ASX falls 0.4pc on 'disappointing' Chinese stimulus package, Resolute Resources executives detained in Mali, shares crash — as it happened

The ASX has fallen 0.4 per cent, influenced more by a "disappointing" new Chinese financial rescue package than the record-breaking rally on Wall Street following what looks like a Republican "clean sweep" in the elections.

On the local market, gold miner Resolute Resources tumbled more than 30 per cent per cent after the company confirmed three of its executives, including its CEO, had been detained in Mali over a dispute with its business practices there.

Look back at the day's events.

Disclaimer: this blog is not intended as investment advice.

Live updates

Market snapshot

- ASX 200: -0.4% to 8,266 points (live values below)

- Australian dollar: +0.2% to 65.92 US cents

- Nikkei: flat at 39,506 points

- Hang Seng: -2.2% to 20,289 points

- Shanghai: -0.1% to 4,098 points

- S&P 500 (Friday): +0.4% to 5,996 points

- Nasdaq (Friday): +0.1% to 21,118 points

- FTSE (Friday): -0.8% to 8,072 points

- EuroStoxx (Friday): -0.7% to 499 points

- Spot gold: -0.4% to $US2,672/ounce

- Brent crude: -0.5% to $US73.52/barrel

- Iron ore (Friday): -2.3% to $US102.60/tonne

- Bitcoin: +6.5% to $US81,530

Prices current at around 4:30pm AEDT

Live updates on major ASX indices:

Goodbye

That's it for another day on the ABC's markets blog.

Thanks for your company. We'll be back bright and early tomorrow for another ripping adventure jam packed with thrills and spills, winners and losers, numbers and percentages. Don't miss it.

Until next time, au revoir.

LoadingASX 200 drops 0.4%, dragged down by miners

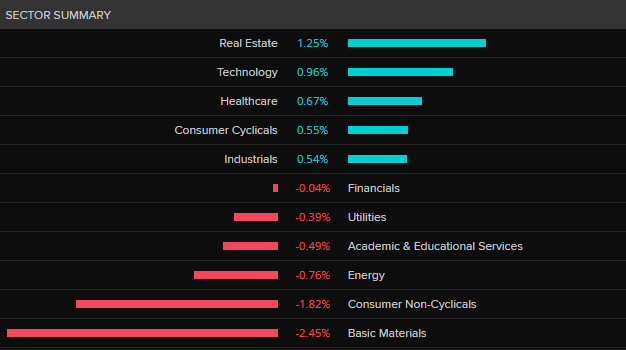

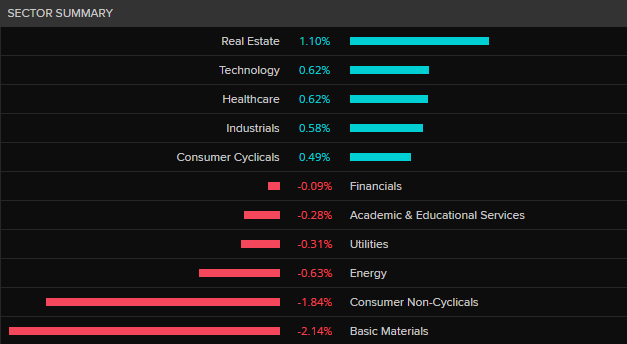

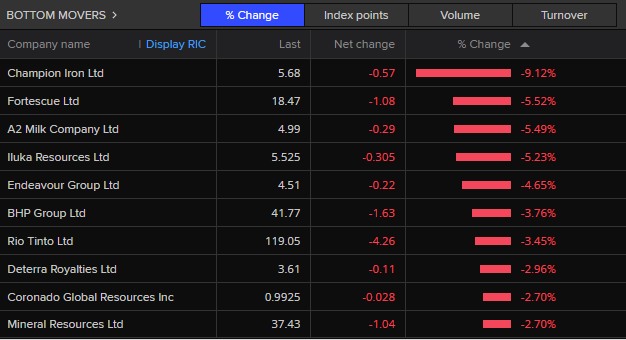

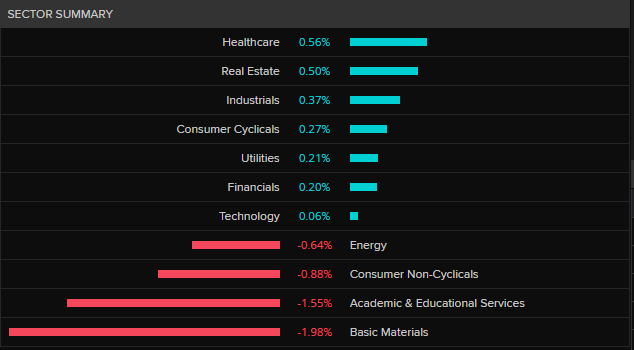

The ASX 200 fell 0.4% on the first session of the week, with negative news out of China weighing more on sentiment than the positives of another record close on Wall Street.

The fall was primarily driven by the miners, with the basic materials sector being the biggest drag on the market, outweighing gains in real estate, technology and health care.

All the big miners have been hit by what the market has seen as a disappointing financial rescue package in China targeting heavily indebted local governments but avoiding any direct fiscal stimulus to business or households.

Resolute Resources, which resides outside the ASX 200, was the biggest loser, down more than 32.9%, or 22 cents to 44 cents, on news that its CEO and two other executives have been detained in Mali over a dispute with the government there.

The banks were mixed, ranging from NAB up 0.9% to Westpac down 0.1%.

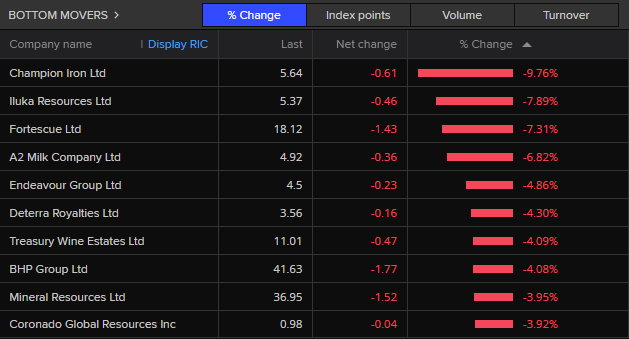

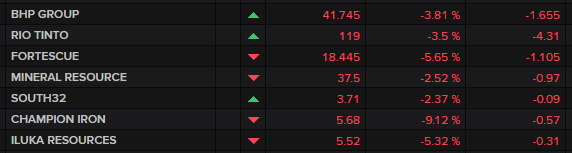

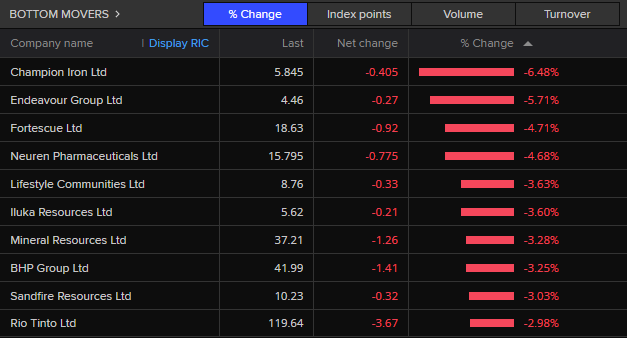

Iron ore junior Champion Iron was the worst performer on the ASX 200, down 9.1%.

A2 Milk fell 6.8% after the big NZ processor Fonterra raised its forecast for farmgate milk prices.

Hotel and liquor retailer, Endeavour Group, dropped 4.9% on a poorly received quarterly earnings update.

Incitec Pivot picked up 0.3% despite announcing it had cut dividends and swung into at $311 million loss from a $560 million dollar profit the year before.

Asset manager HMC Capital was the biggest winner (+4.1%) after announcing it would set up a data centre investment trust, followed by gold miner Genesis Minerals (+4.0%) backed by a positive drilling update.

Oil (-0.5%) and gold (-0.4%) lost ground as the day wore on, while Bitcoin continued to push higher above $US80,000 in the afterglow of the Trump victory.

Across the region, Japan's Nikkei and China's Shanghai index were flat in afternoon trade, while Hong Kong's Hang Seng was down 2.2%.

Looking ahead to Wall Street's opening, S&P 500 futures point to a 0.2% gain, in other words, another record close could be on the cards.

Sneak peek at tonight's The Business

Hi, Kirsten Aiken here, jumping in to give you a first look at an interview running on tonight's program.

Amid reports multinational corporations are already making production decisions based on the tax and tariff policies of incoming US president Donald Trump, I've been speaking to Huw McKay about what big business needs to weigh in the wake of Trump's win.

Dr McKay is a visiting fellow at ANU and until recently a vice-president of market analysis and economics at BHP.

Here is his extended interview ahead of tonight's show.

Loading...But wait there's more!

Don't forget to watch the full program tonight on ABC News at 8:44pm, after the late news on ABC TV and anytime on ABC iView.

Resolute Mining executives still being detained

Just a bit more on the Resolute Mining executives being detained by the Malian junta.

As we reported earlier, the company’s CEO Terry Holohan and two other executives have been detained by government officials in the capital Bamako since a meeting broke up on Friday, November 8.

Resolute said in statement this morning the executives were in Bamako to hold discussions with mining and tax authorities regarding Resolute's "in-country business practices, and to progress open claims made against Resolute, which the company maintains are unsubstantiated".

British born Mr Holohan joined Resolute in 2021, initially as chief operating officer and was promoted to managing director and CEO in May 2022.

He has 30 years' experience working in African mine development and a further 10 years re-engineering precious and base metal mining projects in Asia.

Resolute holds 80% of a subsidiary that owns the north-western mine of Syama, with the Malian state controlling the remaining 20%, according to the firm’s website.

Resolute also owns a gold production site in Mako in neighbouring Senegal, and has other exploration operations in Mali, Senegal and Guinea.

Mali has been under the control of the army since a coup led by Vice President Assimo Goita in May 2021.

The website The Africa Report noted since seizing power, “Mali’s leaders have vowed to ensure a more equitable distribution of mining revenues.”

“Despite being one of the leading gold producers in Africa, the Sahel nation is also one of the poorest countries in the world,” The Africa Report said.

“Mali is embroiled in a political, security and economic crisis, and since 2012 has been battling Al-Qaeda and Islamic State armed groups, as well as a separatist insurgency in the north.

“Gold contributes a quarter of the national budget and three quarters of export earnings.”

The Africa Report said foreign companies, which dominate the mining sector, have recently faced tighter control by the junta.

“Four employees of Canadian mining company Barrick Gold were detained for several days in September before being released.

“Barrick Gold said it has reached an agreement with the state and paid 50 billion CFA Francs ($120 million) in October.

“But the government in late October said Barrick Gold had not honoured its commitments and threatened to pursue the firm,” The Africa Report said.

The Perth-based Resolute said the three employees were being treated well and continued to receive support on the ground from the UK and international embassies and consulates.

Resolute Mining shares were down 34% to 44 cents at 3:10pm AEDT.

Endeavour Group shares tumble to an historic low on disappointing earnings

The big hotel and liquor chain Endeavour Group is heading to its record low close after disappointing investors in a weak quarterly earnings update.

The company, once Australia's biggest pub owner, has been hit by increased competition, tightening margins and higher costs.

Sales grew by around 0.5% to $3.11 billion in the first quarter (the 14 weeks to October 6), but this was well below market expectations of nearer to 2% growth.

J.P. Morgan analyst Bryan Raymond noted, while the hotel business was holding up well, the retailing side – Dan Murphy's and BWS – was struggling.

"Endeavour is seeing similar trends to Woolworths, with increased promotional intensity and a lower-margin sales mix as customers shopped more selectively resulting in a downgrade to 1H25 retail margins," Mr Raymond wrote in a note to clients.

The company's quarterly update pointed to cost-of-living pressures curbing consumer spending, which further squeezed its top line as the key headwinds it currently faced.

And there is unlikely to be any immediate turn around as the company heads towards the famously liquid Christmas/ New Year period.

"In the near term, softer sales and a lower margin sales mix, resulting from both a higher percentage of sales on promotion and consumer downtrading, are expected to impact retail profitability," MD and CEO Steve Donohue said in a statement to the ASX.

Endeavour shares were down 4.9% to $4.50 at 2:30pm AEDT, their lowest level since being spun out of Woolworths in 2021.

The Orwellian office - is Big Boss watching you?

Feel like someone is watching you?

If you're at work, you probably are and it's most likely your boss.

(Editor's note: not so, first warning! we'll talk after your shift).

Anyway, as I was saying before being interrupted, workplace surveillance systems are expanding and becoming more powerful.

Employers say they boost productivity and reduce fraud, but unions argue they are overreaching.

Dan Ziffer has been looking at the practice and has put together this piece - check it out and the video version, well worth the 4 min 30 sec, a terrific piece of TV.

ASX down 0.4%, Resolute Resources crashes on executives being detained in Mali

The ASX 200 is down 0.4% heading into the afternoon session with news out China weighing more on sentiment than the positives of another record close on Wall Street.

The fall has been primarily driven by the miners with the basic materials sector being the biggest drag on the market, outweighing gains in real estate, technology and healthcare.

All the big miners have been hit by what the market has seen as a disappointing financial rescue package in China, targeting heavily indebted local governments, but avoiding any direct fiscal stimulus.

Resolute Resources, which resides outside the ASX 200, is the biggest loser so far, down more than 30%, or 20 cents to 46 cents, on news that its CEO and two other executives have been detained in Mali over a dispute with the government there.

The banks have largely been flat, although Westpac (-1.0%) is the only one of the big four to have stumbled significantly.

Iron ore junior, Champion Iron is the worst performer on the ASX 200, down 9.1%.

A2 Milk is down 6.0% after the big NZ processor Fonterra raised its forecast for farmgate milk prices.

Hotel and liquor retailer, Endeavour Group, is down 4.8% on a quarterly earnings update.

Incitec Pivot has made a solid gain (+0.8%) despite announcing it had cut dividends and swung into at $311 million loss from a $560 million dollar profit the year before.

The payments platform Zip (+4.6%) is the biggest gainer, followed by gold miner Genesis Minerals (+4.0%) backed by a positive drilling update.

Market snapshot

- ASX 200: -0.4% to 8,264 points (live values below)

- Australian dollar: +0.2% to 65.92 US cents

- Nikkei: -0.2% to 39,926 points

- Hang Seng: -2.3% to 20,258 points

- Shanghai: -0.9% to 4,067 points

- S&P 500 (Friday): +0.4% to 5,996 points

- Nasdaq (Friday): +0.1% to 21,118 points

- FTSE (Friday): -0.8% to 8,072 points

- EuroStoxx (Friday): -0.7% to 499 points

- Spot gold: -0.3% to $US2,676/ounce

- Brent crude: -0.3% to $US73.63/barrel

- Iron ore (Friday): -2.3% to $US102.60/tonne

- Bitcoin: +6.2% to $US81,316

Prices current at around 1pm AEDT

Live updates on major ASX indices:

Incitec Pivot's $311 million loss better than expected: analysts

Just a quick update on Incitec Pivot's $311 FY loss, dividend cut and the market's relatively cheery response.

Analysts never seem too fussed by the actual net profit or loss result, preferring to zero in on underlying earnings and profits.

Incitec Pivot's case the roughly $710 million post-tax write-down in the value of assets, primarily in the fertiliser business, was pushed to one side and the underlying (excluding one-offs) profit of $400 million beat the analysts' consensus estimate tabulated by Bloomberg by almost 14%.

The expanding EBIT (earnings before interest and tax) margins of the explosive business edged the declining margins in fertilisers.

The final dividend of 6.3 cents per share, while lower than the year before, was still better than the 4-to-5cps the anlysts forecast.

J.P. Morgan's Abhinav Suthakar noted while EBIT and NPAT were below his estimates, "it was a strong result beating consensus estimates."

"While qualitative outlook commentary for FY25 was also robust, this might be offset by the earnings impact of a busy turnaround schedule for the explosives business in FY25 (A$45-55m impact on earnings)," he wrote in a note to clients.

"Gas costs at Phosphate Hill are also expected to step due to higher spot purchases (A$30-90m)."

The upshot was share are up 0.8% bat 12:30pm AEDT and the broker kept a "neutral" rating on the stock.

No plans for Aldi to set up shop in NT, or elsewhere in Aus

Rhiana Whitson here jumping in to bring you the latest from the ACCC's supermarket inquiry.

The ACCC has been asking Aldi about its expansion plans. Aldi's Managing Director, National Real Estate Andrew Starr, told the inquiry it is not particularly interested in opening new stores.

Aldi has almost 600 stores nationally and 88 distribution centres.

One Federal Labor MP has been campaigning for Aldi to open in the Northern Territory. But today Aldi told the ACCC inquiry it won't be doing that.

Why? Basically, Aldi says the NT market is too small and opening stores there would not be commercially viable.

Aldi says it works on a model in which its trucks must be able to complete a return trip from one of its 88 distribution centres to an Aldi store in one single shift. In short, setting up a new distribution centre and store in the NT doesn't stack up financially for the German supermarket chain. Tasmania hasn't scored a mention at the inquiry yet, but the company has previously said it also has no plans to open there.

For those keen to hear more about what now sounds like a Federal MP's doomed campaign, here is the ABC article the ACCC was referring to just now at today's inquiry:

Non-cash impairment question

G'day. What is a non-cash impairment?

- Scott

Thanks Scott, a non-cash impairment charge is basically a write down the value of an asset - an accounting tool that notes the asset is worth less because there is likely to be a reduced cash flow in the future.

It's often applied if an asset hasn't lived up to expectations on cash generation, hence the write-down in value, as in the case of Incitec Pivot's fertiliser businesses.

Depreciation, amortisation and depletion are common accounting tools reflecting non-cash charges a company will make against assets it holds.

Having said that, accrual accounting is not exactly a strong point of Monday's blog.

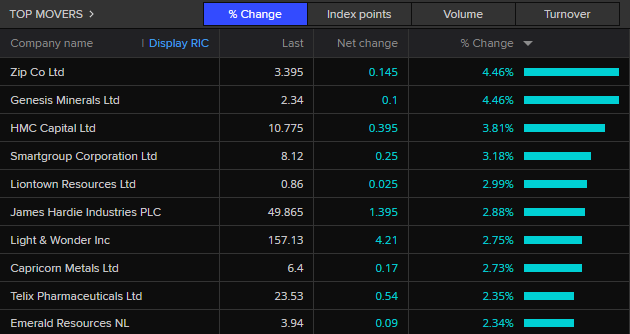

China's $2.6 trillion package – fiscal fizzer or a very cunning plan?

Reducing the debt of China's beggared local governments by CNY (yuan)12 trillion ($2.6 trillion) in less than five years sounds impressive but it has been met with serious disappointment by those on the outside looking in – investors, commodity traders and a large chunk of the commentariat.

Certainly, investors on the ASX were disappointed and were tossing their mining shares overboard at the first opportunity this morning.

Most of the big miners like BHP, Rio Tinto and Fortescue slumped 4-to-5% on opening, the juniors like Champion Iron fared worse, down almost 9%.

However, that disappointment may not be shared by regional party officials who are staring bleakly into the abyss of career destroying insolvency, but it has not exactly fired up confidence that China will resume its barnstorming economic growth of not so long ago.

The perception problem is the lack of any direct fiscal adrenaline shot in the package announced after China's National People's Congress (NPC) standing committee wrapped up its week-long meeting on Friday.

The headline of a CNY12 debt swap left many asking what is a debt swap and how that going to get healthy money pumping through the sclerotic financial system?

In its simplest, the plan is clear the slate with local governments - particularly small ones, not the powerhouse like Beijing, Shanghai and Guangdong - cut their hidden debts of CNY14.3 trillion to a more manageable CNY2.3 trillion, with the central government issuing new loans to struggling regional governments in exchange for the problem debt.

It will allow struggling local governments to refinance "hidden debt" onto public balance sheets through to 2028.

As NAB's Tapas Strickland says the debt swap will save local governments CNY600 billion in interest payments over the next five years, freeing up some funds to spend.

"But this wasn't the sort of fiscal stimulus the market was hoping for, to direct money to households to spend," Mr Strickland said.

So, what will be its impact on the economy?

Societe Generale's China economic team notes the debt issuance will not fund new measures and the Ministry of Finance has pledged to contain growth in any new local government debt.

"But the swap will free up fiscal resources and allow local governments to function more normally," SG said in a note to clients over the weekend.

"That is, local government will be much abler to carry out necessary spending, reduce unnecessary fines and penalties, and pay back arrears owed to the private sector."

It's the absence of direct financial support, or any details beyond the debt swap that's disappointed markets.

"China stimulus bazooka misfires" is how Hamad Hussain, a climate and commodities economist at Capital Economics put it.

Industrial metal prices all fell immediately after the announcement. That sentiment may well be reflected in share prices of Australian miners this morning.

Mr Hussain said there is still some fiscal support in the pipeline from the Chinese government's push to use up remaining budget funds by the end of this year.

"This could yet provide some support to commodity prices over the next few months, especially if these funds are directed towards large infrastructure projects," Mr Hussain noted.

"That said, the fiscal and monetary stimulus packages launched by Chinese policymakers over recent months have not convinced us to alter our long-held downbeat view on industrial metals prices.

"This is because none of the measures announced so far suggest that there will be a surge in property or infrastructure construction that would substantially change the outlook for China's metals demand.

"More generally, the key point is that the structural headwinds facing China's economy remain unaddressed and, as a result, China's metals demand will slow over the second half of next year and 2026.

However, it should be noted that the 2025 fiscal budget is yet to be framed and Finance Minister Lan Fo'an mentioned that more support for the economy would be forthcoming.

As SG's team points out the Chinese economy is showing more signs of bottoming out, and so there is less rush to top up stimulus for 2024.

Also, there is question of keeping some, actually rather a lot of fiscal firepower in reserve to deal with any Trump contingencies.

"There is still so much uncertainty around Trump tariffs — how much and when," SG wrote.

"Why showing all the cards now? We estimate that raising US tariff rate on Chinese goods from 20% currently to 60% could require RMB2-3tn additional fiscal stimulus to counter."

These are questions not likely to be answered before the next NPC meeting next March.

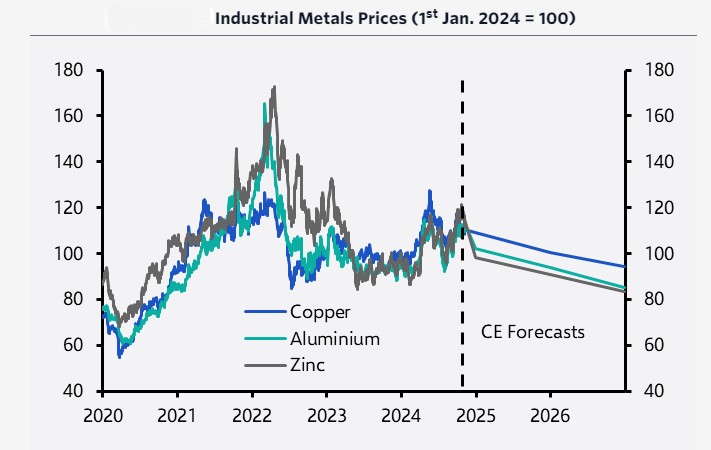

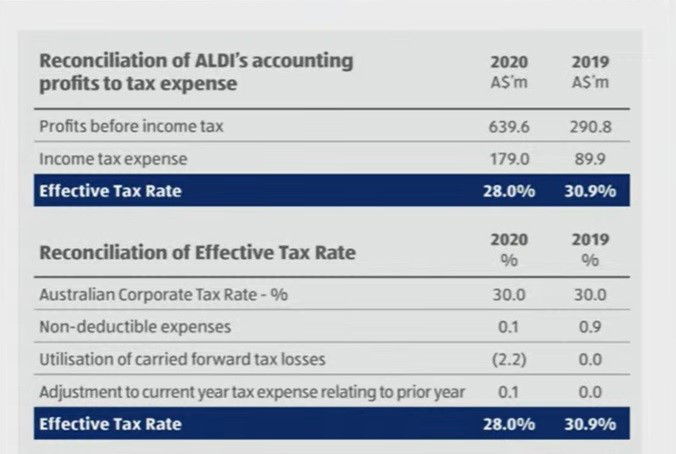

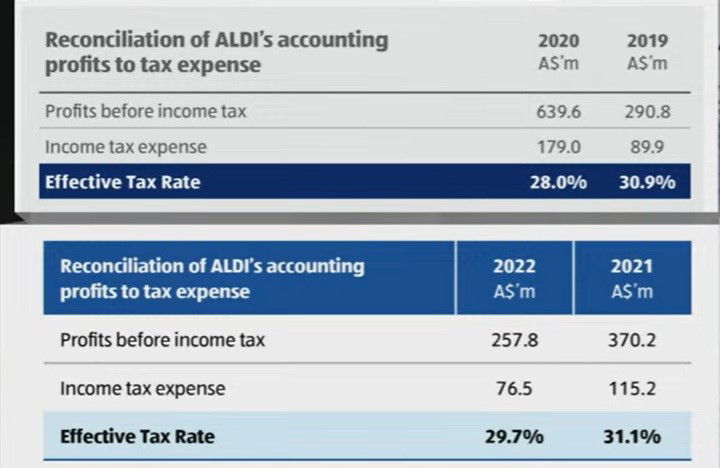

ACCC drilling into Aldi's tax contributions and profits

The inquiry is now going over Aldi's tax payments and profits.

The ACCC asked its representatives to go through these numbers below, and not a whole lot of clarity was gained.

We've also heard Aldi didn't lodge a tax disclosure for 2023.

The ACCC's also just asked Aldi to say whether its profits have gone up or down since 2022, to be told this is confidential and they'd prefer a private hearing.

Aldi's legal advisor then successfully argued to have these questions possibly asked later behind closed doors.

Bitcoin punches through $US80,000

Just a quick squiz at Bitcoin today.

It first punched through the $US80,000 level on Sunday, after easing a bit over night renewed its drive higher through to a new record this morning.

It's up around 5% today, 15% for the month and more than 90% on the year-to-date.

Aldi confirms its annual revenue is about $12b

The German supermarket chain operates privately in Australia, meaning that it doesn't disclose its sales figures in the same way that Woolworths and Coles do to the ASX.

The ACCC's supermarket inquiry has been asking its representatives this morning about its sales figures, asking them to confirm reports they are about $12b annually.

Aldi's representatives initially said this sales figure was confidential, but after some back and forth, ultimately agreed that it held about 10% of the market, about this $12b figure.

ASX opens 0.4% lower, Resolute crashes as executives detained in Mali

The ASX 200 has opened in line with expectations, down 0.4% despite another record close on Wall Street.

The fall has been primarily driven by the miners with the basic materials sector being the biggest drag on the market, outweighing gains in property and healthcare.

All the big miners have been hit by what the market has seen as a disappointing financial rescue package in China, targeting heavily indebted local governments, but avoiding any direct fiscal stimulus.

Resolute Resources, which resides outside the ASX 200, is the biggest loser so far, down more than 25%, or 17 cents to 50 cents, on news that its CEO and two other executives have been detained in Mali over a dispute with the government there.

The banks have largely gained, led by ANZ (+0.7%), while Westpac (-0.1%) is the only one of the big four to have slipped.

Iron ore junior, Champion Iron is the worst performer on the ASX 200 this morning down 6.5%.

Hotel and liquor retailer, Endeavour Group, is down 5.8% on a quarterly earnings update.

Incitec Pivot has made a solid start (+1.6%) despite announcing it had cut dividends and swung into at $311 million loss from a $560 million dollar profit the year before.

The salary packaging and administrative services business Smartgroup is the biggest gainer (+3.4%) followed by payments platform Zip (+3.2%).

Aldi fronting the ACCC's supermarket inquiry today

Emilia here with you as I cover the ACCC's supermarket inquiry. Today we have German supermarket chain, Aldi.

You can watch the hearing live.

So far, we've had the ACCC ask Aldi's three representatives about their roles and whether they've read the consumer watchdog's interim report and supplier roundtable summary from their inquiry.

There's been a lot of "in part" and "no" responses, making this a bit like students being asked if they've done their homework.

I'll keep you updated if anything more interesting happens!

Market snapshot

- ASX 200: -0.4% to 8,287 points (live values below)

- Australian dollar: flat at 65.81 US cents

- S&P 500 (Friday): +0.4% to 5,996 points

- Nasdaq (Friday): +0.1% to 21,118 points

- FTSE (Friday): -0.8% to 8,072 points

- EuroStoxx (Friday): -0.7% to 499 points

- Spot gold: -0.1% to $US2,682/ounce

- Brent crude: +0.2% to $US74.00/barrel

- Iron ore (Friday): -2.3% to $US102.60/tonne

- Bitcoin: +5.3% to $US80,591

Prices current at around 10:25am AEDT

Live updates on major ASX indices:

Resolute Mining CEO and two other employees detained in Mali

The African-focused gold miner, Resolute Resources, has confirmed three of its employees, including CEO Terence Holohan, have been detained in Mali by government officials.

Resolute said the executives were in Mali's capital Bamako to hold discussions with mining and tax authorities regarding Resolute's "in-country business practices, and to progress open claims made against Resolute, which the company maintains are unsubstantiated".

"Following the conclusion of theses meeting on Friday, 8 November … the three employees were unexpectedly detained," Resolute said in a statement to the ASX this morning.

"Resolute's priority remains the safety and wellbeing of its employees.

"The company is regular communication with the three detained employees who remain held at the Economic and Financial Centre of Bamako."

Resolute said the employees were being treated well and continued to receive support on the ground from the UK and international embassies and consulates.