Australian share market rises as inflation rate stays steady, Bitcoin pulls back from recent highs — as it happened

Australia's annual inflation rate remained steady in October at a more than three-year low as electricity and fuel prices fell.

Meanwhile, the local share market rose after a rally on Wall Street.

And the price of Bitcoin pulled back from its recent highs, touching levels below $US92,000.

Here's how the day's trade unfolded, plus insights from our specialist business reporters.

Disclaimer: this blog is not intended as investment advice.

Live updates

Market snapshot

- ASX 200: +0.6% to 8,406 points

- Australian dollar: flat at 64.72 US cents

- S&P 500: +0.6% to 6,021 points

- Nasdaq: +0.6% to 19,175 points

- FTSE: -0.4% to 8,258 points

- EuroStoxx: -0.8% to 494 points

- Spot gold: +0.4% to $US2,642/ounce

- Brent crude: +0.1% to $US72.87/barrel

- Iron ore: +0.2% to $US102.75/tonne

- Bitcoin: +1.1 % to $US92,650

Price current around 4:30pm AEDT

Live updates on the major ASX indices:

Over and out from your business bloggers

That's all for our markets coverage today, online at least.

You can catch The Business with Kirsten Aiken tonight on your TVs or anytime on iView.

And for more detail on the inflation data, read this piece from Emilia Terzon.

Join us bright and early tomorrow, thanks for sticking with us.

LoadingASX holds onto gains to close higher

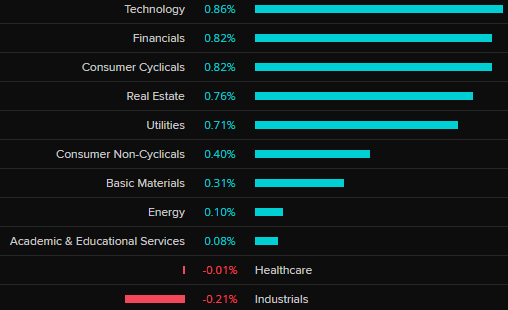

The local share market has ended the mid-week session higher, with the ASX 200 gaining 0.6 per cent.

Overall, 132 stock on the benchmark index rose.

Looking at the sectors, most ended higher, led by tech and financials.

The best-performing stocks were:

- Web Travel Group (+13.5%)

- Life360 (+6.2%)

- Ampol (+4.4%)

- LendLease (+4%)

- Polynovo (+3.9%

And the worst:

- Pinnacle Investment (-5.1%)

- Yancoal (-3.3%)

- Boss Energy (-3.1%)

- BlueScope (-3%)

- Graincorp (-2.8%)

The Australian dollar is pretty much were it was this morning, buying around 64.7 US cents.

WA turns on the heater during long lithium winter

A long downswing in lithium prices has already seen Core Lithium's Finnis mine in the NT and Mineral Resources' Bald Hill mine in WA's goldfields go into care and maintenance.

With no signs on the near horizon of a turn around in prices, the WA state government has stepped in to help keep the lights on at the state's remaining productive mines with:

- Up to $150 million Cook Government lithium support package to protect local jobs and ensure WA remains a battery metals powerhouse

- Lithium Industry Support Program to temporarily waive government fees for downstream processing

- Port charges and mining tenement fees waived for up to 24 months for lithium miners during ramp-up phase of projects

- Loan facility to help under-pressure lithium miners access temporary loans to sustain their operations

Premier Roger Cook said "WA's lithium industry supported more than 11,000 local jobs last financial year and has three new lithium hydroxide refineries currently in construction or commissioning.

"Lithium will continue to be an incredibly important element moving forward - particularly for the global energy transition.

"It is also at the centre of WA's economic diversification story, as we work to position our State as a global leader in downstream processing.

"This package will provide important temporary and responsible support for WA's fledgling lithium industry, taking into account the extremely challenging market conditions it is facing.

"This package is aimed at helping our critical lithium industry and its workforce to the other side of this turbulent period - supporting local jobs and doing what's right for WA."

The funding package was welcomed by the Federal Minister for Resources and Northern Australia, Madeleine King, a fellow West Australian.

The Association of Mining and Exploration Companies CEO Warren Pearce also welcomed the funding.

"It prioritises the protection of jobs now and stabilises the future of an important emerging industry."

A few months ago I put a story together about why lithium prices tanked:

New Zealand dollar up despite rate cut

The New Zealand dollar is on the up, currently 0.6 per cent higher against the US dollar.

That's despite a 50 basis point interest rate cut by the RBNZ earlier today.

But apparently that wasn't a big enough cut for some! Here's a wrap up from Reuters:

The New Zealand dollar bounced on Wednesday, after the country's central bank lowered interest rates for a third straight meeting, but disappointed doves who had wagered on a super-sized move.

The Reserve Bank of New Zealand chopped its cash rate by 50 basis points to 4.25%, marking 125 bps of easing in just four months.

Economists had overwhelmingly tipped a half-point move this week, but markets had priced in around a 40% chance the RBNZ would slash rates by a whopping 75 bps.

The resulting short-covering saw the kiwi dollar rise 0.6% to $US0.5866, and away from a 13-month trough of $US0.5797 hit on Tuesday.

Still, RBNZ Governor Adrian Orr left the door open to another half-point cut at its February meeting should the economy perform as expected.

"Barring negative shocks, we continue to see the RBNZ reverting to a more standard pace of cutting, 25bp per meeting, from February," said Sharon Zollner, chief NZ economist at ANZ.

"If the data comes in soft, then the RBNZ will clearly not hesitate to deliver another 50 bp cut."

Markets imply around a 37% chance of a half-point move, and has rates down around 3.35% by the end of next year.

Trimmed mean inflation is very important

Hi Allan, and further to that post from my colleague Stephanie, here's some more info I think is important to know, re: trimmed mean inflation.

The passages below come from the RBA's August Statement on Monetary Policy:

The RBA considers the outlook for underlying inflation when assessing current monetary policy settings.

The RBA – and many other central banks – monitors and forecasts underlying inflation measures. This allows the Reserve Bank Board to look through volatility in prices and the effect of one-off or temporary measures that do not influence the underlying degree of price pressures in the economy. Considering forecasts of underlying inflation allows the Board to set monetary policy to return inflation sustainably to target.

This is because measures of underlying inflation are more likely than headline inflation to reflect current inflationary pressures, as they generally provide a better indication of price changes across most goods and services. This means they are more likely to reflect the future course of inflation and are useful for forecasting headline inflation. Evidence shows that headline inflation tends to move towards the trimmed mean, while the reverse is not true.

To construct inflation forecasts, the RBA first forecasts trimmed mean inflation (informed by economic models), and then forecasts headline inflation by accounting for changes in specific prices that we can be relatively confident will occur in the future.

It's clear from that that the RBA obviously targets trimmed mean inflation, but its "official" target is the headline figure.

Why do they do that?

Interestingly, from 1993 to 1998, the RBA did officially target a measure of underlying inflation which excluded a fixed set of items from the CPI.

It was referred to as "Treasury underlying" inflation. It's no longer published by the ABS. You can read about it in an RBA 2005 discussion paper titled "Underlying inflation: Concepts, measurement and performance," by Ivan Roberts.

In that paper, Mr Roberts says the Treasury underlying measure of inflation removed the influence of volatile components of the CPI, such as fresh fruit and vegetables, and items whose prices were partly determined outside the market, such as tobacco products. And crucially, it also removed interest rate charges (interest rate charges were included in the CPI in that period), which thereby precluded "a mechanical relationship between changes in monetary policy and targeted inflation."

However, after interest charges were removed from the published CPI in 1998, the CPI then became the RBA's targeted measure of inflation.

Harvey Norman shares rise after sales update

Retailer Harvey Norman held its annual general meeting today and gave an update on its sales.

Sales revenue for July to October was 1.7 per cent higher than a year ago.

The news seems to have been welcomed by investors — the stock is up 3 per cent at the moment.

Citi analysts said the update indicated steady growth for Harvey Norman in Australia, but it does appear to have underperformed appliance retail rival The Good Guys.

"However, we note November is not included in the update period and continue to expect that more consumers are holding out for the all-important Black Friday sales," the analysts wrote.

What's the trimmed mean and why does the RBA care about it?

The RBA states on their website that their target for inflation is between 2 and 3 percent. Nowhere there does it say "trimmed mean" inflation, only CPI, and on the graph they use they show September's CPI of 2.8% and not the trimmed mean. That being the case, why is it that when the RBA talk about CPI they always say the trimmed mean is their preferred measure of CPI? Because, sorry, their target is just CPI, not trimmed mean CPI. They're always talking about only having one lever to pull, but this interpretation of theirs does sound like they are using some discretion, and that they are operating outside of their defined remit.

- Allan

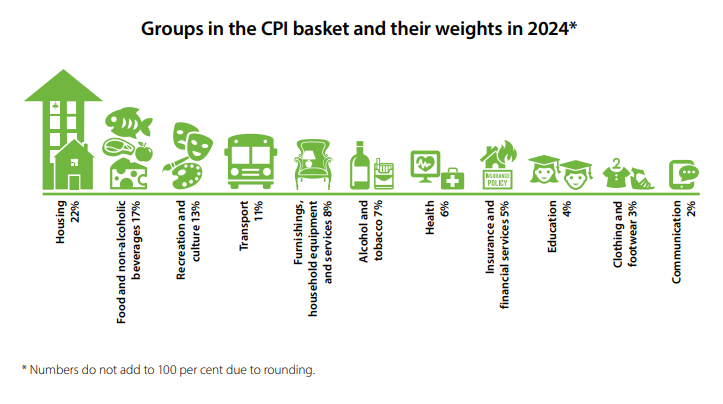

Thanks for writing in Allan — here's a bit more on what you're referring to for anyone else interested:

You're right, the Reserve Bank does target headline inflation between 2-3 per cent.

The measure of headline inflation we're talking about is the consumer price index (CPI), which shows the price changes of a basket of goods and services consumed by households.

Here's what it contains at the moment, according to an RBA fact sheet:

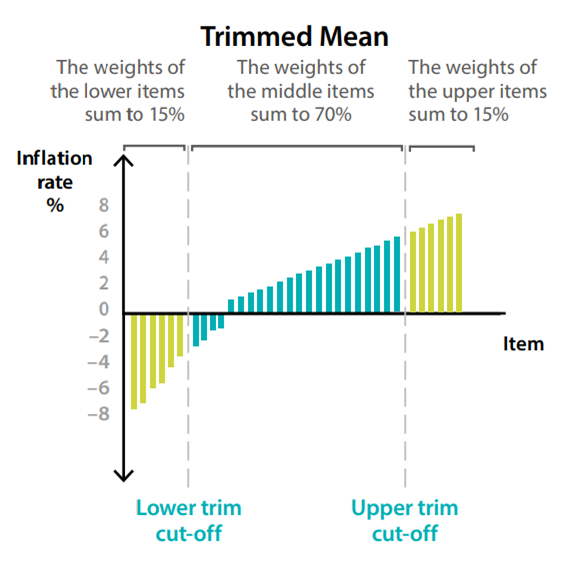

But as you note, we often hear the 'trimmed mean' referred to as the RBA's preferred measure of underlying inflation.

Here's what the RBA has to say about indicators of underlying inflation:

These indicators exclude items that have particularly large price changes (either frequently or in a given period).

Large price changes can often be due to temporary factors, which are sometimes unrelated to broad conditions in the economy.

As the RBA describes it, the trimmed mean is the average rate of inflation after ‘trimming’ away the items with the largest price changes (positive or negative). It is the weighted average of the middle 70 per cent of items.

For the October figures released today, the significant falls in fuel and electricity prices were among those excluded from the trimmed mean.

The trimmed mean isn't the only measure of underlying inflation the ABS reports — it also calculates the weighted median — the inflation rate of the item in at the middle of the price changes in the basket — and the CPI excluding volatile items — the average inflation rate of the basket excluding fruit, vegetables and fuel.

So the RBA targets headline inflation, but the headline readings can be volatile due to one-off factors that don't tell us much about the trend of the economy — say a cyclone, for example.

That's why the central bank — and maybe more noisily, the analysts, economists and commentators trying to predict its next movements — looks to underlying measures, like the trimmed mean.

ASX rallying, with all sectors on the up

The local share market remains in positive territory with a few hours of trade left, with the ASX 200 currently up 0.6%.

All sectors have gained ground, led by education and technology.

Taking a look at some of the biggest stock moves Web Travel Group (+13.5%), Life360 (+5.5%) and Genesis Minerals (+4.9%) are on the up, while Yancoal (-3.2%), Boss Energy (-3.2%) and Pinnacle Investment Mgmt (-3.1%) have fallen the most.

'Worst of cost-of-living shock behind us'

Economists surveyed by Reuters had expected the annual headline inflation rate to edge higher to 2.3 per cent in October — so the 2.1 per cent outcome showed price growth easing more than expected.

Here's some of the reaction we've seen so far:

Bendigo Bank chief economist David Robertson

"Ahead of the last RBA meeting for 2024, the latest inflation data continues to support no change to official rates in December, but more evidence that the RBA should be cutting rates by May with the worst of the cost-of-living shock behind us.

"The 2.1% annual rise in the CPI indicator for October was below consensus and maintained the same pleasingly low rate as the previous month, but was driven primarily by electricity rebates.

"Underlying inflation measured by the ‘trimmed mean’ was higher at 3.5% so more progress is needed on this front, with the full quarterly numbers to be released on January 29th."Markets had been expecting an RBA cut in February but have recently pared back these expectations and are now aligned to our unchanged view of the easing cycle starting in May."

JP Morgan economist Tom Kennedy

"…roughly half of the reported subgroups posted outright price declines in October, supporting our view that price pressures have eased significantly and that underlying inflation will continue to moderate.

"Given today's CPI indicator imparts some downside risk to our quarterly inflation forecast (0.7%q/q), we maintain our call for the RBA to cut 25bp in February."

Market snapshot

- ASX 200: +0.5% to 8,402 points

- Australian dollar: flat at 64.71 US cents

- S&P 500: +0.6% to 6,021 points

- Nasdaq: +0.6% to 19,175 points

- FTSE: -0.4% to 8,258 points

- EuroStoxx: -0.8% to 494 points

- Spot gold: flat at $US2,631/ounce

- Brent crude: -0.2% to $US72.70/barrel

- Iron ore: +0.2% to $US102.75/tonne

- Bitcoin: +1.1% to $US92,710

Price current around 12:55pm AEDT

Live updates on the major ASX indices:

New Zealand cuts interest rates, flags further cuts ahead

The Reserve Bank of New Zealand (RBNZ) has cut its official cash rate by another 50 basis points to 4.25 per cent.

The RBNZ said annual inflation had declined and is sitting close to the mid-point of its 1-3 per cent target band, while growth remains subdued, wage growth has slowed and employment levels and job vacancies have fallen.

"If economic conditions continue to evolve as projected, the Committee expects to be able to lower the [official cash rate] further early next year," the RBNZ statement read.

Here's what Capital Economics' head of Asia-Pacific Marcel Thieliant made of it:

"For our part, we think the [RBNZ] will cut interest rates more aggressively to a terminal rate of around 2.25%.

"After all, the Bank has always underestimated how far it would lower interest rates at the start of an easing cycle and we think that the current one won’t be an exception.

"While the Bank signaled that it is in two minds whether to cut rates by another 50bp in February or reduce the pace of easing to a smaller 25bp cut, we expect the Bank to deliver another 50bp cut at its next meeting."

Here's what prices have been rising and falling

If you're more of a visual person, here's a chart of how prices in different categories moved over the year through October:

Analyst says stubborn inflation numbers mean delay to rate cuts

Sean Langcake from BIS Oxford Economics says people will have to remain patient waiting for a rate cut.

That's after the RBA's preferred measure of underlying inflation, the trimmed mean, increased to 3.5 per cent annually in October, despite the headline inflation rate remaining steady.

You can watch that full interview with Alicia Barry here:

Loading...Court docs reveal flaws in Environmental Defenders Office case

Federal Court documents have revealed questionable tactics by the Environmental Defenders Office (EDO) in its failed attempt to block Santos's $5.8 billion Barossa gas project in the Tiwi Islands.

During the court case, Justice Natalie Charlesworth described the EDO's evidence as "distorted and manipulated", and said staff misrepresented Traditional Owners.

Santos petitioned the Federal Court in April to compel four environmental groups to reveal their communications with the EDO. Those documents were obtained by The Australian which said they revealed the EDO created a rainbow serpent and crocodile man songline map with little consultation with Traditional Owners and that maps and a cultural report were sent to the EDO lawyers to be edited before they met with Tiwi Islanders.

Australian Energy Producers CEO Samantha McCulloch says the revelations prove the EDO prioritises activism over representation and has urged the government to halt the group's $2 million annual funding.

"At a time when Australia urgently needs new gas supply, it is unacceptable for these tactics to undermine energy security and economic stability," she said.

Aussie dollar, ASX unaffected by inflation data

Checking in on how the share market is tracking in the wake of that latest inflation data — it remains higher, with the ASX 200 up about 0.6 per cent.

Looking at the currency, the Australian dollar is also fairly steady about 64.7 US cents — so despite headline inflation coming in slightly cooler than anticipated, it isn't moving markets much.

Inflation steady in October, at lowest annual rate since July 2021: ABS

Here's some commentary from the Australian Bureau of Statistics head of price statistics Michelle Marquardt:

"Annual inflation was steady at 2.1 per cent in October and remains the lowest annual inflation since July 2021…

"The falls in electricity and fuel had a significant impact on the annual [consumer price index] CPI measure this month.

"When prices for some items move by large amounts, measures of underlying inflation like the CPI excluding volatile items and holiday travel, and the trimmed mean can provide additional insights into how inflation is trending.

"Annual trimmed mean inflation was 3.5 per cent, up from 3.2 per cent in the previous month and similar to where it was in August.

"The CPI excluding volatile items and holiday travel was 2.4 per cent in the 12 months to October, down from 2.7 per cent in September."

Emilia Terzon is across the story and we'll be bringing you plenty more detail and analysis throughout the next few hours:

Trimmed mean inflation rises to 3.5 per cent in October

Falls in electricity and petrol prices were big contributors to the inflation rate remaining steady in October.

The Reserve Bank closely follows underlying measures of inflation, including the trimmed mean — which "reduces the impact of irregular or temporary price changes", according to the ABS.

The trimmed mean inflation rate rose to 3.5 per cent for the 12 months through October, up from 3.2 per cent in September, as it excluded both fuel and electricity price falls.

So that puts it further above the RBA's 2-3 per cent inflation target band.

Largest monthly fall on record for electricity prices

Here's some more detail from the ABS monthly consumer price index — and electricity subsidies saw power prices significantly lower in October:

Electricity prices fell 35.6% in the 12 months to October, down from a 24.1% annual fall in September. This is the largest annual fall for the monthly Electricity series on record.

The combined impact of Commonwealth Energy Bill Relief Fund (EBRF), rebates in all States and Territories and State Government rebates in Queensland and Western Australia, drove the fall in electricity prices.

Inflation rate remains at 2.1 per cent in October

Australia's inflation rate came in at 2.1 per cent for the year to end of October, slightly lower than expectations and the same as in September.

The Australian Bureau of Statistics says the most significant price rises were food and non-alcoholic beverages (+3.3%), recreation and culture (+4.3%), and alcohol and tobacco (+6.0%).