Australian share market falls, housing affordability deteriorates further according to ANZ Corelogic report — as it happened

Australian shares ended lower on Wednesday, a day after reaching a new record high, following a mixed finish on Wall Street overnight where investors mostly brushed off an escalation of the Russia-Ukraine conflict.

Meanwhile, research from ANZ and CoreLogic showed the typical household faces spending half their income to service a new home loan.

Look back on the day's developments as they happened with our blog.

Disclaimer: this blog is not intended as investment advice.

Live updates

Market snapshot

- ASX 200: -0.6% to 8,326 points (final values below)

- Australian dollar: -0.1% at 65.25 US cents

- S&P 500: +0.4% to 5,916 points

- Nasdaq: +1% to 18,987 points

- FTSE: -0.1% to 8,099 points

- EuroStoxx: +0.5% to 500 points

- Spot gold: +0.2% to $US2,636/ounce

- Brent crude: flat at $US73.29/barrel

- Iron ore: +1.8% to $US101.15/tonne

- Bitcoin: +0.3% to $US92,460

Price current around 4:25pm AEDT

Updates on the major ASX indices:

That's it for the blog today

Thanks for joining us throughout the day.

We'll be back to do it all again tomorrow — but if you're after a wrap of today's news to tide you over, here's what's coming up tonight on The Business:

- The federal government puts super funds on notice, as the regulator pursues Cbus for late dealth and disability payments;

- Business insolvencies hit the highest rate since the peak of the pandemic — and are expected to stay there for another 12 months; and

- The big four banks have joined forces to launch an intelligence-sharing network to put a stop to Australians losing $2.7 billion a year to scams.

Catch The Business with Kirsten Aiken on ABC News at 8:45pm, after the late news on ABC TV, and anytime on ABC iview.

LoadingIs the cost of 'sliving' coming back to bite the budget?

That's the take of economist Chris Richardson, who has shared some thoughts on Treasurer Jim Chalmers' economic update earlier today.

He says Mr Chalmers "buried the headline" in his update when it came to revenue upgrades, noting that the government has revised up expected revenues by a third of a trillion dollars across a four year period.

That upwards revision wasn't because of raising taxes, Mr Richardson wrote, but because of war, migration and inflation.

Here's what he shared:

"War drove up the price of things we sell to the world – so the pie we tax got bigger.

"Migration saw population growth roar – which also meant the pie got bigger, and the tax take rose (most of the budget costs of migration fall to the states).

"And inflation changed slices of the pie – families got less and the taxman got more.

"But those factors have now faded – iron ore prices are down, inflation is down too, and migration is slowing.

"So today the Treasurer said any revenue upgrade in the coming budget would only be a "sliver" of what it has been enjoying.

"Like Paris Hilton, the budget has been 'sliving' until now – it's been "slaying mixed with living its best life".

"But the transition from 'sliving' to 'sliver' means that the carnival is over.

"In fact if I were doing the Treasury estimates of the coming tax take, I'd be edging them lower, not higher.

"That says the choices we make as a society are about to lose the cushion we've enjoyed in recent years."

In short?

LoadingASX retreats from record high at end of trade

A day after setting a new record high, the ASX 200 has closed lower, shedding 0.6% to finish at 8,326 points.

Only three sectors ended in positive territory: industrials (+0.3%), utilities (+0.2%) and healthcare (+0.1%).

The rest were solidly in the red, with education shedding the most (-2.8%), followed by technology (-1.3%), consumer cyclicals (-1.1%) and energy (-1.1%).

As for the best performing stocks:

- Tabcorp +2.8%

- West African Resources +2.4%

- Healius +2.3%

- Genesis Minerals +2.1%

- Block +2%

While the worst performers included:

- Neuren Pharmaceuticals -7.5%

- New Hope Corporation -3.6%

- Karoon Energy -3.5%

- Brambles -3.5%

- Netwealth Group -3.3%

Forging friendships

Good on ya Phil!

- Peter

We want people to have a good time in this blog

Bang

Sorry Peter but Biggsy is wrong. Treaty was signed in 1994.

- Phillip

And the train just blew up

We plan to have no plan

Hi Gareth, whether someone arriving in Australia is a temporary or permanent migrant they still need somewhere to live when they get here. Visa applications include questions on where migrants propose to live and should include details on whether they intend to rent or buy. The results should be easy to extract.These figures should be shown to politicians with the exact question “how on earth do you not see the problem”?

- Phillip

Hi Phillip,

It's an interesting one. In that 2016 Productivity Commission report, commissioners said they were baffled by some of the behaviour of our leaders:

"The Australian Government’s decisions on migration have impacts on the infrastructure costs of state and territory governments.

"For example, while there are fiscal costs and benefits for the Australian Government from immigration, some of the costs of immigration (urban congestion, infrastructure funding, urban planning) fall disproportionately on state, territory and local governments.

"Representatives of state and territory governments are active participants in the .... consultation processes on the size and composition of the annual permanent migrant intake.

"State and territory governments provide social, economic and labour market advice and analysis. But the full range of issues (such as infrastructure funding) affecting their constituents (including local governments) do not appear to be adequately considered in their feedback.

"For example, all state and territory governments supported maintaining or increasing the annual immigrant intake in 2016-17. However, this preference is somewhat baffling in the light of significant pressures for infrastructure renewal associated with sizable population increases in some states and territories.

"Representatives of state and territory governments consulted as part of this inquiry did not identify immigration’s effect on infrastructure as a concern.

"Other evidence has also shown that all levels of government have not demonstrated a high degree of competency in infrastructure planning and investment. As a consequence, additional infrastructure funding emanating from migration-induced population growth will inevitably be partially borne by local residents either through user-pays fees or general taxation.

Toot toot!

Thank for the tip. Just spoke to Ronnie Biggs. Said there is no extradition treaty! 😂

- Peter

We've got a train to catch

Chaka chaka

I’ve had it with interest rates and insane house prices. I’m moving to Rio de Janeiro to be closer to Albo.Packed my maracas. See ya @ the Coppa! 🕺🕺

- Peter

Watch out Peter.

The Brazilian hosts of the G20 have just convinced the world's leaders to ensure that ultra-high-net-worth individuals are effectively taxed. It's part of a big global push to make tax systems fairer. You might get snared in their net!

LoadingPlan? What plan?

Shadow Treasurer Angus Taylor had some interesting things to say in his ministerial statement on the economy a little earlier, in reply to Treasurer Jim Chalmers' ministerial statement in the House of Representatives.

He had a section in his speech on housing:

Migration and Housing

We see this so clearly in the way Labor has mismanaged our migration program.

Australia is a proud migrant nation and we will remain so.

But we also need to face the reality.

Labor plans to bring in 1.67 million migrants over five years whilst falling short of its own targets by at least 400,000 homes.

To put this into perspective, one person is arriving to live in Australia every 44 seconds.

But as the RBA Governor has said we haven’t been building enough housing for our population.

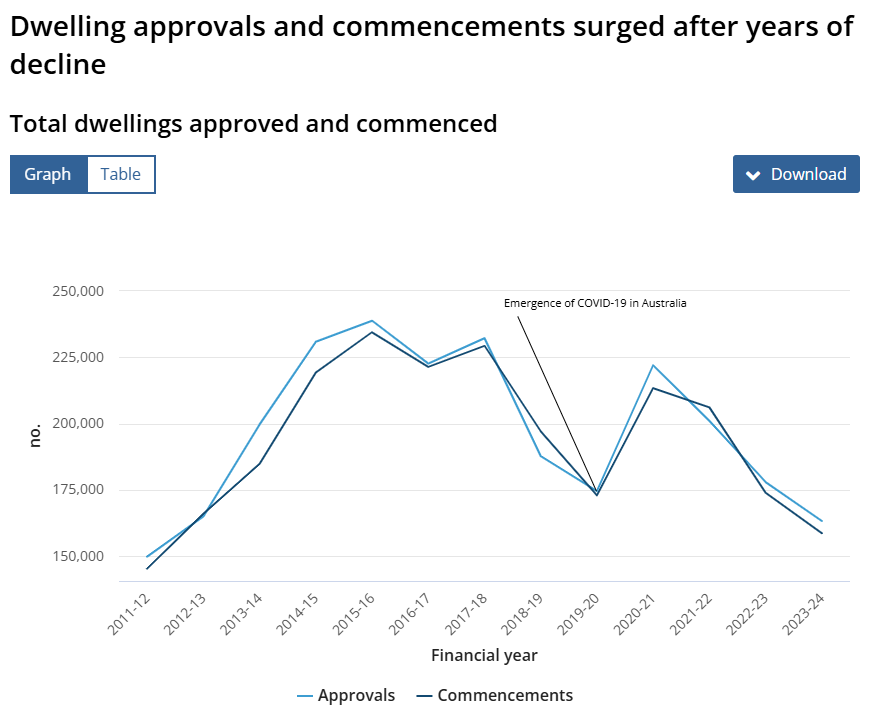

Under this Government, building approvals have fallen to their lowest level in over a decade, and commencements dropped 8.8 per cent to just 158,690 new starts in 2023-24.

You simply cannot bring in 1.67 million people over five years without any planning for it, without the homes and supporting infrastructure required.

This Government’s ‘Big Australia’ policy, which is forcing Australians out of homes, wasn’t something the Australian public voted on or gave a mandate to at or before the last election.

Now for so many, the great Australian dream of home ownership has never felt further out of reach.

He says Labor is "planning" to bring in 1.67 million migrants over five years.

That figure comes from the 2024/25 budget papers (Budget Paper No.1 page 53). The numbers come from Treasury and ABS.

The budget papers show an outcome of 528,000 net overseas migration in 2022/23, and forecasts of 395,000 in 2023/24, 260,000 in 2024-25, 255,000 in 2025-26, and 235,000 in 2026/27.

That equals 1,673,000 people over five years.

To say that Labor is "planning" to bring that many people into Australia is the type of word that will be weaponised in the federal election next year.

But here is what's actually happening.

Under our current migration system, the vast majority of people are coming to Australia on temporary visas, which are uncapped. They're "demand-driven" visas, meaning if there's demand for people to come to Australia to study, work, or holiday, that demand is being met by Australia offering them a temporary visa. For example, there's a lot of demand from young people overseas to study at Australia's universities.

Treasury officials look into the future and do their best to forecast how much demand they think there'll be, in coming years, for people to come to Australia.

Then they produce their forecasts for net overseas migration.

Now, the federal government's annual budget process takes into account its plan for permanent migration every year. But it doesn't have an annual plan for temporary migration. And Australia's temporary migration intake is much bigger than its permanent migration intake.

Interestingly, back in 2016, the Productivity Commission delivered a mammoth 713-page report on Australia's migration intake to the then-Coalition government.

It had some things to say, like this:

"A feature of Australia’s immigration policy is the largely uncapped nature of Australia’s temporary migration program. This means that the Australian Government has less control over Australia’s NOM, and hence population levels and growth."

"The annual size of the Migration Programme appears to be largely driven by a limited approach that attempts to take into account some labour market and economic and social factors and is informed by short- to medium-term economic and fiscal modelling ... Consequently, systematic and transparent consideration of the broader ramifications to the Australian community (and its future generations) arising from population growth — for example, the uncapped nature of temporary migration, the negative externalities imposed on the natural environment and the required investment in infrastructure — appear to be ‘remnant’ considerations within the process that sets of size of the annual migration intake."

Remember, that was from 2016. And that Coalition government was in power from 2013 to 2022. Unfortunately, those passages in that PC report could have been written to describe today's system, because they weren't acted upon.

And what about the "Australian dream of home-ownership"?

We Millennials and Gen-Zs have been living this problem for a very long time. We've been watching the old certainties disintegrate for our entire adult lives. The disappearance of the Australian Dream isn't something that's happened in the last two years. It's been decades in the making. Through successive generations of Coalition and Labor governments. We now report on the utterances of politicians in Parliament who have multiple properties, and then we go home to our rented cardboard boxes.

Interestingly, yesterday the Bureau of Statistics released some great data on home-building through the pandemic.

It said the conditions for residential building in Australia have changed considerably over the past 5 years.

It said dwelling approvals and commencements had been falling since 2015-16, and they hit a multi-year low on the eve of the pandemic, but then dwelling approvals and commencements surged in the second half of the 2020-21 financial year following the introduction of record low interest rates and government stimulus programs directed at home building.

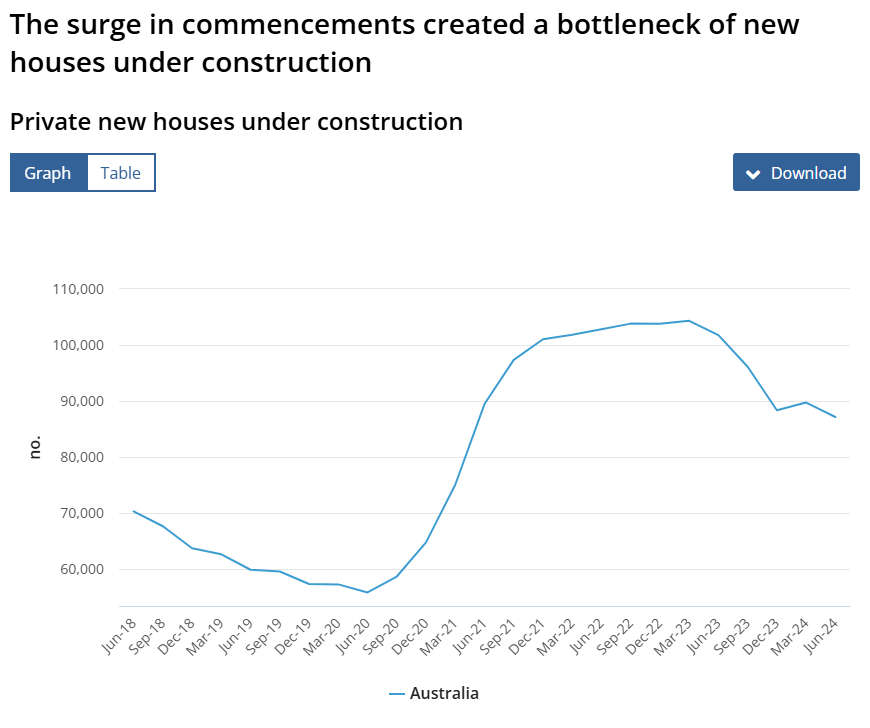

Then we saw incredible bottlenecks:

The surge of commencements in June 2021 created an influx of new houses being built and moving through construction stages at the same time.

This led to competing demand and shortages for the same trades and materials, which caused construction delays. With projects stalling at various stages of construction, new houses took longer to complete.

Extreme weather events and construction industry insolvencies further added to the construction delays, leading to a bottleneck of houses under construction, which has started to ease through mid-2023.

Lots of builders have gone bust in recent years, in that chaos.

And house prices have never been more out of reach for millions of Australians.

Add those festering housing problems to the system we have for migration, where temporary visas are uncapped (and there's no formal link between growth in net overseas migration and growth in housing and infrastructure), and where people have started returning to Australia en masse to start living the lives they'd planned on living before the pandemic interrupted everything, and it will help to explain why we have the situation we have.

That's why in the Parkinson Review, which was handed to the government in early 2023, Dr Martin Parkinson recommended overhauling our migration system. He said the government should start formally targeting permanent and temporary migration in its annual budget process, and over a longer timeframe (with a 10-year plan, for example, rather than a 12-month plan).

Why weren't those kinds of ideas implemented 10 years ago or more?

Wages and salaries paid to employees passes $100 billion

Yes, you read that correctly — the total wages and salaries employers paid to their workers in September surpassed $100 billion.

That's according to the latest monthly employee earnings indicators released by the ABS earlier today.

All up, employers paid $103.7 billion in wages and salaries in September, making it an all-time monthly high.

Between August and September, total wages and salaries rose by 3.9% (or $3.9 billion), which has been partially attributed to some industries paying bonuses in September — but it wasn't the only reason.

The ABS also identified underlying wage growth, changes to hours worked, employment growth and periodic and one-off payments like bonuses and backpay as reasons for the multi-billion-dollar boost.

Despite that though, the ABS's head of labour statistics Bjorn Jarvis said annual growth this year was lower than in 2023.

"Given these factors were stronger a year ago, annual growth in total wages and salaries to September of 6.3% was lower than annual growth to September 2023 of 7.3%," he said.

Nick Scali shares hit four-month low over delivery delays

In less than ideal news if you're waiting for some Nick Scali furniture (or are a shareholder), the company's share price is down roughly 0.8% today after telling the ASX one of its logistics partners overseas has collapsed.

The retailer said one of its freight forwarders and customs agents has "experienced operational issues" and has entered administration — resulting in a number of shipping containers bound for Australian shores being delayed.

However, the company has since obtained court orders to release the containers, and is now working on getting them delivered.

But news of the delay — and Nick Scali's warning that it will hurt its projected profit for the first half of the 2025 financial year — has resulted in Nick Scali's share price falling to its lowest level since mid-July.

ASX keeps sliding away from record high at lunch

The ASX 200 is continuing its descent from its record high yesterday, with local shares down 0.4% to 8,344 points at 12:55pm AEDT.

(You can get live figures at the top of the blog.)

Unsurprisingly it's a sea of red for most of the sectors, with only industrials and basic materials higher — they're up 0.5% and 0.2% respectively.

The biggest losses on the sectors have been for education (-3%), technology (-1%), consumer cyclicals (-0.8%) and energy (-0.8%).

As for the top performing individual stocks:

- Perseus Mining +2.7%

- Genesis Minerals +2.1%

- West African Resources +2.1%

- South32 +1.9%

- Tabcorp +1.9%

While the worst performing stocks include:

- Neuren Pharmaceuticals -7.3%

- Reliance Worldwide -3.1%

- Fletcher Building -2.7%

- Elders -2.7%

- IDP Education -2.7%

Here's what else made the treasurer's economic highlight reel

Let's speed through the rest of the treasurer's near-3,000 word speech.

Here are some other highlights he called out, cliffnotes edition:

- Real wages are higher, and the gender pay gap is narrowing

- Cost-of-living relief has helped households doing it tough, including tax cuts, energy bill relief, childcare subsidy rate increases, and Commonwealth Rent Assistance

- Federal budget repair, with back-to-back surpluses, banking $285 billion of revenue upgrades, and lowering gross debt

- Legislating its commitment to net zero by 2050

- Supporting local manufacturing in the future with the establishment of its $23 billion Future Made in Australia plan

- Overhauling merger settings and improving competition in the supermarket sector

- Establishing a $900 million National Productivity Fund to "boost competition and productivity"

'This is the soft landing we have been planning for'

The treasurer continues by saying that the Australian economy has made substantial progress in combatting inflation, while preserving economic growth and the strong jobs market.

While he notes that economic growth was below 0.3% in every quarter of the last financial year — "for only the second time in the last half-century" — but says "any growth at all in these circumstances is welcome".

"Treasury is expecting a gradual recovery in the economy driven by rising real incomes thanks to our cost-of-living relief, jobs growth and progress bringing inflation down," he says.

"We’ve already seen a modest recovery in consumer confidence, with the ANZ Roy-Morgan measure at near two-year highs and showing households are now feeling more confident about the next 12 months.

"This is the soft landing we have been planning for and preparing for — inflation coming back to band, an economy still growing and unemployment with a 4 in front of it."

Australian economy has 'performed better than most', Chalmers says

The treasurer has gone into plenty of detail about the challenges that the Australian — and global — economy has endured, particularly inflation.

"But the Australian economy has performed better than most countries," he says.

"Our inflation peaked lower and later than most developed countries.

"That means prices have risen less here than in countries like the US, UK and New Zealand, and our services inflation is lower than the UK and US too.

"Interest rates also climbed higher than ours in almost every comparable country, causing worse unemployment, slower job creation, lower growth, or a combination of all three.

"And even though rates are coming down slightly in places like the US, UK and New Zealand, they are still higher than ours."

Treasurer Jim Chalmers giving economic update

Down in Canberra, Treasurer Jim Chalmers is on his feet in the House of Representatives giving his second Ministerial Statement on the Economy.

It's been two and a half years since he delivered his last one, and a lot has changed — and he's quick to highlight the progress that's been made on inflation.

Back in July 2022, the June quarter inflation data showed inflation had come in at 6.1%, and interest rates had just started being hiked by the RBA.

He's also giving an overview of the global and domestic economy, and previewing what's to come in next month's Mid-Year Economic and Fiscal Outlook (aka, MYEFO).

If you're so inclined, you can watch it below on Parliament House's House of Representatives live stream on YouTube — but I'll bring you some highlights from his speech right here on the blog, too.

ICYMI: Harvey Norman and Latitude set to appeal misleading conduct ruling

In case you missed it late yesterday, Harvey Norman and Latitude Financial have announced plans to appeal a court ruling that found they deliberately misled customers into taking out credit cards.

If you're not sure what the story is: mid-last month, the Federal Court ruled that both Harvey Norman and Latitude misled consumers through an advertising campaign that spruiked 60-month interest free payments without the need for a deposit between January 2020 and August 2021.

The businesses were taken to court by the corporate regulator ASIC, which alleged Harvey Norman's ads on TV, radio and newspapers hid the fact customers would be signing up for a credit card with Latitude to purchase items instead of an interest free payment plan.

In a statement posted to the ASX yesterday, both Harvey Norman and Latitude told shareholders they will apply for leave to appeal the court ruling.

You can read the full story below:

Is this thing on?

Well hello! Thanks to Sam and Stephanie for holding the fort this morning — I'm here to guide us through the rest of the day's business and financial market developments.

It's another rainy, grey day here in Brisbane (and somehow only just over 20 degrees in late November?) so if it's sunny in your part of the world, please enjoy it for the both of us.

And of course, feel free to send through any comments or burning questions you've got with the world of business and finance, and I'll do my best to answer them — or rope in some outside assistance.

For now though, I offer this GIF to make up for my recent blog absence.

LoadingBluescope hopes for the best as Trump talks tariffs

The boss of Australia's largest steelmaker is confident the business is well placed to succeed under a second Donald Trump presidency, despite the president-elect's promise of widespread tariffs.

Mr Trump will be sworn in to office on January 20 after he campaigned on a promise of introducing tariffs of 10 to 20 per cent on all imported goods.

BlueScope, which operates from Port Kembla in NSW, was Australia's sole exporter of steel to the United States in 2018 when president Trump imposed a 25 per cent tax on steel imports.

But it did not have to pay the tax on the 300,000 tonnes of steel it sent to its Californian subsidiary annually under a tariff deal between Australia and the White House.

Speaking after the company's annual general meeting, Mark Vasella said the company would have to wait to see what happened.

"We did get a pass on tariffs the last time around for the small portion of steel we send to North America," he said.

"The prime minister has talked over the past couple of days about the strong relationship and friendship between Australia and North America and that will continue."

The full story from ABC Illawarra's Tim Fernandez here: