ASX bounces back, ASIC sues NAB over credit breaches to vulnerable customers, ACCC grills Woolworths, and Resolute Mining pays up to release detained executives — as it happened

The ASX 200 bounced back after an early stumble prompted by Wall Street's sell-off on Friday night.

Elsewhere, Woolworths fronted up at the ACCC supermarket inquiry, with supermarket bosses facing questions on competition and pricing, and ASIC sued NAB for the mistreatment of hundreds of vulnerable clients.

Look back at the day's events in our business blog below.

Disclaimer: this blog is not intended as investment advice.

Live updates

Market snapshot

- ASX 200: +0.2% to 8,300 points (live values below)

- Australian dollar: flat at 64.64 US cents

- Nikkei: -1.0% to 38,265 points

- Hang Seng: +1.1% to 19,645 points

- Shanghai: +0.8% to 4,002 points

- S&P 500 (Friday): -1.3% to 5,871 points

- Nasdaq (Friday): -2.4% to 20,394 points

- FTSE (Friday): -0.1% to 8,072 points

- EuroStoxx (Friday): -0.7% to 497 points

- Spot gold: +1.1% at $US2,589/ounce

- Brent crude: +0.4% to $US71.32/barrel

- Iron ore (Friday): -1.6% to $US96.70/tonne

- Bitcoin: -1.3% to $US90,567

Prices current at around 4:20pm AEDT

Live updates on the major ASX indices:

Goodbye

So, as the great Peter Cundell used to say on Gardening Australia, "and that's your blooming lot" — seems more apposite on a gardening program, but there you go.

Just to switch metaphors, blog will just simmer overnight, and someone — maybe "Downtown" Dan Ziffer — will be back early tomorrow morning to turn all the burners up to high and get things cooking again.

So, until next time, thanks for your company.

LoadingASX 200 ends 0.2pc higher after an early stumble

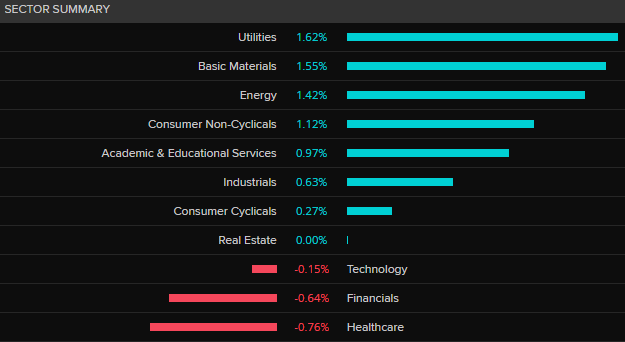

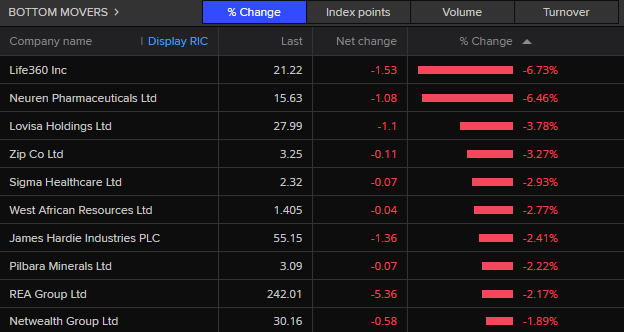

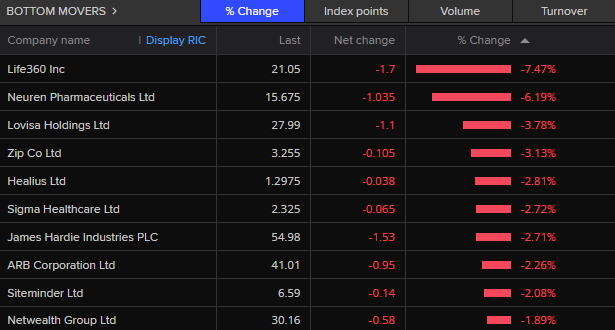

The ASX 200 has battled back from falling 0.4% on opening to end the day 0.2% higher at 8,300 points.

The index gained solidly across the session, only to give up a bit of ground when the late trading settlements came in.

Despite another fall in the iron ore price on Friday, the big miners Rio Tinto (+2.1%), BHP (+0.7%) and Fortescue (+1.2%) were in demand, but anything with an exposure to aluminium such as diversified miner South 32 (+6.2%) and Alcoa (+6.5%), did even better.

The big supermarkets Woolworths (+1.8%) and Coles (+2.1%) brushed off the ACCC inquiry scrutiny they are currently under to lead non-discretionary retailers higher.

The utilities sector, led by pipeline operator APA (+1.7%), also did some heavy lifting.

Financials and healthcare stocks were the biggest drags.

The banks were generally down, led by CBA (-1.4%).

NAB (-0.1%) recovered after being sold off amid reports that ASIC was suing it over the treatment of some of its most vulnerable customers.

ANZ was flat, Westpac (+0.5%) has eked out a gain, while there was a bit of a switch into Bendigo and Adelaide Bank (+3.0%).

CSL dropped 1.7%, perhaps due to it being a vaccine maker at a time when vaccine makers are getting belted ahead of anti-vax campaigner Robert Kennedy Jnr being anointed as Donald Trump's future US Health Department secretary.

Energy stocks did well.

Uranium miners such as Deep Yellow (+7.0%) and Boss Energy (+7.3%) led the index, while gas producers Woodside (+0.4%) and Santos (+1.5%) were in demand.

The biggest losers include Life 360 (-6.7%) and Neuren Pharmaceuticals (-6.5%).

Bitcoin popped back above $US90,000, gold and oil are a bit firmer, as is the Australian dollar.

Across the region trading is mixed with Hang Seng and Shanghai exchanges up around 1% and Japan's Nikkei down 1%.

Futures trading points to a 0.3% rise on the S&P 500 tonight.

Woolworths to return to ACCC inquiry tomorrow

Monday's ACCC inquiry into supermarkets is wrapping up.

It's been a very detailed day. Most questions from the ACCC's legal counsel have been about the company's margins, property ownership, supplier relations and pricing.

There were not a lot of straightforward answers and many were essentially taken on notice and will be answered tomorrow - in particular, questions about how fresh produce suppliers are paid.

This afternoon, Woolworths former CEO Brad Banducci admitted the colour of sales tags was a "challenging" issue the supermarket was trying to change, due to the yellow sales tags looking like an item was on special.

"The yellow, if well executed … people are looking for it and it means if you don't buy today it might not be here tomorrow."

Current Woolworths CEO Amanda Bardwell was asked why the supermarket doesn't just reduce prices instead.

Bardwell said: "Promotional pricing in Australia has been a long tradition. It's always been an important aspect of shopping in Australia."

Coming up on The Business

Hi, hope you are having a good afternoon and a great start to a new week.

Big show tonight!

- The ACCC asks Woolworths some tough questions on competition and pricing. Our reporter Emilia Terzon has been paying close attention to today's grilling and will bring you a full account of the day's proceedings

- I ask Superpower Institute chair Rod Sims how Australia could contribute 10% of the world's emissions reductions (spoiler: by exporting more energy-intensive goods but Professor Sims' own explanation is worth your time)

- and in a busy week for shareholders with 95 AGMs to keep track of, I chat to Vas Kolesnikoff from Institutional Shareholder Services about one company still generating plenty of headlines - Mineral Resources.

Catch The Business on ABC News at 8:45pm (AEDT), after the late news on ABC TV, and any time on ABC iview.

Woolworths makes 3 cents per $1 spent by customers

The ACCC inquiry this afternoon focused on Woolworths' financial performance, pricing practices, and supplier relations.

ACCC counsel Naomi Sharp SC went back and forth with former head of Woolies, Brad Banducci, about EBIT vs NPAT and whether its figures reflected Woolworths' contention that the supermarket industry was a low-margin business despite making about $1.7 billion NPAT last year.

Documents presented to the inquiry showed Woolworths made about 3 cents per $1 spent by customers, with much of the profit reinvested into the business.

Pricing and Consumer Impact

Despite increasing supermarket prices, Woolworths maintained and even grew its profit margins, prompting questions about balancing customer, supplier, and shareholder needs.

In Q1 2025, Woolworths' margins dropped, attributed to higher delivery costs and customers opting for cheaper products or house brands

Supplier Relationships

Last week, suppliers said they were at the whim of supermarkets when it came to what they were paid for fresh produce.

The ACCC raised concerns about supermarkets' margin expectations being communicated to suppliers and suppliers funding rebates and advertising.

Woolworths struggled to answer questions about its dealing with suppliers and said it would be better placed to answer those questions tomorrow.

Cbus investigation flags broader problems in $4 trillion super industry

With the news cycle slowing a bit as we head towards the market's close, we're still stoking the blog for you.

If you've been glued to the blog, you may well have missed this excellent piece from our gun investigative reporter Adele Ferguson on governance issues in Australia's $4 trillion super industry.

You can check it out here:

The relationship between local governments and land banking

Hello! I'm making a brief blog appearance to dig into commenter Bill's earlier question about land banking.

He specifically asked about the role local governments play when it comes to development permits.

I looked into this very issue for a story about a month ago, and the short answer is while yes, local governments have a big role in this, it's mostly because planning and zoning restrictions (set by state governments) make it that way.

Generally speaking, the supermarkets have to prepare and lodge development applications (DAs) with local councils to be given permission to build a supermarket, and can only start to build once that's been given the green-light.

When you consider that building almost anything right now is a challenge thanks to labour and supply shortages, you start to understand how the supermarkets can "hold onto" parcels of land for a long time (and therefore be accused of land banking).

For what it's worth though, the ACCC's interim report into the supermarkets noted that planning and zoning laws can slow down a supermarket's ability to develop new stores — which echoed the findings of the ACCC's last grocery inquiry way back in 2008.

I spoke to Graeme Samuel about this too, who was the boss of the ACCC at the time of the 2008 inquiry, and he summarised the town planning restrictions imposed by local governments as a "major impediment" and an "important, difficult issue" that needs to be addressed.

If you want to know more, you can read the full story by following this link:

Miners lead the bounce back, are green shoots appearing in China?

Against the overall risk-off trend prompted by Friday's Wall Street sell-off, and another substantial decline in iron ore prices to end last week, Australia's miners have bounced back solidly today.

The ASX 300 mining index is up around 1.3%.

All the big iron miners are back in demand, and the diversified South 32 which digs up and processes bauxite, manganese, copper, silver and other metals, is up a very healthy 5.5% today.

So, what's up, given the overall trend on the mining index has been down - 5% for the month and 16% year-to-date.

Well aluminium for one thing, it jumped more than 5% on Friday which helps South 32 and the local listing of Alcoa, which is up 5.9% (a shout out to James who wanted to know what was happening with South 32).

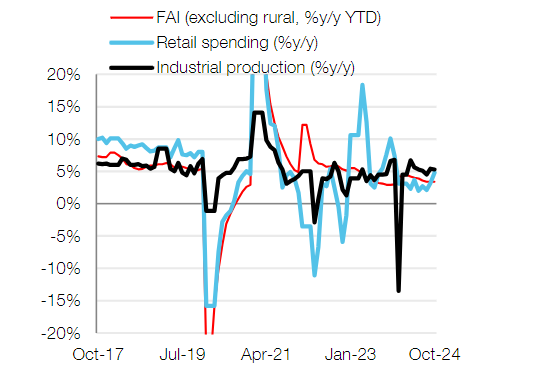

But from a broader perspective, CBA's commodities economist Vivek Dhar says the market has spotted some green shoots in China's recent data, much of which was released late on Friday and over the weekend.

At first glance, much of the data didn't look great.

Chinese industrial production growth slowed slightly from 5.4% YoY in September to 5.3% in October.

Fixed asset investment, a proxy for construction and infrastructure spending, slowed in seasonally adjusted terms, but was in line with consensus thinking.

Retail spending rose 4.8% YoY in October, but in seasonally adjusted terms growth slowed there too.

Mr Dhar said the larger than expected uptick in China's retail sales indicate that subsidies to help consumer purchases of equipment, appliances and cars may be working.

But he cautioned it's far too early to conclude though that China's attempts to rebalance the economy towards consumption have proven successful.

Property data released on Saturday also had a glimmer of good news.

"While new home property prices across 70 cities in China fell again on average for the 17th consecutive month last month, the pace of contraction was the lowest since March 2024," Mr Dhar noted.

The annual pace of contraction in floor space sales, in square metres, also eased considerably from 11%/yr in September to 2%/yr in October.

"However, these green shoots do little to change the narrative that China's property sector still needs significant support to stabilise," Mr Dhar said.

The third green shoot Mr Dhar spotted was infrastructure investment, which accelerated from 1.0% MoM (seasonally adjusted) in September to 1.7% in October marking the largest expansion since November 2023.

"The government's debt swap program should see infrastructure spending supported for the remainder of the year.

"We continue to see infrastructure spending as the best chance for China's economy to reach its growth target of 'around 5%' this year.

"China's economy needs to accelerate from 4.6% in Q3 2024 to ~5.4% in Q4 2024 for the economy to grow 5% in 2024.

"We see policymakers deploying more stimulus next year, especially if Trump's promised tariffs are implemented in full."

Good question Bill

Hi the talk about land banking is interesting, however you could also ask the question about the role local governments play in this story. It's my understanding that development permits are required for the construction of these supermarkets. My query is that these development permits are not issued forever and must be renewed if the work is not carried out, if this is true then why are local governments renewing these permits if no work is being carried out? Thanks

- Bill legg

Local governments won't be questioned in the inquiry but it's a good idea for a future story.

Isn't this land banking?

Ms Sharp has continued questioning Woolworths about land banking.

This time bringing up a redacted balance sheet which included the statement:

"Properties held on balance sheet not planned for a future development or indefinite long-term hold. These sites may also be strategically held or earmarked for disposal.

"Sites held for strategic reasons."

Isn't this land banking? she asked.

Kemmler: "I don't believe so."

Sharp: "Well, it says the properties are held on the balance sheet and are held for strategic reasons and not for development, do you want to give us an example of what that means?

Kemmler said it included land that had "long-term underlying leases that have been developed for other purposes".

Sharp: "I want to zero in on these words: sites held for strategic reasons — what does that mean?"

Kemmler said it was a broad term to encompass all sites that did not fit into other categories.

Sharp: "So you are 100 per cent sure the strategic reasons for which any of these properties were held did not include land banking?"

Kemmler: "Some of that land we don't have an intention to develop it, but it's not withheld for competitive reasons."

Sharp asked once again if the land was held to block competitors.

Kemmler said it was not.

ASX 200 up 0.1pc as miners bounce back; banks and CSL fall

The ASX 200 has battled back from falling 0.4% on opening to be in marginally positive territory heading into the afternoon session.

At 12:40pm AEDT, it was 0.1% higher at 8,285 points.

Despite another fall in the iron ore price on Friday, the big miners Rio Tinto (+2.0%), BHP (+1.2%) and Fortescue (+0.4%), and the diversified miner South 32 (+5.6%), are propping things up at the moment.

The utilities sector, led by pipeline operator APA (+1.7%), is also in demand.

Financials and healthcare stocks are the biggest drags.

The banks are generally down, led by CBA (-1.7%), while NAB (-1.0%) is also being sold off after ASIC said it was suing it over the treatment of some of its most vulnerable customers.

Westpac (+0.1%) has eked out a small gain, while there's a bit of a switch into Bendigo and Adelaide Bank (+2.2%).

CSL is down 1.7%, perhaps due to it being a vaccine maker at a time when vaccine makers are getting belted ahead of anti-vax campaigner Robert Kennedy Jnr being anointed as Donald Trump's future US Health Department secretary.

The big supermarkets are outperforming the market - Woolworths (+1.1%) and Coles (+1.4%) - despite the ACCC hearings into their operations cranking up this week.

Energy stocks are also doing well.

Uranium miners such as Deep Yellow (+8.8%), Boss Energy (+7.0%) and Paladin (+6.6%) have led the pack, while Woodside (+0.3%) and Santos (+1.3%) have been in demand.

The biggest losers include fast fashion outfit Lovisa (-7.5%) and Neuren Pharmaceuticals (-6.4%).

Bitcoin popped back above $US90,000, gold and oil are a bit firmer and in Japan the Nikkei is down.

Woolworths says it does not land bank - according to ACCC definition

The ACCC's legal counsel has begun questioning Woolworths about land banking practices.

Woolworths managing director of property Ralph Kemmler said the industry's definition of land banking differed from the ACCC's.

According to Kemmler, land banking is the accumulation of land for future sites.

"In the industry, that's a common practice, in this case, the ACCC has used a different definition of land banking and uses: the accumulation of land to prevent competition".

Sharp clarified the ACCC's definition of land banking was: "acquiring an interest in land without an intention to develop that land, or secondly, to acquire land earlier than is needed to develop that land in order to lock competitors out from developing that land".

She asked if, on that definition, that is a practice Woolworths engaged in.

Kemmler said "no."

Sharp: "Do you agree with that Ms Bardwell?"

Bardwell: "Yes I agree with that."

Sharp: "Is it your evidence that Woolworths has never, say in the last 10 years, acquired an interest in land without an intention to develop that land?"

Kemmler: "As far as I know, yes."

Is there room for another supermarket chain in Australia?

The supermarkets inquiry is beginning to get into land banking territory.

Legal counsel for the watchdog has asked Woolworths about German chain Kaufland backing out of its plans to open stores in Australia a few years ago.

Former CEO Brad Banducci was asked what Woolworths' strategy was when Kaufland announced it wanted to enter the market.

He said there was no other strategy other than focusing on what Woolworths was offering.

Kaufland has said the inability to secure suppliers and lock in land for stores were the main reasons it backed out of Australia. Ms Sharp asked Woolies CEO Ms Bardwell if those two factors remained barriers to entry in Australia.

Bardwell: "No. If you look at Aldi they have a large exclusive range that they offer."

Sharp: "Leaving Aldi aside would a new operator face significant barriers to entry?"

Bardwell: "I wouldn't have thought so, no."

Sharp: "If it was a supermarket that aspired to operate nationally?

Bardwell: "No. Suppliers will also look for opportunities to sell their products across a range of retailers. Suppliers … happily offer ranges to Amazon and other competitors."

Sharp: "What likelihood do you place on an overseas supermarket company commencing operations in Australia over the next ten years?

Bardwell: "It depends on your definition of supermarket. We have a number of competitors [in the grocery market] like Amazon."

Market snapshot

- ASX 200: flat at 8,288 points (live values below)

- Australian dollar: +0.2% to 64.74 US cents

- Nikkei: -0.7% to 38,295 points

- S&P 500 (Friday): -1.3% to 5,871 points

- Nasdaq (Friday): -2.4% to 20,394 points

- FTSE (Friday): -0.1% to 8,072 points

- EuroStoxx (Friday): -0.7% to 497 points

- Spot gold: +1.0% at $US2,588/ounce

- Brent crude: +0.1% to $US71.11/barrel

- Iron ore (Friday): -1.6% to $US96.70/tonne

- Bitcoin: -1.5% to $US90,375

Prices current at around 12:20pm AEDT

Live updates on the major ASX indices:

Is there 'fierce' competition in Australia's supermarket sector?

Ms Sharp asked if Woolworths agreed with the ACCC's interim report that various non-supermarket retailers were not significant competitors to supermarkets.

Woolies chief exec Bardwell disagreed with that premise and said: "They're increasingly strong competitors in this market and we'll see that continue to increase over time. More customers are shopping online. Over the past 12 months, more than 50% of customers shop online in some context ... Particularly when we think of young customers ... they naturally turn to digital and online retail ... we would certainly expect that to continue to increase."

Sharp: "Is there a state of fierce competition in the grocery market?"

Bardwell: "Yes."

Sharp: "It's dominated by Woolworths and Coles isn't it?"

Bardwell: "We are a substantial part of the market overall that is dramatically changing."

Sharp: "Coles remains Woolworths' closest competitor?"

Bardwell: "Coles is certainly a major competitor along with many others ... including Aldi ... Costco, Amazon, Chemist Warehouse, now Bunnings as well. All of those compete."

Sharp: "Does Woolworths have a strategy other than to neutralise Coles on price?"

Bardwell: "We offer competitive prices for our customers which again is a very important part of our strategy overall."

She said Woolies also tried to provide high-quality products, e-commerce, and low-priced own-brand products to compete.

ASX 200 bounces back at midday

Just a quick update, at midday (AEDT) the ASX 200 has regained this morning's early losses and has scrambled back into positive territory, up 0.1% t0 8,290 points.

I tend to agree with you Alex...

What’s the point of ACCC asking Woolies executives questions like how many distribution centres do you have? Absolute waste of time. Have them fill out a questionnaire ahead of the hearing. ACCC in serious need of some “efficiency dividends”

- Alex

All things competition

The ACCC inquiry has gone on a quick break.

The morning has been dominated by the issue of competition.

ACCC senior counsel Naomi Sharp SC has been going back and forward with Woolworths about what other supermarkets were considered true competitors.

She asked about Coles, Costco and IGA supermarkets and whether Woolworths considered them true competitors.

Coles was the biggest (obviously).

Woolworths CEO Amanda Bardwell and former head Brad Banducci were quick to say all the company was competing against all other supermarkets.

Costco was "famous" for their salmon and chicken, Mr Banducci said.

Ms Bardwell said customers were willing to travel a very long way to shop at Costco and to buy in bulk.

IGA supermarkets (owned by Metcash) were a smaller competitor, focused on convenience and servicing local customers.

Resolute Mining shares slide further on Mali settlement

Resolute Mining's confirmation of a $US160 million ($242 million) settlement with the government in Mali has done little to arrest its share price.

It is down another 4.4% this morning, and about 30% since the three executives were detained last week.