ASX climbs as Bitcoin hits fresh record, Coles faces supermarket inquiry, WiseTech slumps — as it happened

Local shares have ended the week on a positive note, while Bitcoin continued to close in on $US100,000.

Coles executives were grilled on supplier deals and WiseTech shares fell after its annual meeting.

Look back on how it unfolded on the markets blog, plus insights from our specialist business reporters.

Disclaimer: this blog is not intended as investment advice.

Live updates

Market snapshot

- ASX 200: +0.9% to 8,393 points

- Australian dollar: -0.4% to 64.89 US cents

- Wall Street: Dow +1.1%, S&P +0.5%, Nasdaq flat

- Europe: Dax +0.7% FTSE +0.7% Stoxx600 +0.4%

- Spot gold: +0.6% to $US2,685/ounce

- Brent crude: +0.1% $US74.29/barrel

- Iron ore: +1.1% to $US102.15 a tonne

- Bitcoin: +1% to $US99,059

Prices current around 4:35pm AEDT.

Live updates on the major ASX indices:

A fresh high, and goodbye

That's where we leave our markets blog for the week — thanks for your company!

The ASX 200 set another record closing high today, and flirted with intraday highs as well, although it fell short of the all-time peaks it touched on Tuesday.

And bitcoin continued its climb towards $US100,000.

LoadingWe'll be back with our live coverage on Monday.

In the meantime, we'll have plenty of coverage on the ABC business page over the weekend, including a wrap up of this week's supermarket inquiry — just in time for your Saturday grocery shop.

And catch Close of Business on ABC News Channel or on iView.

David Chau will be joined by Tim Buckley from Clean Energy Finance and Gemma Dale from nabTrade.

A happy Friday for the ASX

That's a wrap on local trade for the week, and the ASX 200 gained 0.9 per cent on Friday.

That leaves it 1.3 per cent higher for the week.

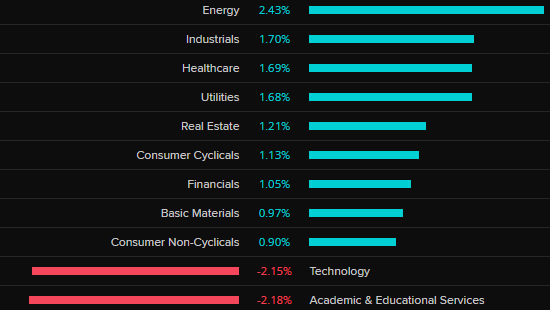

Energy was the best performing sector, while technology and education lagged.

Here are the biggest individual movers:

Top

- A2 Milk (+13.3%)

- Deep Yellow (+6.3%)

- Paladin Energy (+5.9%)

- Yancoal (+5.4%)

- Sigma Healthcare (+5.4%)

Bottom

- WiseTech (-12.4%)

- Megaport (-9.5%)

- Pilbara Minerals (-6.8%)

- Audinate Group (-5.5%)

- NEXTDC (-3.7%)

Adore Beauty sets its sights on Mecca and Sephora

Hello! I'm popping in with an interesting business development in the Australian beauty retail space.

If you're into beauty, you'll probably be familiar with Adore Beauty. Established in 2000, it was Australia's first online retailer dedicated to beauty, and today it sells an assortment of makeup, skincare and haircare products — with more than 300 brands and 13,000 products on offer.

(They also have a bit of a cult following for including a Tim Tam when shipping their orders.)

What you may not know is that Adore Beauty is actually listed on the ASX — and today they held their AGM in Melbourne.

The big news to come out of that was Adore Beauty unveiling a brand new three-year strategy that will see it become an "omni-channel beauty retailer".

In other words, they're going to open retail stores around the country — and are aiming to open at least 20 of them over the next three years.

And if you know anything about the beauty retail space in Australia, it's dominated by local darling Mecca, and the global giant that is Sephora.

Both have physical stores dotted around the country to complement their online offerings, and now Adore Beauty is ready to take the pair on.

New Adore Beauty CEO Sacha Laing said the time was right for the company to take the next step.

"Taking the group from a pureplay online beauty platform into an omni-channel beauty authority is a natural evolution for the group," he said.

"This plan is just the beginning with significant opportunity to continue to capture increasing share of the $13.9 billion beauty industry over the long term."

(No word on what the plan is for in-store Tim Tams though...)

Less than one hour to go… but who's counting?

We're now counting the time remaining in this session in minutes, not hours.

And most sectors of the ASX 200 are in positive territory:

If the benchmark index holds on to its current 1 per cent gain, that'll leave us 1.5 per cent higher for the week.

Trump bump sees bitcoin close in on $US100,000

Bitcoin has come within a whisker of closing above $US100,000 for the first time on Thursday as the election of Republican Donald Trump as US president spurred expectations that his administration will create a friendly regulatory environment for cryptocurrencies.

The world's largest cryptocurrency was trading between $US98,000 and $US99,000 in late afternoon trading in the US on Thursday, after briefly touching $US99,073.

Bitcoin has more than doubled in value this year and is up about 40% in the two weeks since Trump was voted in as the next US president and a slew of pro-crypto lawmakers were elected to Congress.

Trump embraced digital assets during his campaign, promising to make the United States the "crypto capital of the planet" and to accumulate a national stockpile of bitcoin.

Crypto investors see an end to increased scrutiny under US Securities and Exchange Commission Chair Gary Gensler, whom Trump has said he will replace.

Trump also unveiled a new crypto business, World Liberty Financial, in September. Although details about the business have been scarce, investors have taken his personal interest in the sector as a bullish signal.

Billionaire Elon Musk, a major Trump ally, is also a proponent of cryptocurrencies.

Over 16 years after its creation, bitcoin appears on the cusp of mainstream acceptance.

"Everyone who's bought bitcoin at any point in history is currently in profit," Alicia Kao, managing director of crypto exchange KuCoin, said.

"But those who bought it early, when there were significant obstacles to doing so and there was the might of the world's financial and governmental forces intent on crushing it, are the real winners. Not because they're rich, but because they're right."

Bitcoin's rebound from a slide below $US16,000 in late 2022 has been rapid, boosted by the approval of US-listed bitcoin exchange-traded funds in January this year.

The Securities and Exchange Commission had long attempted to block ETFs from investing in bitcoin, citing investor protection concerns, but the products have allowed more investors, including institutional investors, to gain exposure to bitcoin.

Funds rush into crypto after US election

More than $US4 billion has streamed into U.S.-listed bitcoin exchange-traded funds since the election. This week, there was a strong debut for options on BlackRock's ETF IBIT, with call options — bets on the price going up — more popular than puts.

"There is a persistent bid in the market," said Joe McCann, CEO and founder of Asymmetric, a digital assets hedge fund in Miami. "$US100,000 is a foregone conclusion."

Crypto-related stocks have soared along with the bitcoin price and shares in bitcoin miner MARA Holdings were up nearly 2.3% on Thursday (US time).

"Once you break out to new highs, you attract a lot of new capital," John LaForge, head of real asset strategy at Wells Fargo Investment Institute, said.

"It's like gold in the 1970s, where this new high is in a price discovery mode. You don't know how high it's going to go," he said.

Yet the rise is not without critics.

Two years ago, the industry was wracked by scandal with the collapse of the FTX crypto exchange and the jailing of its founder Sam Bankman-Fried.

The cryptocurrency industry also has been criticized for its energy usage, with miners under scrutiny over their potential impact on power grids and greenhouse gas emissions due to their energy-intensive operations.

Crypto crime also remains a concern, with an analysis by crypto researchers Chainalysis finding that at least $US24.2 billion worth of crypto was sent to illicit wallet addresses last year, including addresses identified as sanctioned or linked to terrorist financing and scams.

Reuters

WiseTech shares down 9 per cent

Shares in software logistics firm WiseTech are having a not-so-great Friday — currently they're down around 9 per cent.

That's after the company's annual general meeting wrapped up, with shareholders lobbing questions at the board over its handling of the very public scandal surrounding founder and former boss Richard White.

WiseTech also issued an update, lowering its revenue guidance as it delayed the launch of certain products.

On the issue of Mr White's conduct, here's a wrap of what we heard at the AGM, from Reuters:

An ongoing external governance review, which includes an investigation into White's conduct, found there was no evidence that any required matters had not been disclosed to the board.

The initial findings largely cleared White of any wrongdoing, though the review acknowledged that his management style might be perceived as intimidating by some employees.

WiseTech engaged Herbert Smith Freehills and Seyfarth Shaw LLP to investigate the "current state of affairs" surrounding White, with Seyfarth Shaw concluding that "the close personal relationships set out in Mr White's disclosures were in each instance previously disclosed or known to relevant WiseTech officers and senior managers."

Muesli bar bargains?

I agree with Ben i had that situation with IGA they were 25cents higher so bit the bullet went to ALDI similar item 95cents cheaper guess we're I'm going now

- David-W

Not sure if you used to favour the same brand as Ben, David.

Market snapshot

- ASX 200: +0.9% to 8,399 points (live values below)

- Australian dollar: flat at 65.11 US cents

- Wall Street: Dow +1.1%, S&P +0.5%, Nasdaq flat

- Europe: Dax +0.7% FTSE +0.7% Stoxx600 +0.4%

- Spot gold: +0.5% to $US2,683/ounce

- Brent crude: +0.5% $US74.57/barrel

- Iron ore: +1.1% to $US102.15 a tonne

- Bitcoin: +0.8% to $US98,777

Prices current around 2:35pm AEDT.

Live updates on the major ASX indices:

Bitcoin hits record high above $US99,000

Here's the price action over the past week:

ASX 200 higher in early afternoon trade

It's a good day for the Australian share market, which is up one per cent this afternoon, driven by gains in the energy sector.

The ASX 200 is up 1.07% to 8410 points.

The All Ordinaries is up 1.01% to 8654 at 1:50pm AEDT.

Update

At the heart of the supplier/supermarket to and fro is the question “who takes the hit if there is a market oversupply at harvest time “. The suppliers obviously want the supermarkets to accept the risk and guarantee prices in advance. Won’t happen. Company directors are obligated to act in best interest of their own company and such a guarantee could not possibly be in the best interests of supermarkets.

- Phillip

Thanks for sharing your views Phillip

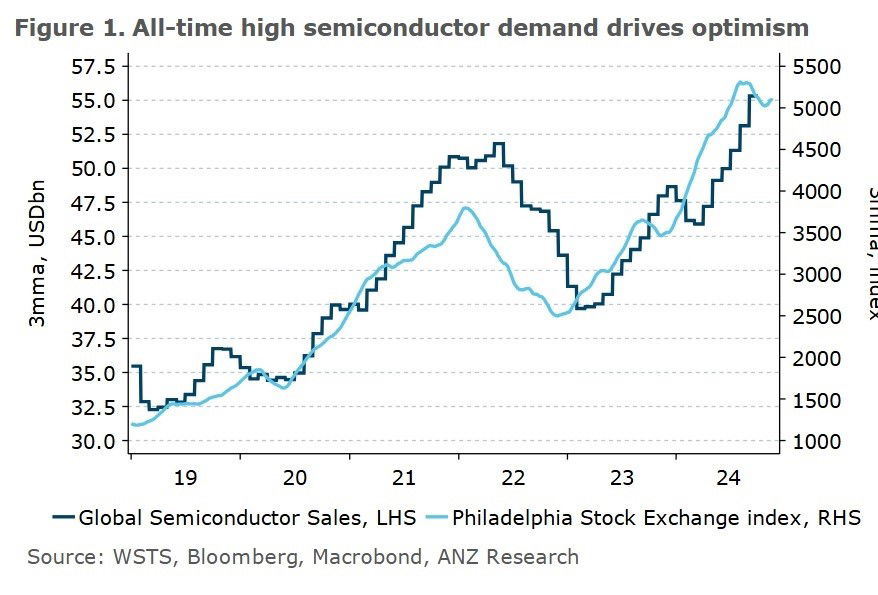

Has the semiconductor bubble burst?

A report by ANZ shows global semiconductor sales hit an all time high in September - but the bank warns a slowdown is on the horizon.

"Our view is that the semiconductor cycle is at or near its peak in the current cycle. We expect to see a moderation in the pace of demand growth in upcoming months. We do not expect any downturn."

The demand for semi conductors is likely to continue into the future due to the rise of AI, ANZ says.

Financial markets are optimistic about the sector - see this graph with the Philadelphia semiconductor index (SOX) which is up 16.9%

So have we reached the peak of the semi conductor hype? ANZ has analysed data from several key Asian economies where electronics growth and export volume has slowed and said while it did appear that the semiconductor cycle was at its peak, there was no sign yet of a downturn.

But they said unknown impacts of potential Trump policies could pose a risk to the sector and that would need to be monitored in the months and years ahead.

Multinationals could be forced to publicly reveal taxes they pay worldwide

Hello, Nassim briefly with you to share on one of my favourite topics: tax!

Multinationals could soon face new laws that force them to publicly reveal taxes they pay in each jurisdiction around the world.

The Albanese government is set to introduce its corporate tax transparency disclosures legislation to parliament this week.

While about 140 corporations, including BHP, Rio and Woolworths, already do some form of voluntary public country-by-country reporting, this would force all multinationals operating in Australia to open their books to the public with far more detailed information than is currently available.

Business lobbies have been fighting the laws, arguing it goes far beyond tax transparency disclosures offered in other jurisdictions including the EU.

But in a joint letter to the federal government from Australian trade unions and international civil society organisations, they urge the government to keep "standing firm against the intense lobbying it has faced from the professional enablers of tax abuse".

Jason Ward, principal analyst at the Centre for International Corporate Tax Accountability and Research, said arguments by business that this would be a major cost impost were over exaggerated given all companies were already reporting this information to the Australian Taxation Office (ATO).

"Transparency will drive changes in corporate behaviour, if obvious profit shifting practices will be exposed and open to criticism," he said.

The Tax Justice Network's Mark Zirnsak said "publicly seeing where corporations are conducting their business and where they are allocating their profits helps to deter and expose tax avoidance".

"It allows customers to decide which corporations they wish to buy from and investors which businesses they wish to invest in knowing the risks that a corporation might be at high risk of adverse action by tax authorities," he said.

I wrote a detailed piece when business first fought off the laws, you can read that here:

'Can you answer my question?' Coles tight-lipped on supply commitments

Some tense back and forth between the ACCC's inquiry chair Mick Keogh and counsel assisting Naomi Sharp SC, and Coles' executives and lawyers.

In answer to questions about whether Coles was contractually obligated to purchase certain volumes of fruit and vegetables from suppliers, supermarket execs were unwilling to state that they weren't legally obliged.

They repeatedly referred to 'forecasts' and 'commitments' reached with growers, but would not concede that those don't represent firm contracts.

Coles' lawyers intervened to put an end to the repeated questioning.

The search for cheaper muesli bars

I’ve always bought a particular brand of muesli bars from Coles and Woolworths, as I can’t get them from Aldi. I remember before the pandemic they were under $6 for a pack of 5. A few weeks ago both Coles and Woolworths sold them for $7.50. However only recently, both have increased the price to $7.90. I find it hard to believe these two chains are competing on price given the increase is so minuscule and both are unwilling to lower them even by a fraction. I feel there is strong reason to believe there is collusion rather than competition, since this happens so often today. Is this something that will be addressed in the ACCC inquiry?

- Ben

Thanks for writing in Ben — Coles boss Leah Weckert answered some questions at yesterday's ACCC hearing, about how Coles and Woolies compete on price — you can catch up here.

Ms Weckert was also asked about how the supermarket decides when to hike prices, and she said one factor is the supplier requesting an increase.

Data journalist Madi Chwasta crunched the numbers on prices across a slew of products at Woolworths and Coles in this piece:

AusPost wants to hike stamp price to $1.70

Australia Post has notified the ACCC that it wants to increase the price of basic stamps from $1.50 to $1.70 from July next year.

It's the postal service's latest attempt to offset what it calls "significant ongoing losses" from delivering letters.

It's not proposing any change to concession and seasonal greeting stamps, which remain at 60 cents and 65 cents respectively — AusPost says those prices have not changed since they were launched more than 10 years ago.

Fewer than 3 per cent of letters are sent by individuals, with the vast majority mailed by businesses and government agencies and total letter volumes are expected to reduce further.

Volumes of letters dropped nearly 13 per cent over the last financial year — back to levels last seen in the 50s.

Apparently the average household buys five to six full-cost stamps a year, so the price hike would equal $1.20 per household.

So essentially AusPost is saying it's nothing to write home about… which seems to be the entire issue…

Shares in jewellery chain Lovisa fall as sales disappoint

Lovisa shares are currently down around 1 per cent, but earlier in the session the stock fell as much as 5.7 per cent, as the jewellery retailer's sales update disappointed.

Sales for the first 20 weeks of the financial year were up 10 per cent, but that was a slow down from a 13 per cent increase over the first eight weeks, according to RBC Capital Markets.

RBC analyst Wei-Weng Chen said total sales growth was behind expectations and showing deceleration.

WiseTech's Richard White under scrutiny at AGM

The AGM has heard a question from activist shareholder Stephen Mayne regarding allegations made previously by former WiseTech board member Christine Holman about Richard White's conduct towards her, including allegations of bullying.

Those allegations are among those currently being investigated by law firms Herbert Smith Freehills and Seyfarth Shaw.

Today WiseTech released an update to the ASX on that review, finding so far “no evidence” of misconduct.

This morning's AGM also heard from two female board members who told the meeting they found Mr White respectful towards them.

According to today's statement, the WiseTech review found that Mr White’s behaviour was “generally consistent with the process of ‘creative abrasion’, which was widely acknowledged … to create significant value for the organisation”.

The law firm Seyfarth Shaw concluded:

"there has not been repeated unreasonable behavior, or behavior that could be characterized as “bullying” or “intimidatory” or otherwise unlawful."

"Seyfarth Shaw also found that Mr White has a direct approach and that from time to time is involved in robust and challenging discussions."

Market snapshot

- ASX 200: +0.8% to 8,387 points (live values below)

- Australian dollar: flat at 65.12 US cents

- Wall Street: Dow +1.1%, S&P +0.5%, Nasdaq flat

- Europe: Dax +0.7% FTSE +0.7% Stoxx600 +0.4%

- Spot gold: +0.1% to $US2,672/ounce

- Brent crude: +2.1% $US74.33/barrel

- Iron ore: +1.1% to $US102.15 a tonne

- Bitcoin: +0.2% to $US98,316

Prices current around 11:25am AEDT.

Live updates on the major ASX indices: