ASX gained 0.3 per cent to a new record close despite falls among the banks and miners — as it happened

After a bright opening, the ASX 200 faded at the end of the session, but the 0.3 per cent gain was still enough to post a new record close.

The gain was despite weakness among miners and banks, although one bank, the CBA, stood out, gaining 0.7 per cent to finish above $160 per share for the first time.

Look back at the day's events in our business blog below.

Disclaimer: this blog is not intended as investment advice.

Live updates

Market snapshot

- ASX 200: +0.3% to 8,418 points (live values below)

- Australian dollar: +0.2% to 65.16 US cents

- Nikkei: +1.4% to 38,802 points

- Hang Seng: -0.5% to 19,138 points

- Shanghai: -1.1% to 3,825 points

- S&P 500 (Friday): +0.4% to 5,969 points

- Nasdaq (Friday): +0.2% to 20,776 points

- FTSE (Friday): +1.4% to 8,262 points

- Euro Stoxx (Friday): +0.8% to 497 points

- Spot gold: -1.6% to $US2,668/ounce

- Brent crude: -0.5% to $US74.67/barrel

- Iron ore (Friday): +0.5% to $US102.50/tonne

- Bitcoin: -1.0% to $US98,425

Prices current around 4:30pm AEDT

Live updates on the major ASX indices:

Goodbye

That's it for another day on the blog, thanks for your company.

Looking ahead, the S&P 500 futures point to a 0.4% rise on Wall Street tonight.

For more financial news and analysis don't forget to tune into The Business with Kirsten Aiken at 8.45pm AEDT on ABC News, or after the late news on ABC-TV, or indeed anytime on ABC iView.

Until next time.

LoadingASX fades at close, but still notches a fresh high

The ASX 200 bounced out of the blocks on pace for 0.6% gain, or better, but faded at the end of the day to just eke out win.

However, rising 0.3% to 8,418 points was more than enough for its second record close in as many sessions.

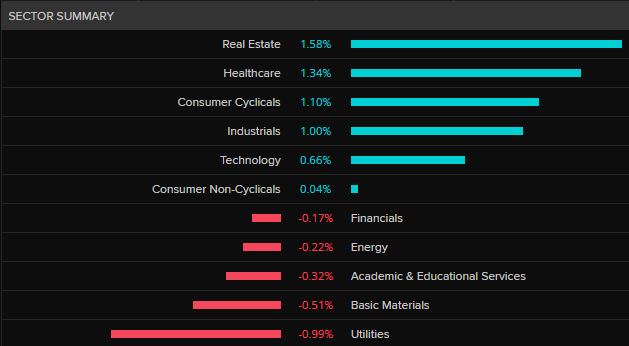

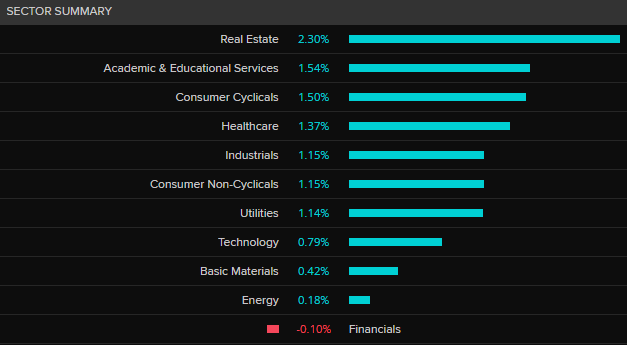

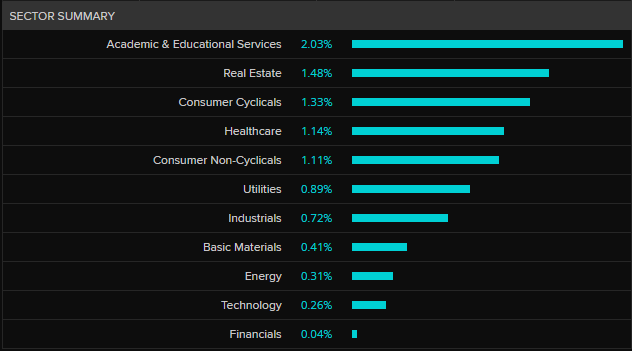

Real estate and healthcare sectors did most of the heavy lifting, while the miners, banks and utilities were drags on the day.

The CBA was the only bank to make any headway, closing 0.7% just above $160.00 for the first time.

Everything else in the sector dropped 1.2% or worse, although Macquarie's fall was limited to 0.4%.

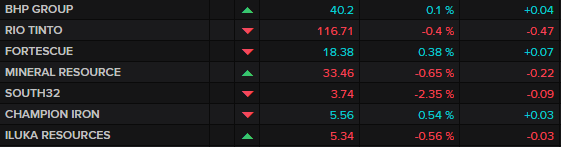

The miners were also a fairly mixed bag, despite marginally stronger commodity prices.

The biggest winners of the day were the payments platform Zip (+4.4%) and fast-food outlet Guzman Y Gomez (+4.3%).

Outside the ASX 200, the novated lease and salary packaging business SG Fleet started brightly, up more than 20% on takeover news, but lost a bit of momentum to finish the day up "just" 18% at $3.16, well below the bid price of $3.50.

The biggest losers were Tabcorp (-5.5%) and Bellevue Gold (-4.1%).

Across the region only Japan's Nikkei (+1.4%) made much headway.

The Australian dollar was a bit firmer, gold fell as did oil, while Bitcoin was still bubbling away just under $US100,000.

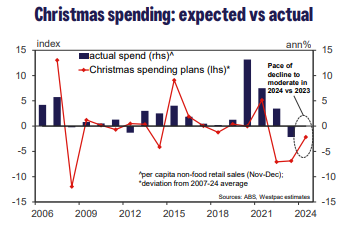

Retailers ho, ho hoping for a better Christmas

Retailers may be in for a slightly merrier Christmas this year with Westpac's latest spending plan survey signalling consumers are a bit less downbeat than in the previous two years.

The key finding is spending intentions improved for a second consecutive year in 2024, up 6.6% from a year ago, signalling a slightly less negative outlook for retail conditions over the festive season.

Westpac economist Neha Sharma said there remained a significant caveat to the improvement.

"Australians still have a negative bias toward spending, with those intending to spend less than last year still outnumbering those intending to spend more," Ms Sharma said.

"Compared to a year ago, 35% planned to spend less, 51% the same and 12% planned to spend more, highlighting an ongoing negative bias towards spending intentions."

"The period accounts for around 20% of annual non-food retail sales on average, and in some years, this share has climbed as high as 25%."

Spending in the December quarter commonly accounts for more than a third of a retailer's annual earning.

"Consumers appear to remain price-sensitive with a majority intending to purchase gifts during Black Friday sales and shop at larger retailers," Ms Sharma noted.

Labor to get housing bill up largely unchanged after Greens change tack

Bit of breaking news out of Canberra — The Greens have given Labor an early Christmas present by agreeing to finally endorse the government's signature Help to Buy housing bill.

It ends a lengthy stand-off with the Greens supporting the bill without requiring significant amendments.

The exclusive story from our political reporter Tom Crowley has just been posted.

Southern Cross Media hit with first stike on exec pay

Broadcaster Southern Cross Media has been hit with a first strike on its remuneration report at its AGM.

Almost 30% of the votes were directed against adopting the board's remuneration report and around 40% of votes were directed against issuing performance bonuses to CEO John Kelly.

One of the blocks making the protest vote was ARN Media, Southern Cross's biggest broadcasting rival and one of its three largest shareholders.

The media company which broadcasts the Triple M and Hit brands, as well as running a regional radio network, has seen its profits dwindle away over many years.

"Having blown up $1.4 billion of shareholder money since the 2005 float, investors are entitled to be angry with Southern Cross Media," shareholder activist Stephen Mayne said after the meeting.

However, Mr Mayne added "it was strange of radio competitor ARN Media to be joining the protest votes when it was trying to engineer a merger and is also not allowed to control Southern Cross Media under the two-station rule in the Broadcast Service Act."

"ARN Media also has more than $1 billion in accumulated losses.

"So, at one level this is just dying old media companies scrapping over a shrinking pie having been laid to waste by big tech, streaming and the internet," Mr Mayne observed.

Is Amazon really a threat to Coles and Woolworths?

The ACCC hearings into supermarkets has prompted all manner of discussion into whether there is much, if any, meaningful competition in the sector.

The big two, Coles and Woolworths, naturally argued there is competition, with Coles pointing to the global online behemoth Amazon as a significant threat, particularly in beauty products, confectionary and cereals.

Coles chief executive Leah Weckert noted Amazon was now even selling grocery items, such as canned goods and pasta, as loss leaders.

Goldman Sachs analysis quoted in the AFR this morning suggested Amazon will generate $1.3bn of grocery sales this year.

As J.P. Morgan's retail analyst Bryan Raymond noted "Woolworths claim 40% of its range of grocery, household and personal care products are on Amazon, while Coles called out 6,000 Amazon products which compete with Coles' products."

However, Mr Raymond says the threat from Amazon to Coles and Woolworths is "significantly overstated."

"We estimate CY25 online sales for Coles at $4.1bn and Woolworths at $7.0bn," Mr Raymond wrote in a note to clients this morning.

"Given (around) 40% of Woolworths and Coles range would be in fresh/chilled categories in which Amazon does not participate, this would imply Amazon is roughly half the size of Coles' ambient online business.

"The ACCC's consumer survey of over 21,000 shoppers is a good gauge of Amazon's competitive position in the grocery industry: 5% 'regularly' purchase groceries from Amazon and 17% 'occasionally' purchase groceries from Amazon.

"In fact, 78% of respondents have never purchased groceries from Amazon.

"We consider Amazon an emerging competitor to Woolworths and Coles, with a focus on selective categories, similar to Bunnings.

"It is a smaller competitive threat than Costco, Chemist Warehouse, etc."

Mr Raymond wrapped up his note pointing out it is naturally in Woolworths and Coles' interests to highlight the competitive threat of a very well capitalised global competitor in an ACCC hearing.

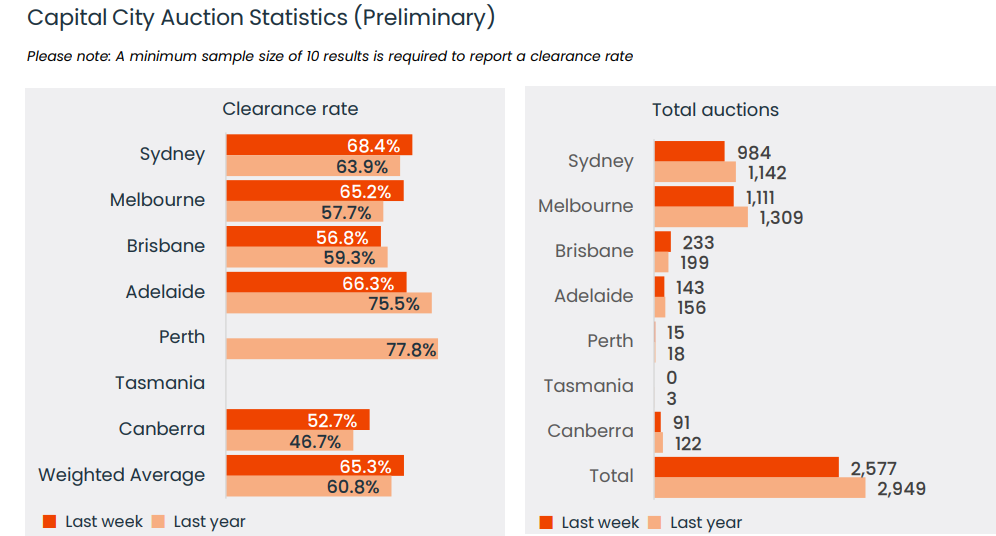

Home auction clearances still soft

Home auction clearances have edged up slightly, but still the long-term spring average and is still below 70% for almost the third consecutive month.

On preliminary figures from industry analyst CoreLogic, the auction clearance rate came in at 65.3% last week, up slightly from the week prior (64.1% which revised down to 57.3% on final figures).

The clearance rate may well be tested further with around 2,750 homes coming onto the market nationwide next weekend, up from 2,577 last weekend.

ASX up 0.7%, banks stumble and SG Fleet soars

The ASX 200 remains on track to beat the record close it set on Friday.

At 1pm AEDT, the ASX 200 was up 0.7% to 8,448 points.

All sectors have made gains with the exception of financials.

While there's a bit of love for the insurers, all the banks, including Macquarie, have been dumped.

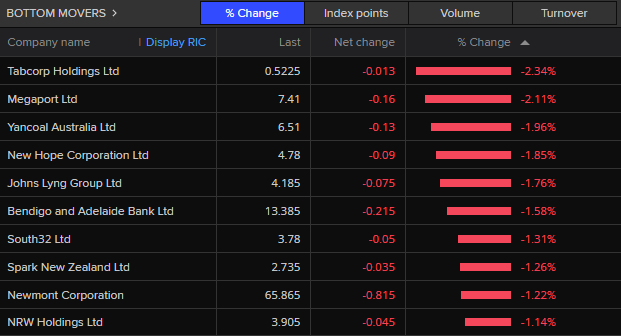

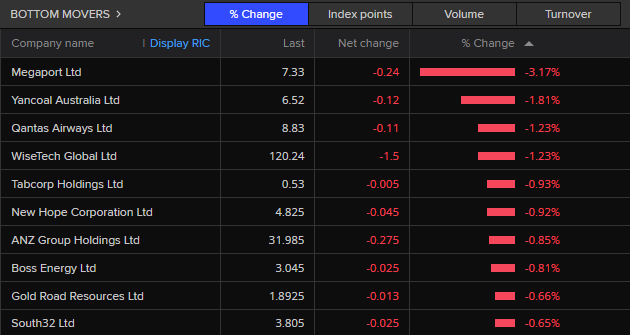

Tabcorp is the weakest performer so far, down 2.3%, while software developer Megaport is down 2.1%.

The coal sector is also struggling, led down by Yancoal (-2.0%).

Qantas is also losing altitude (-0.4%) after Air NZ highlighted issues with accessing aircraft due to an engineering backlog with engine suppliers.

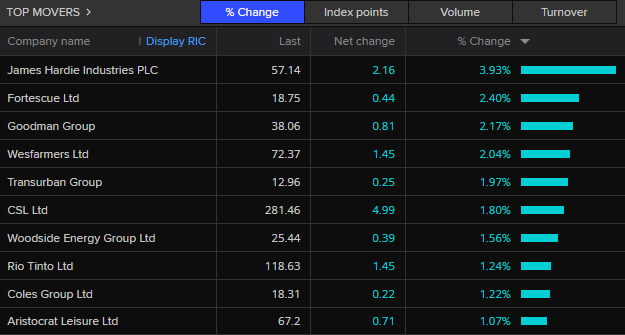

On the positive side of the ledger, Neuren Phamaceuticals is up 4.8% on no real news, while the property plays such as Mirvac (+4.0%) an Scentre (+3.4%) are in demand.

Wisetech has bounced back from an earlier sell off to be up 1.4% courtesy of a few broker upgrades.

The iron ore miners are generally stronger after demand picked up last week, with Fortescue up 2.0% and Champion Iron gaining 1.8%.

Outside the ASX 200, SG Fleet Group is the clear leader, up 20% to $3.20, still a fair way below the private equity bid of $3.50/share that lobbed this morning.

Across the region, all the key markets are in positive territory with the Nikkei up 1.7%.

The Australian dollar is a bit firmer, oil is flat, and gold has shed just a bit of its lustre.

Bitcoin is still in touching distance of $US100,000 but losing some momentum.

Market snapshot

- ASX 200: +0.7% to 8,456 points (live values below)

- Australian dollar: +0.6% to 65.40 US cents

- Nikkei: +1.7% to 38,928 points

- Hang Seng: +0.4% to 19,297 points

- Shanghai: +0.3% to 3,878 points

- S&P 500 (Friday): +0.4% to 5,969 points

- Nasdaq (Friday): +0.2% to 20,776 points

- FTSE (Friday): +1.4% to 8,262 points

- Euro Stoxx (Friday): +0.8% to 497 points

- Spot gold: -0.5% to $US2,699/ounce

- Brent crude: flat at $US75.14/barrel

- Iron ore (Friday): +0.5% to $US102.50/tonne

- Bitcoin: -2.1% to $US97,354

Prices current around 12:45pm AEDT

Live updates on the major ASX indices:

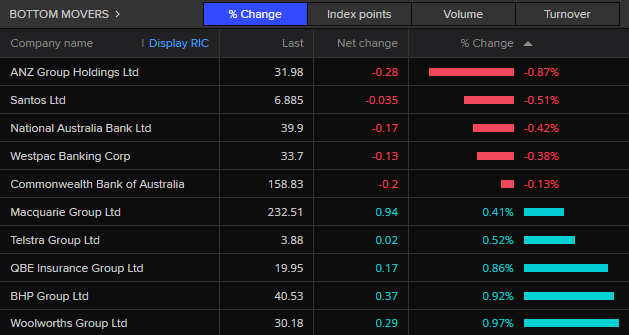

Banks not enjoying the market's bounce

Just a quick check in on the top end of town - the ASX top 20.

Nothing much of note this morning; 15 of the top 20 have gained, 5 are down.

Four of the five going backwards are the big banks.

They are joined by Santos (-0.7%), while its bigger gas producing Woodside has made a solid 1.6% gain.

ASX opens 0.6% higher primed for record close, SG Fleet soars on takeover talks

The ASX 200 has followed its weekend futures pricing opening 0.6% higher and on track to beat the record close it set on Friday.

All sectors have made gains, although financials and the banks are lagging somewhat.

Software developer Megaport is the weakest performer so far, down 2.5%, while Wisetech is down 1.4% despite a few upgrades from brokers.

The coal sector is also struggling led down by Yancoal (-1.4%)

Qantas is also losing altitude (-1.2%) after Air NZ highlighted issues with accessing aircraft due to an engineering backlog with engine suppliers.

On the positive side of the ledger, custom jewellery maker Lovisa is up 2.7% while Guzman Y Gomez has put on 2.8%

The iron ore miners are generally stronger after demand picked up last week, with Champion Iron leading the pack up 3.2% and Fortescue up 1.0%.

Outside the ASX 200, SG Fleet Group is the clear leader, up 22% to $3.32, still a bit below the private equity bid of $3.50/share that lobbed this morning.

APRA keeps home loan serviceability buffer at 3pc

The banking regulator APRA has maintained its current existing macroprudential policy settings in its latest quarterly update.

Particularly topical is its mortgage serviceability buffer — which APRA has kept at 3 percentage points.

That means lenders have to test a borrower's ability to make repayments at 3 per cent above the home loan rate they're offered.

Here's what APRA had to say today:

Uncertainty in the economic outlook remains and the risk of financial shocks has not abated, although the sources of this uncertainty have shifted over the past year or so.

Risks from higher interest rates and inflation have receded somewhat, though underlying inflation remains elevated.

Cost-of-living pressures continue to weigh on households and the risk of shocks to incomes from a slowing labour market are prominent.

Meanwhile, risks in the global economic environment which could impact the Australian financial system – including ongoing geopolitical instability – are pronounced.

Credit is flowing to households and businesses and is accessible to good quality borrowers.

That said, the level of household debt in Australia is high relative to incomes both compared with its long-term history and relative to international peers, making this a key vulnerability if adverse economic scenarios came to pass.

A parliamentary inquiry is currently looking into the hurdles to home ownership and will hand down its recommendations by next week, which could include changes to the serviceability buffer.

The major banks are divided on whether the buffer should be reduced, to allow first home buyers easier access to finance, or maintained to avoid risky lending.

You can read more from Nassim Khadem here:

Market snapshot

- ASX 200: +0.6% to 8,442 points (live values below)

- Australian dollar: +0.6% to 65.40 US cents

- S&P 500 (Friday): +0.4% to 5,969 points

- Nasdaq (Friday): +0.2% to 20,776 points

- FTSE (Friday): +1.4% to 8,262 points

- Euro Stoxx (Friday): +0.8% to 497 points

- Spot gold: +0.1% to $US2,715/ounce

- Brent crude: +0.1% to $US75.24/barrel

- Iron ore (Friday): +0.5% to $US102.50/tonne

- Bitcoin: -1.2% to $US98,211

Prices current around 10:20am AEDT

Live updates on the major ASX indices:

Private equity lobs a $1.2 billion takeover bid at SG Fleet Group

The fleet management and salary packaging business SG Fleet Group has confirmed it has received a $1.2 billion bid for the company from the private equity group Pacific Equity Partners.

The $3.50 per share bid represents a 31% premium to SG Fleet's Friday close of $2.67.

In a statement to the ASX before opening, SG Fleet's board said it was in the best interests of all shareholders to engage with PEP and give it a period of exclusivity to put forward a binding offer.

The exclusivity period expires on November 29.

The board said shareholders do not need to take any action on PEP's indicative proposal at this stage and there is no certainty the bid will result in a transaction.

SG Fleet Group hit a record price of $4.38 back in July 2016 and has been trading in a range between $1.50 and $3 a share for the past few years.

What could Trump's Treasury pick mean for the $A

Over the weekend president-elect Donald Trump announced hedge fund investor Scott Bessent as his pick for the key cabinet position of Treasury secretary.

It's a position with leverage over economic, regulatory and trade policy.

Mr Bessent is known to have a warm relationship with Mr Trump and while an adherent to free market policies, he is a supporter of using tariffs as a negotiating tool and has praised Mr Trump's scepticism of regulation and international trade.

Despite wanting low inflation and lower interest rates, Mr Bessent believes this can be achieved while keeping the greenback strong — and by extension the $A weak.

NAB's head of FX research, Ray Attrill, put together this handy primer on Mr Bessent and what is known of his views this morning:

On the Fed

Bessent was publicly critical of the Fed's 50-point September rate cut, implying it undermined the integrity of the institution (i.e. coming so close to the US election).

It was Bessent who floated the notion in a Barron's interview last month of creating a 'shadow Fed chair' by an early appointment of Jay Powell's successor, such that "based on the concept of forward guidance, no-one is really going to care what Jerome Powell has to say anymore."

On tariffs

Bessent has of late been publicly supportive of tariffs, saying "we should not be afraid to use the power of tariffs to improve the livelihoods of American families and businesses." And that "tariffs are also a useful tool for achieving the president's foreign policy objectives. Whether it is getting allies to spend more on their own defence, opening foreign markets to US exports, securing cooperation on ending illegal immigration and interdicting fentanyl trafficking, or deterring military aggression, tariffs can play a central role."

On the US dollar

Bessent has publicly lauded dollar strength following news of Trump's election win, saying (to the FT, Bloomberg, et al), "The reserve currency can go up and down based on the market. I believe that if you have good economic policies, you're naturally going to have a strong dollar. It's a market reaction and he (Trump) understands that tariffs cause a stronger dollar, so a weaker dollar with tariffs is an economic abnormality. We could see what's called the dollar smile. What we have now is high interest rates and high deficit and inflation above target. If you get inflation down … interest rates could come down, and you would have a market-based dollar depreciation. But in terms of an over-weak dollar policy, I wouldn't expect that at all."

Mr Attrill said given the above, he was somewhat perplexed by the suggestion that the early (Sydney day) weakening in the USD is because of the news of the Bessent appointment (which came after the US markets had closed on Friday).

"[Mr Bessent] is an avowed fiscal hawk, so perhaps that has something to with it, but seeing is going to be believing in this regard, unless the DOGE [Department of Government Efficiency] really is going to take axe to large tracts of non-discretionary as well as the [much smaller] discretionary spending elements of the US budget.

Govt proposes tax incentives for critical minerals

The federal government will introduce legislation today to implement production tax incentives for renewable hydrogen and critical minerals to help boost investment in the sector, which could play a major role in energy transition plans.

The proposed law will set up a tax incentive worth 10 per cent of relevant processing and refining costs for 31 critical minerals from the fiscal year ending June 2028 to the 2039-40 fiscal year, for up to 10 years per project, the government said.

For renewable hydrogen, the planned legislation will establish a tax incentive worth $2 per kilogram of renewable hydrogen produced during the same period.

"The legislation will give investors clarity and certainty to invest in Australia's potential to add more value to its natural resources, and help deliver cheaper and cleaner energy," treasurer Jim Chalmers said in a statement.

The incentives will be provided once projects are up and running, producing hydrogen or processing critical minerals used in products like wind turbines, solar panels and electric cars, Chalmers said.

Major economies are seeking to invest billions to support clean energy projects and compete with China in manufacturing electric vehicles and semiconductors, seen as vital for prosperity and national security.

The Labor government in its May budget pledged to introduce tax incentives worth $7 billion for the processing and refining of critical minerals and $6.7 billion for renewable hydrogen production from 2027/2028 to 2039/40.

Reuters

ICYMI: Has the Future Fund always been politicised?

In case you missed it, last week the federal government said it'll direct Australia's public wealth fund, the Future Fund, to invest in housing and the green energy transition, where profitable.

The decision drew some heavy criticism — including from David Murray, the Future Fund's inaugural chairman, who said the fund's "independence" was the bedrock of its investing success and reputation as a sovereign wealth fund, and we shouldn't mess with it.

But as Gareth Hutchens writes, you don't have to look too far to find an example of the Future Fund's investments being politicised:

Corporate calendar: AGM season wraps up

Mon: AGMs – Promedicus, Southern Cross Austereo, Comet Ridge

Earnings report - Smartpay half year results

Tue: AGMs – Ramsay Healthcare, Regis Healthcare, Brickworks, K&S Corp

Wed: AGMs – Lynas Rare Earths, Monash IVF, Cardno, NRW Holdings, Dubber

Thu: AGMs – Star Entertainment, Retail Food Group, Strike Energy

Earnings report – Fisher Paykel Healthcare

Fri: AGMs – Macquarie Technology, Paladin, Emerald Resources

The AGM season for 2024 finally wraps up this week, but not before another 160 or so publicly listed companies hold their annual general meetings.

As a general rule, a bit like the reporting season, the blue chips are not commonly found trotting out their business just before the deadline, but there are still some interesting meetings this week.

This morning the broadcaster Southern Cross Austero, home to the likes of MMM, is likely to receive a first strike on its remuneration report from disgruntled investors.

On Tuesday, the big private hospital group, Ramsay with former Telstra boss David Thodey in the chair, is facing a grilling from investors about its struggling offshore business and whether the whole strategy should be dumped.

On Wednesday, one time tech darling and voice recognition business, Dubber, is certain to face some very uncomfortable questions about its large accumulated losses (around $325m which is disconcerting for a company with a current value of $25m), just where the money went and the embarrassing media reports on how some very "colourful" characters seemed to get involved in the company's finances.

On the earnings front, just one company of note drops an update, the ASX and NZSX listed Fisher Paykel Healthcare releases its first half year results on Thursday.

This week: Inflation and GDP previews

Australia:

Wed: CPI indicator (Oct), Construction work done (Q3)

Thu: Business investment/ Private capex (Q3), RBA speech, Governor Bullock

Fri: Private sector credit (Oct)

International:

Tue: US – Fed meeting minutes (Nov), Home prices (Sep), New home sales (Oct), Consumer confidence (Nov)

Wed: NZ – RBNZ rates decision

US- GDP (Q3), PCE inflation (Oct), Durable goods orders (Oct), Personal income & spending (Oct)

Thu: US – Thanksgiving Day market holiday

Fri: EU – CPI (Nov)

Sat: CH — PMIs

It is another quietish week data-wise, with local market likely to focus on the October inflation outcomes (Wednesday).

Headline inflation is likely to remain parked at around 2.1% YoY, which is towards the bottom of the RBA's target band, however the more important core inflation figure – certainly more important to the RBA – is likely to see "trimmed mean" CPI tick up from 3.2% to 3.4% as some more favourable price movements from a year ago drop out of the survey.

Also of interest will be RBA Governor Michele Bullock's speech (Thursday) the day after the inflation data.

The CBA she will have the opportunity to clarify if at least two 'good' quarterly CPI prints are a necessary pre-condition to cutting interest rates.

"If the governor does confirm this, then the RBA will have ruled out any rate cuts until at least May 2025," CBA economist Steven Wu said.

The first of the September quarter GDP partials will be released with quarterly construction work (Wednesday) and business investment/capital investment (Thursday) are expected to show moderate rises after fairly tepid outcomes in June quarter.

Off to side of the National Accounts, but very important nonetheless, the ABS will publish data on Indigenous "Closing the Gap" surveys focussing particularly on health and employment outcomes (Tuesday).

The ABS will also publish its first survey on the contribution of unpaid care to the economy (Friday) and update its annual look Australia's energy generation and usage (Thursday).

Overseas, the US will be dominated by Thursday's annual turkey cull on Thanksgiving, which should keep things pretty quiet (except in the turkey community).

However, Q3 GDP (Wednesday) will garner more than a cursory glance even though the economy is forecast to maintain growth at around 2.8%.

Core PCE (Thursday, the Fed's preferred measure of inflation), is expected to remain parked at 0.2% over the month.

Over in New Zealand, the RBNZ is again expected to swing the axe on its official rate setting, lopping another 50bps off to 4.25%, a tad lower than the RBA 4.35% setting.