Rex given $80m bailout, while ACCC warned Qantas controls 65pc of market and prices are up, ASX loses ground — as it happened

Qantas defended itself from allegations of "slot hoarding" at a heated Senate inquiry, while the federal government gave regional airline Rex an $80 million lifeline as its voluntary administration is extended.

Follow the day's financial news and insights from our specialist business reporters on our live blog.

Disclaimer: this blog is not intended as investment advice.

Submit a comment or question

Live updates

Market snapshot

- ASX 200: -0.13% to 8,255 points (close)

- Australian dollar: -0.41% to 65.46 US cents

- Wall Street: S&P +0.1% Dow +0.7% Nasdaq flat

- Europe: DAX +1.1% Stoxx600 +1.1%

- Spot gold: -0.6% to $US2,604/ounce

- Brent crude: -0.26% to $US71.64/barrel

- Iron ore -0.43% to $US101.35 a tonne

- Bitcoin: +0.53% to $US88,493

Prices current at around 5:00pm AEDT

Live updates on major ASX indices:

That's it for today

Thanks for joining us today.

Make sure to catch The Business tonight at 8.45pm AEDT, hosted by unflappable presenter Kirsten Aiken.

The show will cover the Artificial Intelligence Forum held in Melbourne today, which was attended by Mike Cannon-Brookes and others.

Tristan Edis, director, analysis and advisory, at Green Energy Markets will join the show to talk about what Donald Trump's presidency will mean for the global energy transition.

And we'll look into the issue of "forever renters," which is another sorry development in the evolution of Australia's housing situation.

Tomorrow, the Bureau of Statistics will release its latest Wage Price Index (covering the September quarter), so we'll be covering that in the blog. Make sure to join us.

Until then, take care of yourselves.

Best and worst performers

Paladin Energy was the worst performer on the ASX200 today, plunging 28.9%. It was accompanied by other mining and energy stocks, which tracked the fall in global commodity prices.

Bellevue Gold (-6.71%), Emerald Resources (-5.08%), Newmont Corporation (-4.58%) and Boss Energy (-4.49%) all took a hit.

Block Inc was the best performer, rising 10.7%.

It was joined by Neuren Pharmaceuticals (+4.29%), Charter Hall Group (+2.74%) and Eagers Automotive (+2.61%).

“Trump-trade” remains the driving theme, joined by crypt Santa-rally

Here's how Kyle Rodda, senior financial market analyst from Capital.com, has summarised the trading activity today:

"The markets were relatively steady in Asia, although the overarching narrative still centres around the winners and losers produced by the “Trump trade”. That means strength in US equities but more mixed performance in the Asian region.

"Weakness can still be seen in markets and sectors sensitive to Chinese growth as the prospect of trade restrictions and tariffs loom.

"Meanwhile, Japanese equities are being favoured due to the impacts of a weaker Yen and favourable trade and foreign relations with the US - although the Nikkei lost steam in the afternoon.

"Those China-sensitive assets were supported by news of fresh support for China’s housing market from the country’s authorities, this time in the form of cuts to homebuyer taxes. Once again, while welcomed, the policy is considered modest and arguably too incremental.

"The ASX200 lifted off the lows off the session thanks to signs of stronger support from Chinese authorities. It wasn’t enough to offset weakness in the materials and energy sector – the latter also weighed down by a drop in oil prices due to positive diplomatic rumblings coming from Hezbollah about negotiations with Israel.

"Block was the extreme outlier as it rallied with the price of Bitcoin, which again came within a whisker of $US90,000 in US trade. It’s proving perhaps the biggest beneficiary of Trump as it prepares an (almost) characteristic melt-up.

"Previous crypto-Santa-rallies in 2016, 2017 and 2020 (attached) saw the price of Bitcoin rise approximately 60%, 180% and 160% between the middle of November and roughly the end of the year."

Sharemarket loses 0.13pc

Trading on Australia's public stock market has closed for the day, and the ASX200 index has shed 10.6 points (-0.13%) to finish on 8,255.6 points.

Poke the nest

NSW airline getting an Australian taxpayer lifeline....... what's not predictable.

- Rye an

Here's an interesting addition to the conversation. The parochial angle!

A wrap on today's aviation news

Our very own Rachel Clayton has put this handy wrap of all the aviation news from today into one concise summary. The ACCC report, the senate hearing and the Rex funding package - take a squiz!

ACCC warns Qantas controls 65pc of market and prices are up

In case you missed it, my colleague David Chau spoke to ACCC commissioner Anna Brakey earlier today about the problems facing Australia's airline industry.

Loading..."We have seen REX stop servicing the major city routes. They are the routes between the capital cities. That means that there are now, at best, two airlines servicing each route, or airline groups, and as a result, we have seen air fares increase on average by 13.3%," Ms Brakey said.

"That's at a time where we have particularly higher demand, particularly this September with intercity teams playing in grand finals and holidays. Nevertheless, what we do know is when there are more airlines services any particular route, we see lower airfares.

"It is not good news that we are down to, at best, two airlines servicing a route."

Regional communities in Western Australia want higher standards alongside $80m Rex lifeline

Different areas of Australia have their own view of Rex Airlines.

In Western Australia, state government data indicate the airline has routinely failed to meet required service standards, with the airline blaming pilot turnover for its struggle to meet passenger expectations. The airline also owes hundreds of thousands of dollars in unpaid airport fees to councils in Esperance and Albany.

But WA community leaders have still welcomed the federal government's $80 million lifeline for the airline, saying the importance of its service still offsets the challenges.

For example, in Esperance, 700 kilometres south-east of Perth, the only alternative to Rex's service is a near seven-hour drive.

See more in this story from ABC colleagues Charlie Mills and Alistair Bates:

In South America, Trump already losing a trade battle with China

This is a really interesting story from Reuters:

In South American copper giant Peru, the incoming Donald Trump White House will find itself already on the losing side in a trade battle with China, part of a bigger power realignment around the resource-rich region in Washington's backyard.

Peru, the world's no. 2 copper exporter, is set to host Asia-Pacific Economic Cooperation leaders this week, with China's President Xi Jinping expected to attend and inaugurate a major new Chinese-built port in the country.

Outgoing U.S. President Joe Biden is also on the guest list.

Peru reflects a wider challenge for the White House around South America, where China's presence has grown rapidly given its huge appetite for the region's main exports: corn, copper, soy, beef and battery-metal lithium.

That's made Beijing the go-to trade partner from Brazil to Chile and Argentina, eroding Washington's regional political clout, a trend that widened under Trump's 'America First' inward turn during his first administration and again under Biden.

"The strategic value is that this is the United States' backyard," said Li Xing, professor at the Guangdong Institute for International Strategies, adding it helped counter U.S. presence around the Indo-Pacific and offset trade war risks.

"China can't start by building military bases there because it's too sensitive and will make China's conflict with the United States too pronounced... So it has made inroads with economic ties first."

Peru demonstrates the dramatic shift.

China's trade lead there over the United States widened to US$16.3 billion last year, UN Comtrade data show, a stark reversal of just a decade ago when Washington was the dominant player. That's come hand-in-hand with investment from energy to mining.

China overtook the United States in 2015 on trade with Peru, widening the gap under Trump's previous administration from 2017-2021, and again under Biden.

See the graph in the Reuters story:

"China has entered the region aggressively, is learning quickly, and is prepared to remain for the long term," said Eric Farnsworth, a former State Department official now at the Council of the Americas and Americas Society.

"Unless the United States meaningfully prioritizes regional economic policy in a new and more effective way, the region will continue to tilt toward Chinese interests."

CreditorWatch chief economist says readings for Australia's economy are in "pretty good shape"

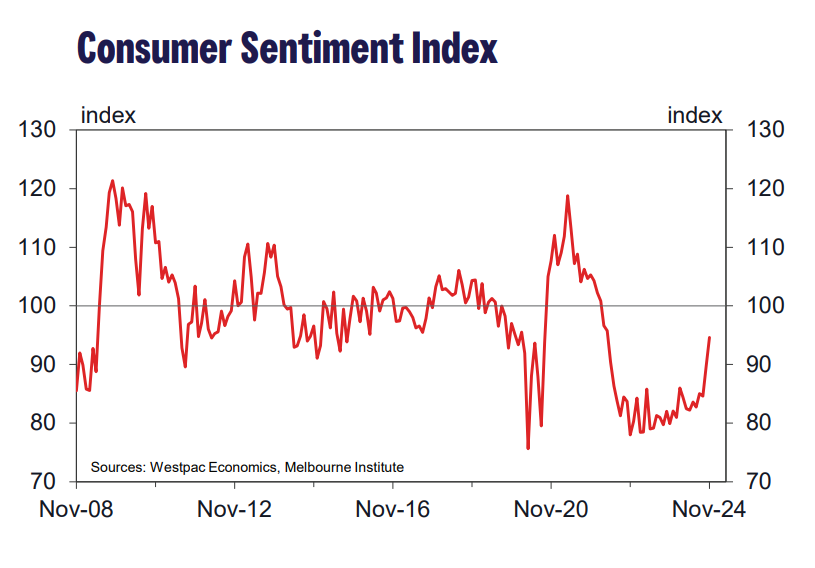

Ivan Colhoun, the chief economist at CreditorWatch, has some thoughts on today's consumer sentiment and business surveys.

Consumer sentiment:

"It’s a wow!" he says.

"Pretty much all parts of the monthly Westpac-Melbourne Institute survey of consumer confidence recorded further strong improvement in November and have risen even more strongly from low points in either June or July this year.

"This is likely to reflect the beneficial impacts of the government’s 1 July income tax cuts together, perhaps, with expectations that interest rates will not rise further.

"There was also a spectacular fall in the unemployment expectations series, which has a good lead on unemployment trends and which at face value suggests the unemployment rate may decline rather than rise in the months ahead.

"Low unemployment has been an important positive preventing more significant pressures on consumer spending and bad debts."

Business confidence:

"The overall picture from the NAB Survey isn’t quite as good as that from the Westpac survey of Consumer Confidence, but overall, the readings for the economy are in relatively good shape," he said.

"There was a welcome jump in business confidence (though that typically is not as good an indicator as business conditions), [and] labour and input cost pressures continue to moderate though retail prices bounced back this month.

"Conditions remain weakest in Manufacturing and Retail (something of a global phenomenon) and strongest in Mining and the broader services sectors.

"Capacity utilisation remains well above long-term averages, but is easing slowly, likely signalling an ongoing slow easing in inflationary pressures.

"Overall, the survey doesn’t seem to be showing the same recent strength as consumer confidence, though the former may be leading in this cycle as consumers benefit first from the tax cuts and improved cash flow and confidence take some time to flow into business conditions."

Clarence Valley councillor criticises $80m federal grant for Rex

Our ABC colleague Hannah Ross has sent this across:

A Clarence Valley councillor who once said Regional Express should "pull their finger out" has criticised an $80 million federal grant to the regional airline.

The federal government has committed the money as part of plans to extend the voluntary administration period for REX.

In 2020, Debrah Novak sparked controversy with her comment after REX asked for the council to give it a $9,000 rebate. Ms Novak refused to apologise for the remark and the airline pulled its service from Grafton.

Ms Novak says the airline did no favours for her community.

"You have locally-owned airlines that can go in and backfill these routes when Rex is no longer there, so why wouldn't you give that money to those companies who are paying their taxes here," Ms Novak said.

Your comments keep coming

Why prop up REX? Its management & policies caused its demise. The problem with REX is it tried to compete on major routes with Qantas & Virgin . History shows that successful carriers of the past such as East West Airlines ran profitably for nearly 50 years on regional routes mainly, & only on major routes, such as Sydney to Hobart, when the major airlines declined to do so. If taxpayer money is being used to keep the airline afloat then restrict its routes to regional only with proven Turbo Props.

- John Myers

It seems like we've got a former regional member saying that we shouldn't be spending government money on airline tickets where the preference is based on an individual receiving perks. And we've got a current regional councillor suggesting that we should be spending government money based on an individual receiving the perk of publicity. Maybe we need to end the perks, look for value for money as if it were your money rather than that of someone else.

- Bof

Rex got $80m payout, my daughter was made redundant, prevented from lodging her last timesheet, then not paid the other outstanding wages, and not paid any redundancy…. Where is the help for her and all the others who have had their wages and entitlements STOLEN.

- Grant

Our politics and public servant are barely able to cope with governing ! Indeed, some of them shouldn’t. Many of them have never been in a commercial enterprise. The government has no business running an airline. Not then, not now, not in the future. Maybe it’s time to stop the big two from killing any competition.

- Andrew Moon

Thank you for letting us know what you think.

Flight Centre Corporate says Rex Airlines is critical for large parts of Australia

Melissa Elf, Flight Centre Corporate's chief operation officer, has issued a statement on the importance of Rex Airlines to Australia's economy.

"REX's regional service is critical to communities and businesses across Australia, particular for mining, construction, health, government and not-for-profit industries," said Ms Elf.

"The demand for regional travel has not slowed, and it remains a very important component of the Australian economy.

"The proof is in the numbers – last quarter (July-September 2024) regional travel was up around 5 per cent compared to the previous year (July-September 2023).

"Flight Centre Corporate books tens of thousands of travellers into regional destinations every month, and Rex has long been a trusted carrier for those who frequent regional cities.

"Regional communities are heavily reliant on carriers like Rex, which are oftentimes their only way of a timely connection to our major cities.

"We're seeing significant volumes of travel into Dubbo, Broken Hill, Roma, Griffith, Mt Isa and Coffs Harbour.

"With much of Australia's economy buoyed by mining and critical minerals, agriculture and manufacturing, seeing travel growing across our regions is a promising sign for the broader economy.

"I anticipate we'll continue seeing an uptick in businesses travelling regionally into next year and beyond, as the promising growth of many regional communities will likely bring with it increased investment in infrastructure, technology, tourism, transport and housing that will prove rewarding for businesses."

Wagga Wagga Councillor Richard Foley calls on Government to nationalise Rex

And here's ABC colleague Jess Scully again:

Wagga Wagga councillor Richard Foley would like the Federal Government to absorb Rex as an asset, he’s concerned the proposed $80 million is too short-term to ensure a future of the airline.

“That’s obviously the financial life support they’re throwing, is it going to be money well spent?” he said.

Cr Foley said he'd like to see the government nationalise the airline in the interest of regional Australia.

“It’s an investment, it brings with it stability and assurance for regional communities that those jobs are going to stay”.

“Surely the Labor Prime Minister could see the political windfall that will give him” said Mr Foley.

Should government flights be split evenly across different airlines?

Our ABC colleague Jess Scully reports that former member for Riverina Kay Hull, who was instrumental in getting Rex off the ground after Ansett Australia collapsed, would like to see the Albanese Government mandate an even split of carriers for government travel to give an underpinning of viability to all airlines, not just Rex.

“Everybody who travels on the taxpayer purse, MPs and public servants, should give 50/50 parity to all carriers… Government wouldn’t have to step in… and aviation would not be at risk.”

Ms Hull says Regional Express often offer the cheapest fares on contested routes, but these are not selected in favour of other providers.

“Because of the various perks, issues of lounge access and accrual of points… they book there for the benefits”.

Paladin Energy plunges on cutting output forecast for Namibia mine

The value of Paladin Energy shares have plunged today and, as Reuters points out, are on track for their worst session in more than seven years, after it cut its fiscal 2025 output forecast for its Langer Heinrich mine in Namibia.

Paladin Energy is a Western Australian based uranium production company.

Its stock was down by as much as 28.9% a little earlier (its biggest intraday percentage loss since May 2017), but it's currently down around 24.48% at $7.31 a share.

The forecast cuts in output are partly related to a lack of water in Namibia.

As per Reuters:

Australia's biggest pure-play uranium miner in terms of market value said its October production was "lower than primarily planned", as disruptions in water supply from state-owned NamWater led to lower throughput volume of ore tonnes processed.

The Perth-headquartered miner said that a planned shutdown at the Langer Heinrich mine was scheduled in the second half of November and would run for about two weeks. The shutdown would pave the way for operational upgrades to be implemented at the mine.

Paladin said water would be stored during the shutdown and this would "provide a buffer" against any disruption during the Namibian summer, when demand was at its peak.

"The company states the production drop is due to variable ore grades (inevitable) and lack of water supply – a worrying development as it speaks to issues in operating in countries with less developed infrastructure," said Michael McCarthy, chief commercial officer of Moomoo Australia.

Paladin also withdrew all other previous forecasts for the coming fiscal year and said that unit operating costs could be impacted by the forecast cut, which would lead them to re-assess realised prices for uranium sales.

The fall in Paladin's share price has the share price back to the price on June 28 last year.

See below:

A peep behind the curtains of food price inflation

At the ACCC's inquiry into the supermarket sector this morning, Aldi has given us some insight into those crazy high grocery bills that appeared out of nowhere a few years ago, and why they've remained stubbornly high ever since.

Jordan Lack, Aldi's managing director of national buying, is being questioned by counsel assisting Naomi Sharp.

LACK: In 2022/23 we had 1,396 requests from suppliers for cost increases. That is obviously a significant portion of the 1800 lines (of packaged stock) that we do have in our range. And I must call out that those requests are outside of the normal tender process.

So we would have tendered and contracted that, and 1,396 came outside of that tender process. We accepted 78% of those in full.

We did so because we understood in full that at that particular time the industry and our supply partners were experiencing significant cost pressures, which we were also experiencing as a business, and which were widely understood coming out of the COVID period, and many other factors that were going on at the time.

SHARP: Has that slowed down?

LACK: They have, so [the volume of those requests] reduced the following year to 676, so we're definitely seeing the number of requests coming through decrease year-on-year.

We still do have cost inflation coming through, cost inflation in the most recent period that is greater than our retail inflation, so I think that still speaks to how there are still cost pressures that our suppliers are facing, and we're continuing to work through that with them.

Dust in the wind

"Why somebody paid $1.6m for a Turing portrait"... as my dad used to say, 'they are getting paid too much'

- Rob

That's a good Dad quote.

Consumer sentiment improves again, in hopeful sign for Christmas retailers

The Westpac-Melbourne Institute Consumer Sentiment Index rose 5.3% to 94.6 in November, up from 89.8 in October.

The survey is based on 1,200 adults aged 18 years and over, across Australia.

It was conducted in the week from November 4 to November 9 2024, so it provides a gauge of consumer reactions to both the RBA's November monetary policy decision, announced on November 5, and the US election which saw results coming in over the course on November 6.

Given that interesting timing of the survey, Westpac economists say three things stand out.

Firstly, consumer sentiment was markedly higher at the start of the week with an index read of 99.7 amongst those surveyed prior to the RBA announcement.

Secondly, sentiment was unaffected by the RBA decision, with the index unchanged on November 5.

Thirdly, sentiment posted a sharp fall following the US election result but with a tentative recovery forming towards the end of the week.

That means the swings in sentiment make the November survey result trickier to assess.

But there are still positive things to glean from it.

"The mood does look to be improving and is providing some more positive signs for retailers ahead of the all important Christmas high season," says Matthew Hassan head of Australian Macro-Forecasting, Westpac.

"Certainly, spending plans are looking less austere than in previous years."

He said Australians are becoming "much more assured" about the labour market outlook too.

The Westpac–Melbourne Institute Unemployment Expectations Index fell 7.2% to 120.5 in November, marking the most confident labour market assessment since April last year (a lower index means more consumers expect unemployment to fall over the year ahead).

The more confident outlook also looks to have given a boost to housing-related sentiment.

The "time to buy a dwelling" index surged 11.3% in November to 86.8, the highest read in nearly three years. The gain centred on a particularly big rise in Victoria where modest price slippage over the last year looks to be generating a lift in buyer interest.