ASX in the red, Australian dollar drops as Trump pledges tariffs on Mexico, Canada and China — as it happened

Local stocks reversed and the Australian dollar is near a seven-month low as the incoming US president Donald Trump pledged a 25 per cent tariff on all products from Mexico and Canada, and an extra 10 per cent tariff on China.

Here's how the trading day unfolded on our live blog.

Disclaimer: this blog is not intended as investment advice.

Live updates

Market snapshot

- ASX 200: -0.7% to 8,359 points (live figures below)

- Australian dollar: -0.2% at 64.90 US cents

- Nikkei: -1.5% to 38,201 points

- Hang Seng: +0.3% to 19,214 points

- Shanghai: +0.1% to 3,268 points

- Dow Jones: +1% to 44,736 points

- S&P 500: +0.3% to 5,987 points

- Nasdaq: +0.3% to 19,054 points

- FTSE 100: +0.4% to 8,291 points

- EuroStoxx: +0.7% to 469 points

- Spot gold: -0.2% at $US2,622/ounce

- Brent crude: +0.4% at $US73.27/barrel

- Iron ore: Flat at $US102.25/tonne

- Bitcoin: +1% to $US94,603

Prices current around 4:40pm AEDT.

Live updates on the major ASX indices:

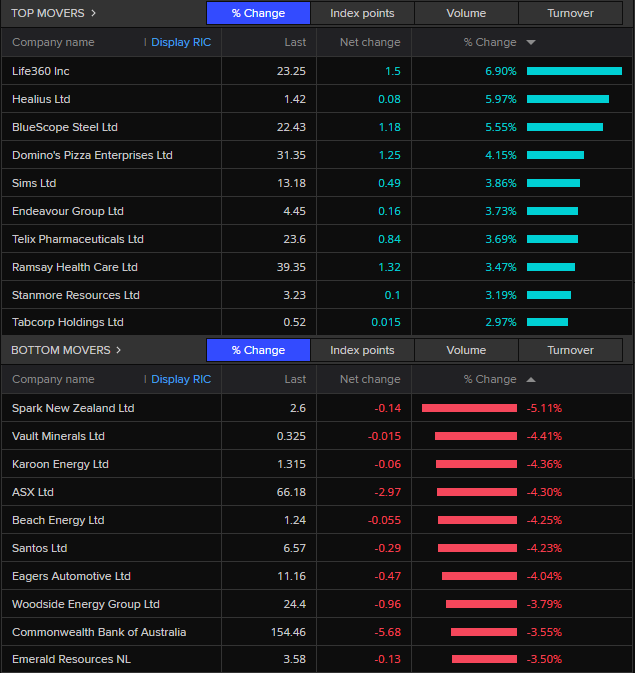

Banks and energy lead ASX decline as Trump tariffs surprise

The ASX 200 gave up early gains to finish 0.7 per cent in the red at 8,359 points as traders got the jitters about Donald Trump's tariff announcements.

The president-elect says his first presidential action will be orders for 25 per cent taxes on Canadian and Mexican imports and additional 10 per cent tariffs on Chinese goods.

While these moves don't necessarily directly affect a lot of the companies that fell on the ASX today, they do indicate that we are about to enter a less predictable economic environment driven by the whims of one man.

Japan's Nikkei took a bigger hit of 1.5 per cent, but Chinese markets were mixed with a modest fall in Shenzen, flat trade in Shanghai and a modest rise in Hong Kong (as at 4:30pm AEDT).

The Australian dollar also fell, sitting below 65 US cents.

And that's the Business Reporting Team signing off for today. Who knows what will happen overnight…

Markets at the mercy of 'unrestrained Trump'

What a difference a few hours makes for markets — especially when at the mercy of Donald Trump.

Just this morning, Wall Street had cheered the relatively orthodox choice the US president-elect had made for his Treasury secretary nomination.

NAB strategist Rodrigo Catril described veteran hedge fund manager Scott Bessent as "a safe pair of hands" and "a voice of reason that should be a moderating influence on the president".

Bloomberg News declared that the pick would give China "breathing room" on tariffs, based on Bessent's previous interview comments that Trump's tariff talk was a "maximalist negotiating position".

US Treasury yields tumbled while the Dow Jones added 1 per cent.

But just hours after the US market had closed, with cheerful analyst notes still hitting inboxes, things took a turn.

Moderated, Trump wasn't.

Read my full piece here:

Bubble tea giant Chatime fined just over $120,000

Here's some more on the story we brought you earlier about Chatime.

The bubble tea chain has been fined just over $120,000, after the retailer's Australian arm was found to have paid its "vulnerable workers" as little as $7.59 an hour to make hot and cold takeaway drinks.

The penalties against the Australian wing of Chatime and its managing director were ordered by the Federal Circuit and Family Court, and conclude a long running case lodged by Fair Work.

A full write up from Emilia Terzon below:

Get on with it

There seems to be a continuing disbelief amongst many commentators/analysts that Donald Trump is going to be the next “most powerful person in the world”. The general tone is “that can’t be what he means”. Hate him or love him, he has an absolute belief that he knows best and we’d better just get on with it and take him at his word or suffer the consequences.

- Phillip

Thanks Phillip

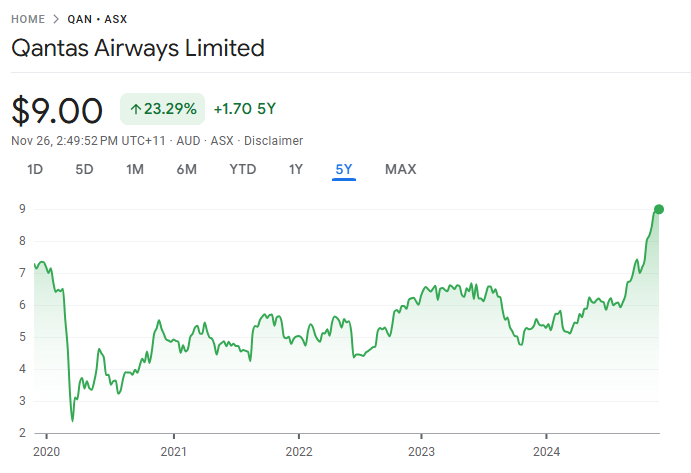

Timing is everything

What a time to have bought QAN during covid, for today at least!

- Kristi

You're right.

Its share price fell to $2.36 in March 2020.

Why Trump's tariffs may not be as bad as feared

A couple of hours ago, we posted quotes from six market participants (collated by Reuters) on their reaction to Trump's tariff plans.

One of those quoted was Tony Sycamore from IG Markets. He said:

"[Trump] has said up to 60% on Chinese goods... so if we're only talking about an additional 10% tariff on Chinese goods on top of the existing levies, that's a lot less than what he had previously indicated. ... so it may be actually less than the worst case scenario we were looking at."

Mr Sycamore has since sent through more thoughts, to expand on what he was getting at. Here's what he's thinking:

"A few thoughts on Trumps tariff news today - which is contrary to today’s sell-off in risk assets.

"Trump announced today via social media that he will introduce an additional 10% tariff on Chinese imports, along with 25% tariffs on goods from Canada and Mexico, effective from his first day in office. The move is intended to tackle issues of migration and drug imports into the US.

"Leading up to the November election, Trump hinted at potentially raising tariffs on Chinese imports to 60% or higher if he secured re-election.

"As it stands, 60% of imports from China are already subject to tariffs, averaging around 17%. In this context, today’s announcement could be interpreted as risk-positive rather than negative for the following reason.

"A 10% increase in tariffs on China would place the average tariff rate at 27%, which is significantly lower than the 60% he threatened during his campaign and well below the consensus of 40%.

The seven ASX shares that have hit all-time highs

Motley Fool has put together a fascinating little list today.

It says in today's topsy-turvy stock movements, seven ASX200 shares have hit record highs, despite no price-sensitive news from any of the companies.

- Pro Medicus: has hit all-time high of $234.39 today.

- REA Group: it's hit $251.99 a share.

- JB Hi-Fi: it's hit $91.32.

- Qantas Airways: it's hit $9.05.

- SGH Ltd (formerly known as Seven Group Holdings): hit $49.57.

- Goodman Group: hit $38.35.

- HMC Capital: it's hit $12.38.

Senate passes Help to Buy legislation

Our colleague Tom Lowrey says one of the federal government's key housing bills is on the brink of passing parliament, with the Senate voting through the 'Help to Buy' shared equity scheme.

The scheme will allow 40,000 homebuyers to co-purchase their home with the government, reducing the size of the deposit required.

Yesterday the Greens dropped their months-long opposition to the bill, agreeing to waive it through.

Another bill the Greens have agreed to support, the government's 'Build to Rent' tax incentives, is expected to pass later this week.

Australia's Future Fund owns $7.8 million in shares in Adani Green Energy

As that previous post noted, yesterday the French oil major TotalEnergies said it would halt financial contributions to its Adani Group investments following last week's indictment.

It owns a 20% stake in Adani Green Energy and has a seat on the Indian company's board of directors.

As reported by Reuters yesterday:

"Until such time when the accusations against the Adani group individuals and their consequences have been clarified, TotalEnergies will not make any new financial contribution as part of its investments in the Adani group of companies," the company said in a statement.

And according to the Future Fund's periodic investment report June 30 2024, as of June, it currently owns $7,794, 514 worth of Adani Green Energy shares.

Fitch places some Adani bonds on negative watch after US bribery charges

Reuters is reporting that ratings agency Fitch has put some of Adani Group's bonds on watch for a possible downgrade after some of the firm's key executives were indicted by US authorities on bribery charges.

As per Reuters:

Adani Energy Solutions Ltd, Adani Electricity Mumbai and some of Adani Ports and Special Economic Zone rupee and dollar bonds are now on "watch negative", Fitch said.

Ratings on four Adani subsidiary senior unsecured dollar bonds were downgraded from stable to negative, the agency said.

Fitch said it would monitor the US investigation for any impact on Adani's financial position, "particularly any material deterioration in near- to medium-term funding access, including their ability to roll over existing credit lines or access new facilities, as well as potentially higher credit spreads".

French oil major TotalEnergies said on Monday it would halt financial contributions to its Adani Group investments following last week's indictment.

US prosecutors have charged billionaire Gautam Adani, founder of the Adani Group, and seven others for their alleged roles in a $265 million scheme to bribe Indian officials to secure power-supply deals.

The Adani Group has said the accusations as well as those levelled by the US Securities and Exchange Commission in a parallel civil case were "baseless and denied" and that it would "seek all possible legal recourse".

Adani dollar bonds steadied on Tuesday and prices rose slightly after three days of heavy falls.

Prices on some of the more liquid Adani Ports and Special Economic Zone debts maturing between 2027 and 2041 were up between half a cent and 1.5 cents on the dollar. They have fallen about 8-12 cents since news of the indictment.

Will Donald Trump's tariff hikes affect Australia?

My colleague David Chau has spoken to the University of South Australia's Susan Stone about the Trump administration's tariff plan.

Dr Stone is a former OECD and United Nations economist. She joined the University of South Australia in 2022 as the Credit Union SA Chair of Economics.

She said Trump's decision to target Mexico, Canada, and China with trade tariffs is because he's targeting the countries with which the United States' has its largest trade deficits.

Loading..."Australia does not have one," Dr Stone said, regarding a trade deficit with the US.

"But one of the things we need to consider is, there are many countries that Australia trades with a great deal that do have a trade deficit with the US, that includes China but also Japan, Korea, India, the UK, Vietnam, these countries you would think might start to have issues with the US in terms of tariffs if Trump follows this path," she said.

It could get messy

If USA taxes our exports to USA, we should reciprocate it on USA goods to Australia.

- Robert

That may not end well.

But then again, if Australia put a tariff on Hollywood's exports of the latest CGI remake of a remake of a remake of a remake, our culture would probably improve.

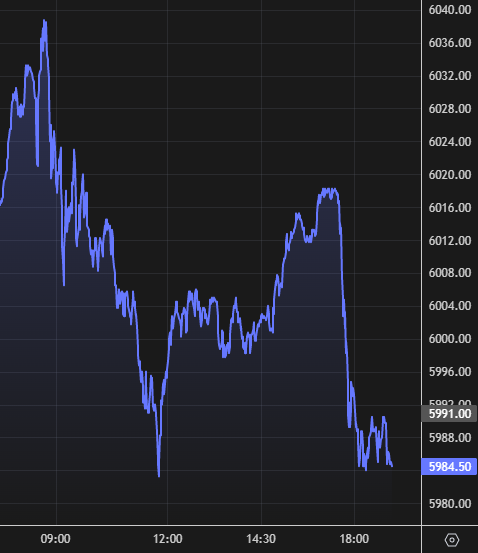

LoadingMarket down in early afternoon trade

We're at the halfway point of the day's trading session on the ASX200, and the index is down 0.4%.

Economist warns Australia should be lobbying incoming Trump administration for tariff exemption

Richard Holden, professor of economics at UNSW Business School, said Trump's announcement of tariffs on all products from Mexico and Canada, plus an additional 10% tariff on Chinese goods was "very worrying".

"As a country that is a small, open economy and a lot of our prosperity comes from international trade anything that leads to increased tariffs … it's not good for us," Professor Holden told the ABC.

Any damage to China's economy, he said, would inevitably impact Australia as well.

Trump has not signalled he will impose tariffs on Australian imports to the US but he hasn't ruled it out either.

Professor Holden said current Australian ambassador in the USA Kevin Rudd and his predecessor Joe Hockey would do well to start lobbying the incoming Trump administration "as much as possible to get some sort of exemption".

"America has a trade surplus with Australia, which for Trump means America is somehow winning with Australia. We should be saying we're not like Canada or Mexico we're an ally, we deserve an exemption and that may be an argument he may be receptive to.

"Hockey is a golf buddy of Trump's — Rudd is widely respected and they're, in a funny way a good team."

Professor Holden said it was key to see the announcement in a global context: "If this is the start of tariffs being slapped on Europe and Europe responding ... it will mean less trade globally."

Markets react to Trump's tariff promise

Reuters has surveyed half a dozen market participants to get their reactions to Donald Trump's tariff promise, and their comments are worth re-posting here:

Rob Carnell, regional head of research, ING, Singapore:

"It reminds me a lot of four years ago, when you'd wake up every morning and markets would be whipped around by whatever the latest comment is. I'm tempted to take it with a bit of a pinch of salt. He's not the president yet.

"This is how he gets stuff done, isn't it? He throws stuff around, mentions various numbers, markets react and maybe it happens maybe it doesn't."

Alex Loo, FX and macro strategist, TD Securities, Singapore:

"While the USMCA agreement is technically only up for renegotiation in 2026, Trump is likely trying to kickstart the renewal process early with Canada and Mexico through today's tariff announcements. MXN and CAD had a kneejerk reaction lower but thin liquidity outside North America time zone may have contributed to the outsized moves seen in Asia this morning."

Sean Callow, senior FX analyst, InTouch Capital Markets, Sydney:

"It was just last month that Trump said that 'the most beautiful word in the dictionary is tariff' so there really should not have been a surprise in Trump’s intention, just in the timing of the comments.

"The fall in trade-sensitive currencies makes sense and should persist near term given the quiet calendar, but Fed policy should return to the fore once we get closer to the December FOMC meeting."

Khoon Goh, head of Asia research, ANZ, Singapore:

"It looks like he's not going to waste much time... so the question now is — on day 1 is he actually going to follow through with it and will the tariffs hit on day 1?

"The other interesting thing is he's laid out his reasons for the tariffs (relating to the movement of people and drugs), so it looks like these tariffs are conditional on those. Whilst this is the opening salvo, maybe this is just the beginning of the deals he's well known for."

Tony Sycamore, market analyst, IG Markets, Sydney:

"I'm just trying to reconcile how it works with the appointment of Bessent. People have been expecting him to be a more moderate voice. Maybe it's also a reaction to 'hey, look, everyone thought that Bessent was gonna moderate some of those more extreme trade policies' ... but Trump's not gonna be moderated by anyone.

"He has said up to 60% on Chinese goods... so if we're only talking about an additional 10% tariff on Chinese goods on top of the existing levies, that's a lot less than what he had previously indicated. ... so it may be actually less than the worst case scenario we were looking at."

Matt Simpson, senior market analyst, City Index, Brisbane:

"It's almost as if Trump wants to remind markets who is in control, after nominating Scott Bessent as Treasury Sec — a man markets expected to cool Trump's potency. But with the Canadian dollar rising against the Mexican peso, markets are assuming this will hit Mexico the hardest."

US futures fall after Trump tariff pledge

Here's how US stock market futures reacted to the news —

European futures have also lost ground.

US dollar gains after Trump vows tariffs against Mexico and Canada

Here's why the Aussie dollar has taken a hit on the tariff news:

The US dollar rose broadly against major rivals after president-elect Donald Trump said he would sign an executive order imposing a 25% tariff on all products coming in to the United States from Mexico and Canada.

The currency rose more than 2% against the Mexican peso and 1% against its Canadian counterpart.

The US dollar has been on the back foot in the past few days as US Treasury bond markets cheered Trump's pick of hedge fund manager Scott Bessent for US Treasury secretary.

"It's almost as if Trump wants to remind markets who is in control, after nominating Scott Bessent as Treasury Sec — a man markets expected to cool Trump's potency," said Matt Simpson, senior market analyst at City Index.

"But with the Canadian dollar rising against the Mexican peso, markets are assuming this will hit Mexico the hardest."

While traders saw Bessent as an old Wall Street hand and fiscal conservative, he has also openly favoured a strong dollar and supported tariffs.

On China, the president-elect said Beijing was not taking strong enough action to stop the flow of illicit drugs crossing the border into the US from Mexico by curbing the export of drugmaking ingredients.

"Until such time as they stop, we will be charging China an additional 10% tariff, above any additional tariffs, on all of their many products coming into the United States of America," Trump said in a social media post.

China has previously denied the allegations.

The Australian dollar fell 0.75% to $0.64555, while the New Zealand dollar touched a one-year low and was last at $0.58075.

Reuters

Have you worked for Chatime Australia?

We'd love to hear from you.

You can email me on terzon.emilia@abc.net.au or on em.terzon@proton.me for encrypted mail.

Chatime Australia fined $132k after underpayment scandal

Fair Work first lodged legal action against the Australian franchise of the bubble tea business Chatime and its managing director four years ago.

Here's some background from investigative reporter, Adele Ferguson:

Chatime — a majority-owned Taiwanese company — was exposed in the media back in 2019, when it was revealed that its franchisees and corporate stores were underpaying workers, most of them foreign students on visas from China and Taiwan, too afraid to speak up for fear of being deported because they had breached their visa conditions and worked extra hours per week to survive on the small hourly wage rate.

Fair Work subsequently took action in a landmark case against Chatime and a senior official. It also went after some individual Chatime franchisees.

Fair Work alleged underpayment of "vulnerable employees" at 19 stores across Sydney and Melbourne.

Chatime ultimately lost the case in the the Federal Circuit and Family Court. Judgement on penalties has been pending since, and were finally delivered in November.

Here's Fair Work:

The court has imposed a $120,960 penalty against Chatime Australia Pty Ltd, which is the franchisor of dozens of Chatime outlets around Australia and also directly owns and operates a number of Chatime outlets.

The Court has also imposed a $11,880 penalty against Chatime Australia managing director Chen 'Charlley' Zhao for his involvement in some of the underpayments.

We'll keep you updated on this story.