ASX closes higher, while another economist pushes back rate cut expectations to May — as it happened

The Australian share market closed higher on Friday. Corporate regulator warns of further action against the $4 trillion superannuation industry.

Catch up on the day's events as they happened on the ABC News markets blog.

Disclaimer: this blog is not intended as investment advice.

Submit a comment or question

Live updates

Market snapshot

(Prices current at 4:35pm AEDT)

Live updates on the major ASX indices:

That's it from us

We'll wrap things up here. Thanks for joining us today.

Take care of yourselves this weekend. See you on Monday.

A possible answer

Can I hazard an answer for Phillip re Rex: I would imagine that the early termination of the leases (the 737's et al) were quite large & the losses from trading through was going to swamp the rest of the business. So going into administration would be a way to short circuit the penalties & give breathing space to re-capitalize the regional routes.

- allan

Thanks Allan.

Best and worst performers

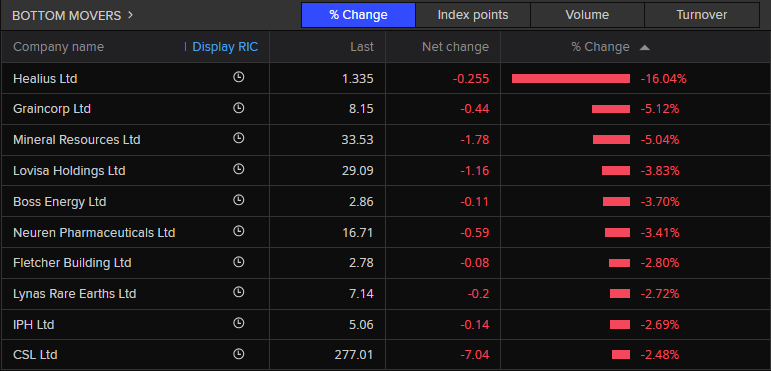

Capricorn Metals was the best performer today, rising 5.04% to $6.25. It was followed by Nine Entertainment Holdings (+4.82% to $1.195) and Insignia Financial (+4.78% to $3.29). Domino's Pizza (+4.04% to $29.61) and Qantas Airways (+3.61% to $8.89) did well too.

Healius was the worst performer. It fell 16.04% to $1.335 a share. It was followed by Graincorp (-5.12% to $8.15) and Mineral Resources (-5.04% to $33.53).

The questions linger

G’day Michael, could you thank Samuel for the answer to my question earlier this week about the REX bailout. It begs the further question though that if REX had enough unfettered assets to provide security for an $80 million loan and the regional operation was profitable as we’ve been told then why didn’t they simply shut down the cash draining inter-city operation, borrow enough to cover the losses , and go back to what they were doing.

- Phillip

Thanks Phillip, we've passed it on.

Market ends Friday in positive territory

The ASX200 index has closed higher today (+0.74%), ending the week on 8,285.2 points.

But today's gains weren't enough to lift the index into positive territory for the week.

Over the last five days, it shed 9.9 points (-0.12%).

The week ahead

The ASX has stopped trading for the week.

While we wait for trades to settle let's see what'll be coming up in the week ahead.

Tomorrow, obviously, Mike Tyson's stepping back into the boxing ring to fight a (much younger) Jake Paul, but that has nothing to do with markets.

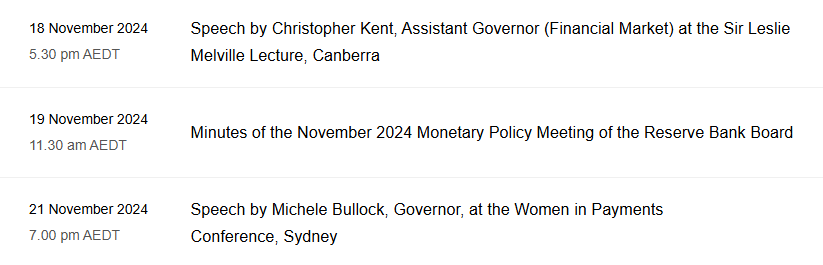

Next week we'll get a few things from the Reserve Bank - two speeches (including one from Michele Bullock) and the minutes of the recent RBA board meeting:

We'll see a few data releases for other countries.

Inflation data will be released in the UK, Canada and Japan. CBA economist Belinda Allen says inflation is expected to rebound a little above 2%/yr in October in the UK, back to the 2% target mid-point in Canada. and print at 2.2%/yr in Japan.

From the Bureau of Statistics we'll also see building activity data (June quarter) and monthly employee earnings indicator data (April to September reference period).

AMP's Shane Oliver warns on US shares as bonds now promise better returns

Shane Oliver's weekly wrap up note usually contains some interesting analysis, and this week is no exception.

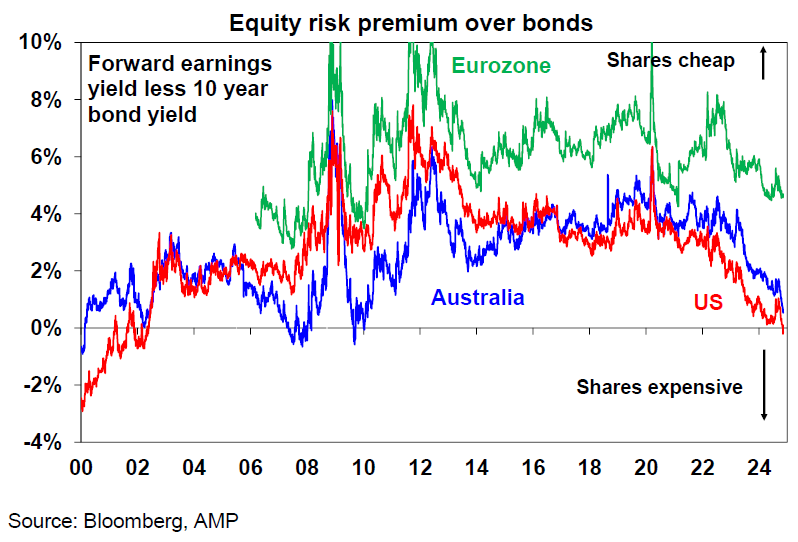

"Our assessment is that the boost to US shares may have further to run in the near term but it is vulnerable to the rise in bond yields and the mix of tax cuts and deregulation (which are positive) versus tariffs (which are mostly negative) could contribute to a more volatile ride as we go through next year," he warns.

When combined with their already elevated valuations compared to expected returns, Oliver thinks US stocks look increasingly at risk of a significant fall.

"With US shares now offering a negative risk premium to bonds following their recent rally and the further rise in bond yields – highlight the vulnerability of the US share market. Australian shares are also stretched on this measure, but not as much and European shares look relatively cheap."

How do we get the 'real wage overhang' out of our heads?

This note from Luci Ellis deserves to be posted in full.

Ms Ellis is Westpac's group chief economist. If you remember, she was previously Assistant Governor (economic) at the Reserve Bank of Australia from December 2016 until October 2023.

The note she's circulated this afternoon is fantastic:

The Wage Price Index increased 0.8% in the September quarter and 3.5% over the year. This was in line with our expectations but – as Westpac Economics Senior Economist Justin Smirk pointed out – slightly below consensus expectations. The extent of the step down in the year-ended growth rate was well anticipated, because it reflected the dropping out of the outsized 2023 National Wage Case and related decisions from the calculation.

The RBA does not publish a full quarterly wages forecast profile, only the forecasts for year-ended growth as at June and December quarters. So, we do not know exactly what they expected for the September quarter. However, it would now need to see a bounce back in quarterly growth to around 1% for the December quarter for its end-2024 forecast to come true. Even allowing for some recent health-care agreements, we consider such a bounce to be beyond the bounds of plausibility given how smooth this series tends to be. There are no strong reasons for a change of direction of this kind, either. Surveys, data on awards and enterprise agreements and feedback from our own customers would all suggest that a sudden bounce back in wages growth is not happening.

We therefore expect that the RBA will have to revise down its near-term wages growth forecasts again in February, having already done so in November.

Forecasting is hard, so some revisions and near-term misses are par for the course. Even so, is there something going on with the way some observers think about domestic labour costs, that could be affecting their interpretation of the economic outlook? And in the case of the RBA, could this be affecting its monetary policy decision-making?

Some insights can be gleaned from the following passage from the latest Statement on Monetary Policy:

At current rates of productivity growth, WPI growth remains somewhat above rates that can be sustained in the long term without putting upward pressure on inflation. All else equal, when productivity growth is positive, WPI growth is able to outpace inflation while still being consistent with inflation at the midpoint of the target range. As trend growth in labour productivity is likely below its rate in previous decades, the sustainable WPI growth rate is probably lower than in the past and below the current rate of growth. That suggests it would be difficult to sustain wages growth at its current pace in the longer term without a higher pace of trend productivity growth.

There are a few things worth noting about this passage.

First, this reasoning comes from the markup model for forecasting inflation. As explained in a previous note, this model starts from the presumption that prices are a (roughly stable) markup over costs, including labour costs. A bit of algebra later leads to a relationship that states that wages growth minus productivity growth is approximately equal to inflation (prices growth). As discussed in that previous note, there are a lot of assumptions underlying the use of this relationship for forecasting. But more fundamentally, the WPI is not the measure of labour cost growth that maps most closely to the one implied in that relationship. Rather, the more volatile average earnings measures from the national accounts are more relevant.

Presumably the RBA has used the smoother WPI measure for ease of exposition. In that case, though, one should be even more circumspect about how tightly the relationship should hold.

Second, there are some interesting implied choices of time period used in that paragraph. For example, it is stated that future trend productivity growth is expected to be slower than the average of previous decades. This is not controversial: the late 1990s was a period of strong productivity growth globally, largely because of the adoption of personal computers and other new technologies. More recent productivity growth was slower, but not zero. The real question is whether future productivity growth will be slower than the average of more recent times, such as the years leading up to the pandemic. Perhaps this is true, but the reasons for a further slowdown have not been elucidated. While any boost from AI and other technology will indeed take time to show up in the productivity figures, just as PCs did, a further decline in global trend productivity growth is not the base case for the profession more broadly.

Third, even granting the reduced noise from using the WPI, and assuming a further slowdown in global productivity, there is the question of why the RBA repeatedly referenced the sustainability of the current rate of growth. At the time of publication, this was the year to the June quarter figure of 4.1%, not the year to September quarter figure of 3.5% just reported. Yet the RBA surely anticipated the step down in growth that was already baked in to awards and many enterprise agreements. Why the focus on the sustainability of a growth rate that everyone knew was not going to be sustained? The question also arises of how we reconcile wages growth having already rolled over, to annualised rates in the low 3s, with the RBA’s view that the labour market is still tight.

Later in the document, the step down in unit labour cost growth from 7% annualised to 3.5% annualised in just six months was noted (as we had previously expected and previously written about). So why the implication that growth in labour costs was much stickier than that?

The deeper question is: with wages growth tracking in the low 3s and productivity growth not being zero, why has the RBA focused so much on the risk that wages growth is unsustainable?

I can’t help thinking that this partly reflects deep-seated narratives about the Australian economy not being competitive. These narratives stemmed from the so-called ‘real wage overhang’ that emerged in the 1970s following the policy-induced wages breakout then. Another bout of this belief system emerged after the mining boom and attendant strong income growth. Since then, restoring competitiveness by crimping wages growth has been a common go-to in the policy discourse in Australia, far more than elsewhere in my observation. It is as if people forget that exchange rates tend to move much faster than domestic labour costs.

In any case, even if productivity growth averages a touch lower than 1% (worse than recent history), then by the RBA’s own figuring, WPI growth averaging 3.2% (the annualised rate of the past three quarters) is well and truly consistent with inflation averaging 2½% or below. Perhaps we need to let go of the pandemic-era hangover.

Rex's $80 million lifeline is a 'loan facility' from the government

There was a question in the blog earlier this week about whether the Rex bailout by the federal government was a loan, a gift or something else.

My colleague Samuel Yang chased it up, and here's the belated answer from the Transport Minister's office:

"The Government is providing financing of up to $80 million as a loan facility to support an extension of Rex’s voluntary administration period. Should the voluntary administrators draw on the loan, commercial interest rates will apply. The loan facilities offered by the Commonwealth are secured against the assets of the Rex Group, which is a common commercial arrangement."

So, Rex's administrators now know they can draw on up to $80 million in Commonwealth finance, but they'll have to pay interest on it.

And, as a secured creditor, the Commonwealth will be near the front of the creditor queue for repayment of any money borrowed if the airline ends up being liquidated.

ASIC chair rejects criticism of the regulator as he puts the super industry on notice

Good afternoon! Alicia Barry jumping into the blog ...

You've been hearing a lot about superannuation and ASIC in recent days, and the chair of the corporate regulator Joe Longo told me we all need to get used to it. I had the chance to speak to him on the sidelines of this year's ASIC annual forum in Sydney.

He told me to expect to see further action against the $4 trillion superannuation industry.

"We're looking at governance issues among superannuation trustee boards, we're looking at whether sufficient progress is being made to implement the retirement income covenant reforms that were introduced now a couple of years ago," he said.

"So, I think the key message is all Australians should be interested in their super. And they should expect regulators like ASIC and APRA to be very intensely involved in supervising and monitoring developments in that sector."

I also pressed him on another issue, the scathing report from Andrew Bragg following a 20-month Senate Economics Committee inquiry into the regulator, which found essentially ASIC had "failed". It made 11 recommendations, the key one being to split the commission into two entities to improve enforcement outcomes. A proposal Joe Longo has strongly rejected.

"To suggest we're not enforcing the law, I reject fundamentally. To be an effective enforcer, you've got to understand the markets you're operating in, the communities you're operating in, what you're regulating," he responded.

" So it's true ASIC's remit is very broad and it's very deep. But the critical question to ask is, is that serving the public interest, and in my view, the twin peaks model [of ASIC and APRA], given the size of our economy and the complexity of the issues we have to deal with, works."

I asked quite a few more questions of the ASIC chair about the criticism that has been heaped on ASIC by the media and academics following the Bragg report, you can find out what Joe Longo had to say this evening on Close of Business at 9:30 AEDT on the News Channel and, as always, on iView.

GIFs continue to divide opinion

Why do we have to have a GIF for everything? You youngsters are sooo this century...

- Merrowyn

Hi Merrowyn.

You're definitely not the only person who hates GIFs in the blog, but our straw polls in the past have found that at least as many of our regular readers love them.

Natty, for one, would be heartbroken if we ditched GIFs altogether!

We try not to overdo it, but we do have to keep up with the times.

Another forecaster pushes rate cut expectations back to May

Hot on the heels of National Australia Bank and investment bank RBC, Capital Economics has joined a now lengthy list of forecasters who expect the first Reserve Bank rate cut won't come until May.

The shift in forecast came after yesterday's ABS Labour Force release showed unemployment remained steady at 4.1%.

With the RBA board's meeting that month currently scheduled for the 19-20 of May, that would come after the latest possible date for a federal election.

Abhijit Surya from Capital Economics says, even though wages growth is slowing faster than the Reserve Bank probably expected, productivity growth is also persistently weaker.

"We expect output per hour to fall by 1.5% y/y in Q4, a much weaker outturn than the 1.0% fall the RBA is predicting," he wrote.

"The resulting persistence in unit labour cost growth is sure to give the Bank pause for thought, especially given that market services inflation has barely moderated at all since the start of the year.

"The upshot is that we're pushing back our forecast for the Bank's first rate cut from February to May. And we remain convinced that the forthcoming easing cycle will be shallow by past standards."

Mr Surya says financial markets have even later expectations for Australian rate cuts.

"For their part, financial markets are pricing in a decent chance that the first rate cut won't come until Q3 [July-September]," he noted.

"However, we think that's a stretch too far. After all, with domestic demand set to remain lacklustre, firms will be constrained in their ability to pass on higher costs to consumers."

Along with economists at three of the four major banks, I think it's too early to rule out the chance of a rate cut in either February or at the next RBA meeting after that in early April, but there have been strong hints from the RBA that it's not in a rush to cut the cash rate, as I wrote recently.

Wellbeing on the rise for first time in 18 months: NAB

Some good news this Friday afternoon: economic research at NAB shows wellbeing is lifting in Australia with anxiety easing for the first time in more than 18 months with a reduction in financial stress

Recently the bank's 'wellbeing' measure had fallen to decade-low levels.

Australians' perceptions of their finances also appear to be improving, with NAB’s Household Financial Stress Index falling noticeably in Q3.

Perhaps unsurprisingly with interest rates where they are, financial stress remains highest among those aged 30-49 and lowest for the 65s.

The survey found fewer Australians felt that money was a source of stress in their lives, more felt in greater control of their daily finances, were better equipped to manage a major unexpected expense, while also feeling a little more confident about having enough money to provide for their financial needs in the future.

Australians report being more satisfied with nearly all aspects of their daily lives than previously.

Cbus chairman Wayne Swan apologises

The chairman of Cbus has apologised for the saga that saw the superannuation giant taken to court by ASIC over delayed death and disability payments.

Former treasurer Wayne Swan, now the chairman or Cbus, said the company takes responsibility for the delays in insurance claims which have seen it in hot water.

Speaking on the Today show, Mr Swan said he accepts responsibility:

"80% of these claims have now been resolved. And in addition to that, we are paying compensation. The cause of this lay principally with the third party operator, but we are ultimately responsible for that, and we accept that responsibility. We're sorry it happened, and we're determined to ensure it never happens again."

According to ASIC, Cbus failed to process more than 10,000 death and disability claims in a reasonable timeframe.

Push to overhaul 'unfair' strata contracts

There are calls for strata management contracts to be urgently overhauled after an ABC investigation found agreements promoted by the peak industry group unfairly disadvantage apartment owners across Australia.

The so-called Strata Agency Agreement, designed by industry group the Strata Community Association (SCA), has been criticised for prioritising strata management firms over unit owners and being almost impossible to terminate.

Read more on this investigation by Echo Hui here:

Powell says no rush to cut US interest rates

Here's a refresher on this morning's big news from the US in case you missed it (we had some tech issues earlier):

The head of the US's central bank said strong economic growth, a solid job market, and inflation that remains above target means the Federal Reserve is in no rush to lower interest rates and will be able to deliberate carefully on future moves.

Speaking in Dallas, Jerome Powell said:

"the economy is not sending any signals that we need to be in a hurry to lower rates. The strength we are currently seeing in the economy gives us the ability to approach our decisions carefully."

The slower pace of rate cuts aligns with current market expectations following Donald Trump's election victory and persistent inflation. Traders are predicting another quarter percentage point rate cut in December and fewer cuts next year than previously forecast.

Mr Powell said officials are taking their time to assess the impact of Mr Trump's slated policies on tax cuts, tariffs and immigration on economic growth and inflation.

But he said the Fed still considers inflation to be "on a sustainable path to 2%":

"Inflation is running much closer to our 2% longer-run goal, but it is not there yet"

ASX rises 0.5pc as healthcare stocks and Mineral Resources weigh on share market

It's been a solid day for the share market so far, with the ASX 200 gaining 0.5% to 8,268 points shortly after midday (AEDT).

However, the benchmark index is on track to post a small loss of 0.3% for the week (after fairly significant losses a few days ago).

Healthcare is the only sector trading lower, as shares of Healius (-13.8%), Sigma Healthcare (-2.3%) and Neuren Pharmaceuticals (-2.7%) fell sharply.

Scandal-plagued miner Mineral Resources is down 3.9%, following more damaging revelations about its founder and managing director Chris Ellison.

The company said it has conducted an investigation into "rent relief" arrangements over an 11-year period, which benefited Mr Ellison's daughter Kristy-Lee Craker.

MinRes is now asking Ms Craker's companies to repay a sum of $158,000.

The mining company has also revealed that it paid $32 million in rent to entities associated with Mr Ellison between 2007 and 2024, which had not been disclosed to shareholders.

On the flip side, Lendlease (+5.2%), Nufarm (+4.9%) and Orica (+4.4%) are some of today's best performing stocks.

Satire website The Onion buys Alex Jones' Infowars out of bankruptcy

Although it sounds like a headline lifted from The Onion, the parody news website is taking over conspiracy theorist Alex Jones' Infowars in a bankruptcy auction.

Infowars was founded by Jones, who confirmed The Onion's acquisition but pledged to file legal challenges to stop it.

Jones owes more than US$1 billion ($1.5 billion) after being found in court to have defamed the families of victims of the Sandy Hook Elementary School shooting, which he falsely claimed was a hoax.

The shooting occurred in the US state of Connecticut in 2012, and is one of the deadliest mass shootings in American history.

Relatives of many of the 20 children and six educators killed in the shooting sued Jones and his company for defamation and emotional distress for repeatedly saying on his show that the shooting was a hoax staged by crisis actors to spur more gun control.

The Onion acquired the conspiracy theory platform's website, social media accounts, studio in Austin, Texas, trademarks and video archive. The sale price was not immediately disclosed.

For more on this development (which I can assure you isn't a parody), here's the story by Thomas Morgan:

Coles and Woolworths to defend class action, alleging 'misleading' discounts

Woolworths and Coles are being sued in a class action for allegedly making misleading claims about the discounts they offer customers.

The case was filed by plaintiff law firm Gerard Malouf & Partners (GMP) in the Federal Court, and the supermarket giants have said they will defend the proceedings.

It comes after the nation's consumer regulator, the ACCC, commenced litigation against Woolworths and Coles in the same court — claiming both companies benefited from revenue it earned though "illusory" discounts on millions of products it sold.

GMP said its case was different from the ACCC, as the law firm was seeking compensation (in the form of refunds) for affected customers, whereas the regulator is seeking financial penalties (ie. fines).

The law firm said it was trying to recover the price difference consumers had to fork out between the advertised 'discounted' prices and the real prices for hundreds of commonly purchased products at:

- Coles (from February 2022 to May 2023), and

- Woolworths (from September 2021 to May 2023).

"We estimate that the average Australian consumer could be eligible for a refund ranging between $200 and $1,300 +, depending on their shopping habits and purchases at these retailers," GMP's chairman Gerard Malouf said.

The law firm alleged that everyday items at both supermarket chains had been subject to price hikes — and the discounted prices were either or higher or same as the price before the increases.