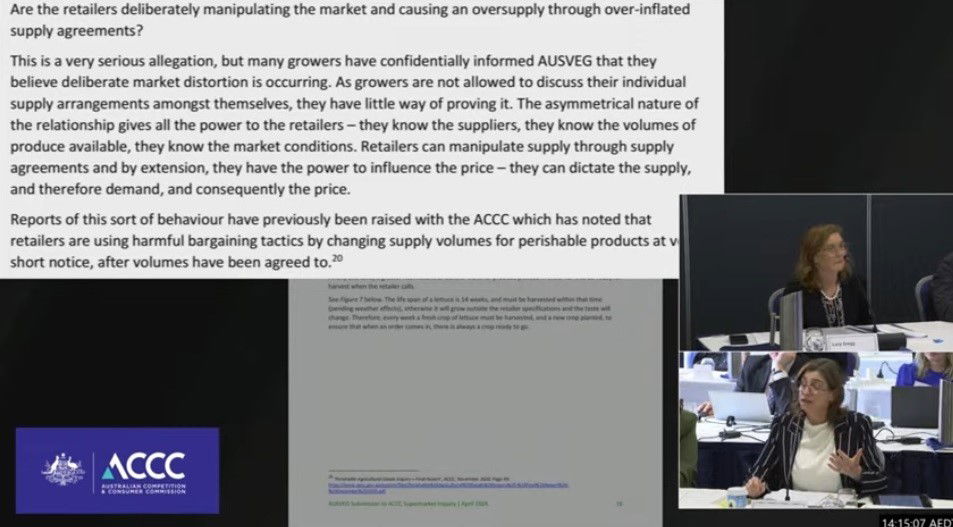

AUSVEG airs allegations that supermarkets are 'distorting' the market

It's been a slow burner this morning, but the ACCC's supermarket inquiry is now hearing some more serious allegations.

AUSVEG, which represents vegetable growers, was just asked to talk about this section of its submission.

As that submission notes, AUSVEG has heard concerns from growers that "deliberate market distortion" is occuring.

AUSVEG's Lucy Gregg is explaining this could be happening because the major supermarkets have the power in their agreements to set an expected level of supply of vegetables.

Yet when it comes to delivery time, the supermarkets don't actually have to take that expected amount. They also don't commit to a set price until its delivery time.

This means the market could end up flush with excess veggies, pushing down prices on the market and thus the retailer.

Grower Peter Hall has been telling the inquiry that he finds pricing offered by the supermarkets as "actually quite vague". He says more data sharing could help suppliers immensely.

"It's a weakness in our industry," he said.

You can watch this inquiry live here:

Iron ore price corrected

Please fix

- Iron ore price incorrect

Thanks for alerting us to the error — I suspect a crude oil price was entered into the iron ore field by mistake.

The futures price for iron ore in Singapore (a major hub for trading Australian iron ore) is currently down 1.4% to $US104/tonne.

Sydney flight delays expected into the afternoon as runway checked for debris

An airport spokesperson said Qantas flight QF520 from Sydney to Brisbane landed safely just after 1:00pm AEDT.

"This departure of aircraft coincided with a grass fire along the eastern side of the airport's parallel runway, which was brought under control by teams from the Aviation Rescue Fire Fighting Serivce," they said.

"It's not clear at this stage if the two incidents are linked and investigations are continuing."

Sydney Airport said the main runway was operational but that passengers should expect some delays until the second runway returned to service.

"With the safe arrival of the aircraft, Sydney Airport's priority is to conduct a full inspection of its parallel runway and to return it to service as quickly as possible," the spokesperson said.

Passengers who are travelling today are also encouraged to check with their airline regarding the status of their flight, or via the online flight information boards on Sydney Airport's website.

ABC journalist was on board flight with suspected engine failure

ABC journalist Mark Willacy was on board the flight and said a "sharp shudder" went through the aircraft after the explosion.

"It was apparent something had happened with one of the engines, then the plane seemed to labour to get off the ground or get any altitude," he said.

"That's when the pilot came on about 10-15 minutes into the journey and he said that there'd been a major problem with the right engine, that everything was under control at that point, but we'd have to go back to Sydney."

All other aircraft at Sydney were put into a ground stop at the time while the Qantas flight circled and prepared to land.

The Qantas flight was followed down the runway by several Aviation Fire and Rescue appliances.

You can read the full story as it develops on ABC News:

Qantas says suspected engine failure caused flight to return to Sydney Airport

A spokesperson for Qantas confirmed the flight experienced a suspected engine failure mid take-off.

"One of our flights to Brisbane experienced a suspected engine failure after take-off from Sydney Airport this afternoon. After circling for a short period of time, the aircraft landed safely at Sydney Airport," the spokesperson said.

"Our pilots are highly trained to handle situations like this and the aircraft landed safely after the appropriate procedures were conducted.

"We understand this would have been a distressing experience for customers and we will be contacting all customers this afternoon to provide support.

"We will also be conducting an investigation into what caused the engine issue."

'Geopolitical uncertainty' poses financial system risks: APRA

In March, the chairman of banking and superannuation regulator Australian Prudential Regulation Authority (APRA), John Lonsdale, announced that the watchdog will be conducting Australia's first financial system stress test in 2025.

APRA executive board member Therese McCarthy Hockey told FINSIA's The Regulators event on Friday that "It's only in a crisis that we truly learn if the financial system can act as an economic shock absorber – keeping money flowing so that households and businesses can buy goods and services, pay their bills and make investments".

"Preparedness for such a downturn is essential at any time, but especially so right now as we face an increasingly volatile geopolitical environment with rising concern over the economic outlook for our main trading partner," she said in a speech.

That's why in in the first half of 2025 APRA would unveil its first system-wide stress test.

The "System Risk Stress Test", she noted, will specifically look at the connections between the banking and superannuation system, and potential impacts on the broader financial system.

"At the moment, we are engaging with industry and fellow Council of Financial Regulators agencies on the design of the activity, including the hypothetical scenario we will examine," Ms McCarthy Hockey said.

"The scenario will contain significant disruptions to financial markets, which will help us explore the impacts of liquidity stress between super funds and banks, and how their response impacts asset markets."

An "operational risk component" would be added to the test scenario to further assess "the dislocation caused by the market disruption".

Ms McCarthy Hockey noted that closely related to the financial system's readiness to withstand a crisis is "the capability to proactively manage the risks that arise from operating a business, whether an electricity blackout, industrial dispute or building fire".

"July's CrowdStrike outage, which impacted millions of Windows systems globally, was a great illustration of why APRA has a new prudential standard on operational risk management coming into force from the first of July next year," she said.

APRA was also building a better understanding of the impacts of climate risk on the financial system.

"Natural disasters linked to climate change present a threat to business continuity we are likely to see more of over coming years," she noted.

Qantas flight makes emergency landing in Sydney

This just in on the ABC News network.

A Qantas flight has made an emergency landing at Sydney Airport.

A passenger on Qantas flight QF520 from Sydney to Brisbane heard a loud bang after take-off.

The pilot on board told passengers there was a major problem with the right engine.

That plane has now landed safely at Sydney.

There is also a grass fire on the runway – it is not yet known whether this is linked.