ASX 200 closes at all-time high, US judge rejects Elon Musk's $US56 billion pay package again — as it happened

The ASX 200 closed at an all-time high, as Woolworths flagged a financial hit from strikes and Metcash shares surged.

Catch up on the day's events and insights as they unfolded our live business blog.

Disclaimer: this blog is not intended as investment advice.

Submit a comment or question

Live updates

Market snapshot

ASX 200: +0.56% to 8,495 points (close)

Australian dollar: +0.03% at 64.73 US cents

S&P 500: +0.2% to 6,041 points

Nasdaq: +1% to 19,407 points

FTSE 100: +0.3% to 8,312 points

EuroStoxx 50: +0.9% to 4,846 points

Spot gold: +0.19% to $US2,644/ounce

Brent crude: +0.24% at $US72/barrel

Iron ore: -0.11% to $US105.3/tonne

Bitcoin: +0.83% to $US96,194

Prices current around 5:10pm AEDT

Live updates on the major ASX indices:

That's it for today

Thank you for joining us today.

We'll be back tomorrow with more business and markets coverage, and to cover the September quarter GDP figures when they're released at 11:30am AEDT.

Until then, take care of yourselves.

LoadingBest and worst performers

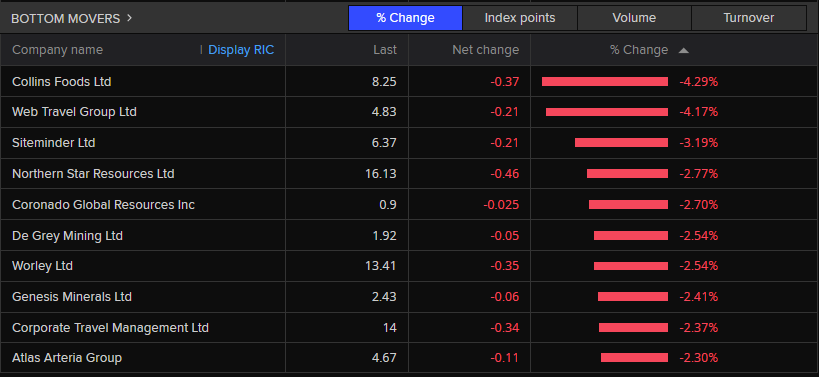

Metcash was the top performing stock today, jumping 7.52% to $3.43. It was followed by Star Entertainment, which jumped by almost as much (+7.14% to 22.5 cents), and Block Inc (+5.82% to $143.94 a share).

Collins Foods was the worst performing stock today, shedding 4.29% to $8.25 a share. It was followed by Web Travel (-4.17% to $4.83) and Siteminder (-3.19% to $6.37).

ASX gains 0.56pc to close on all-time high

Trading has closed on the ASX.

The ASX200 index gained 47.30 points today (+0.56%), to close on 8,495 points - an all-time closing high.

It broke through the 8,500 point barrier for the first time in history today, and at one point it was sitting above 8,514 points.

How many banks are there in Australia? More than 100, but the number is declining

The Council of Financial Regulators has released an issues paper this afternoon.

It's seeking "stakeholder views" in relation to small and medium banks in Australia.

It says stakeholders who wish to provide feedback should make a submission to the CFR by email by 7 February 2025.

I've attached the issues paper below.

It contains an interesting snapshot on the state of Australia's banking system:

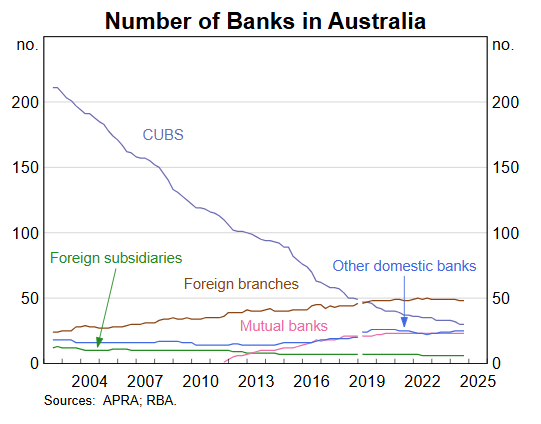

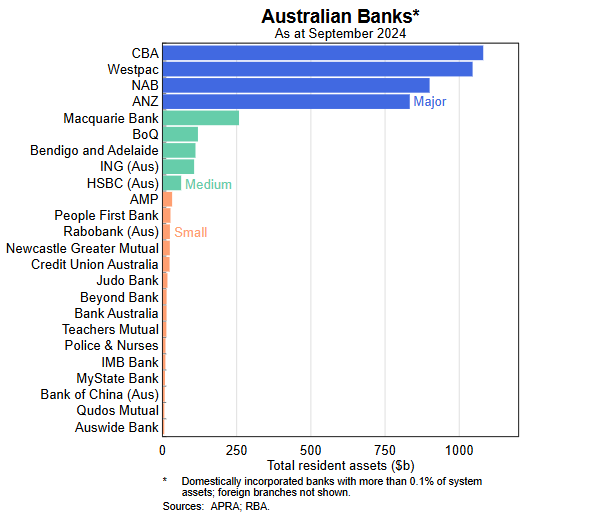

- Australia’s 131 banks differ in size by several orders of magnitude.

- Collectively, the 4 major banks account for around 72% of banking system assets, down from their recent peak of 77% in 2015.

- There are 5 medium banks in Australia with a joint market share of 12%; this group includes most banks commonly referred to as mid-tier or regional banks. The medium banks’ market share had expanded around 3 percentage points in the 5 years preceding Australia and New Zealand Banking Group’s (ANZ’s) acquisition of Suncorp Bank (a medium bank) in July 2024.

- The 74 smallest banks make up 6% of the banking system and are mostly mutual institutions; the number of mutual institutions has fallen from over 200 in the year 2000 as credit unions and building societies (CUBS) have consolidated.

- Foreign branches – of which there are 48 – make up around 9% of the banking system and mostly serve wholesale customers.

The Australian banking system has more than $5 trillion in resident assets (around 200% of GDP). It is similar in size, relative to GDP, to the banking systems in Canada and the euro area.

But the graphs below tell the story of how the number of banks in Australia has fallen significantly in the past 20 years.

The consolidation occurred largely through mergers and acquisitions within the sector, motivated in part by the potential for increased profitability and benefits from increased scale and scope:

CUBS refers to credit unions and building societies.

Are you an aspiring first home buyer?

If you're actively looking to buy your first home, but having trouble finding something you can afford, I'd like to speak with you.

I'm especially keen to find out what effects delays in attaining home ownership is having on your life plans, such as starting a family or a business, where to live, or what job you do.

This would be part of a podcast project I'm working on for next year.

LoadingThe best way to get in touch would be to fill in the contact box below and in the "why are you contacting us section" select news tip or story contribution and then that you are a prospective first home buyer interested in the housing podcast project.

I know the link below appears as "just a moment" in the blog, but it really does take you to our business team contact form if you click on it.

Council of Financial Regulators takes note of potential risks to financial system

The Council of Financial Regulators held its regular quarterly meeting yesterday (2 December).

The Council is the main coordinating body for Australia’s financial regulators, bringing together the Australian Prudential Regulation Authority (APRA), the Australian Securities and Investments Commission (ASIC), the Australian Treasury and the Reserve Bank of Australia (RBA).

The Reserve Bank has released the Council's quarterly statement on its website this afternoon.

Here are two themes it discussed at yesterday's meeting:

Systemic risks and vulnerabilities

The Council discussed a range of current and emerging risks and vulnerabilities that could lead to, or amplify, financial instability in Australia.

The discussion also covered longer-run structural trends for the Australian financial system relating to digitalisation, the environment, and the evolving international security landscape.

In this context, the Council noted that there would be a range of systemic risks and vulnerabilities in focus for the year ahead, including in particular:

- Geopolitical risks. Heightened geopolitical tensions are already leading to economic and financial fragmentation, and a further deterioration in the international security environment remained a risk for the global economy and financial system;

- Operational vulnerabilities.These included the challenges associated with cyber threats and managing dependencies on third-party service providers. The increasing digitalisation of financial services and the nature of operational connections across the financial system were likely to make these vulnerabilities more challenging to manage over time;

- Liquidity risk.The Council noted the potential for liquidity shocks to be amplified through the financial system. The potential for rapid deposit runs had been highlighted by international events in 2023. It was also noted that there are increasing interconnections between the banking and superannuation sectors, which can increase contagion risk;

- High household leverage. Consistent with their long-standing focus on household debt in Australia, CFR agencies continue to closely monitor and assess developments in this area;

- Climate change. Understanding, measuring and preparing for the effects of both the physical and transition risks of climate change is a key priority for the financial system, in line with the Government’s sustainable finance strategy.

Geopolitical risk

The Council noted that geopolitical risk is increasingly cited as a principal concern for regulators and industry internationally, and is likely to fundamentally characterise global affairs for some time.

Heightened international tensions create the potential for adverse effects on the economy and financial system, including from cyber threats and conflicts.

In this context, the Council agreed to a work program that would support member agencies and industry to strengthen the resilience of the financial system.

The Council also noted that there are a number of related initiatives already in train to reinforce financial system resilience, including the implementation of APRA’s operational risk standard and new crisis management powers for financial market infrastructures (FMIs).

Bouquet

Luci Ellis always makes sense when interviewed. Calm and collected. She needs to speak more.

- Allan P

A thought from Allan P.

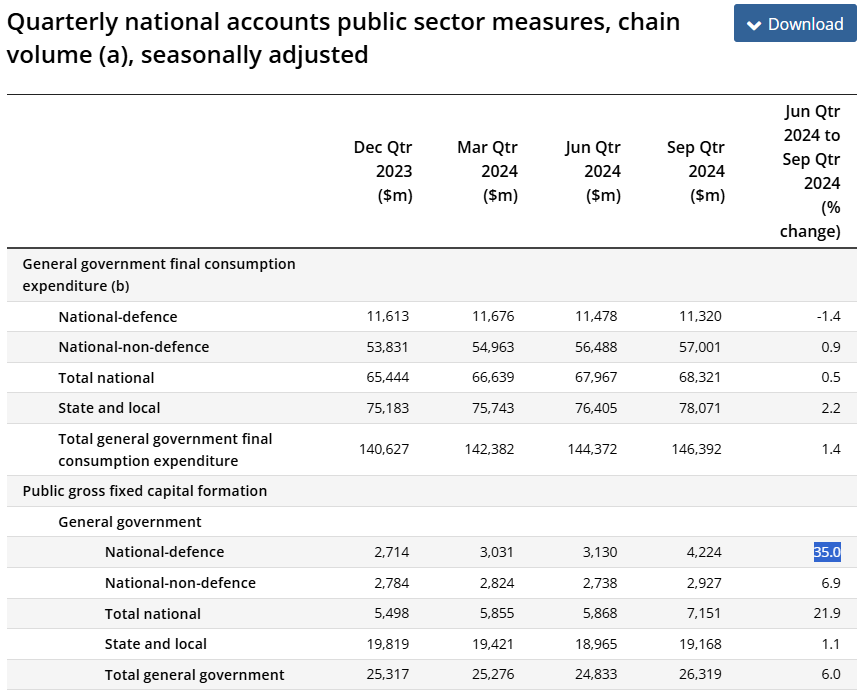

Huge increase in Commonwealth defence investment to support GDP growth

CBA economist Belinda Allen says when the September quarter GDP figures are released tomorrow we'll see that the public sector "will again be the dominant driver of economic growth."

She has circulated a note looking at this morning's ABS data on government finance in the September quarter, which showed how the total volume of public demand was 2.4% higher in the September quarter, and 4.2% larger than a year ago.

But Ms Allen says public investment stood out in the figures, in terms of strength, rising by 6.3% in the quarter.

And she says Commonwealth defence investment was the main driver of the growth, up a massive 35%.

"Even excluding defence spending though, national investment was still 6.9% higher in the quarter," she said.

"State and local government investment spend increased by 1.1%."

"Total public investment will contribute 0.36 percentage points to growth in the quarter," she said.

You can see those figures below:

Banks welcome new anti-scam measures for text messages

The Australian Banking Association has welcomed a federal government move to force telcos to check whether text messages claiming to be from certain organisations have actually come from their registered numbers.

"Impersonating banks, government agencies and popular brands in text messages is a common method used by scammers to deceive customers," noted the ABA's CEO Anna Bligh.

"This register will be crucial to stopping SMS impersonation scams in their tracks before they can cause harm to Australians.

"By requiring telcos to block known scam SMS numbers, Australia will have a new weapon to disrupt a popular business model that scammers use."

What's next for Elon Musk's Tesla pay case?

A US judge has ruled that Tesla cannot give Elon Musk a $US56 billion compensation package despite a vote in support of the CEO's pay deal by the company's shareholders.

So, what's going to happen now?

Here's an explainer from Reuters on what could come next for Tesla and its billionaire boss, who is still seeking a huge payday from the company:

What does Musk want?

Musk told a special committee of the Tesla board soon after a judge voided his compensation in January that he wanted a similar-sized replacement package, according to a securities filing.

In addition, earlier this year he said on his social media platform, X, that he wanted a larger stake in Tesla or he might develop some products outside the company. Musk's other companies include rocket venture SpaceX and Neuralink, which develops brain implants.

Tesla could appeal the ruling

Musk and Tesla's board could appeal and try to reverse the ruling at the Delaware Supreme Court, a process that typically takes around a year.

The case, which involved the largest-ever pay deal at a US public company, raises issues that have rarely been addressed by Delaware judges, adding uncertainty to an appeal.

For example, the trial court judge, Chancellor Kathaleen McCormick, found that Musk controlled the compensation negotiations, even though he owned only about 22% of Tesla's stock.

In addition, Tesla has acknowledged that the June vote by shareholders to ratify Musk's pay was a "novel" legal tactic and has said it was unclear how it would be treated under Delaware law.

Tesla could devise a new plan

Tesla's board could craft a new pay package, although that could be very expensive.

The original plan, agreed to by Musk and the company in 2018, awarded him stock options if the company hit very aggressive performance and financial targets.

The stock options allowed Musk to buy Tesla stock priced at the 2018 level.

The company exceeded the targets, and Tesla's stock has risen 10-fold since then, making the options incredibly valuable.

Tesla booked a cost of $US2.6 billion when the 2018 plan went into effect.

The company has said that a replacement plan for the same cost today would likely have to be less than 10% of the size of the 2018 plan.

Could Tesla just revise the old plan?

Tesla could offer Musk the same 304 million stock options with the same $US23.34 exercise price used in the 2018 plan.

If shareholders wanted to challenge that, they would have to sue in Texas, where the company reincorporated this year, rather than the Court of Chancery in Delaware.

But the company cannot escape accounting and tax implications.

Tesla said putting the old plan back in place would require the company to take a $US25 billion charge, according to securities filings.

In addition, because the stock options would be incredibly valuable from the moment they are issued, they would be treated unfavourably for tax purposes as income.

Musk could be taxed at the highest rate and pay a 20% penalty, meaning authorities could tax his new plan at 57%, according to an analysis by Schuyler Moore of Greenberg Glusker Fields Claman & Machtinger.

Musk could try to settle the lawsuit

Musk could try to settle the lawsuit, which was brought by a Tesla shareholder, and accept a smaller portion of his pay package.

However, that would contradict his track record of taking cases to trial rather than striking deals, even in the face of huge potential liability.

It is unclear how McCormick would view a settlement at this stage in the litigation.

Reuters

Strong public demand, weaker exports, no change to GDP

ANZ economists Adelaide Timbrell and Sophia Angala have their own take on tomorrow's September quarter GDP numbers.

They say after this morning's ABS releases on the balance of payments and government finances, their forecast for tomorrow's Q3 GDP is unchanged.

Why?

Because net exports have ended up contributing a little less to Q3 GDP growth than expected (0.1 percentage points versus ANZ's forecast and the market consensus of 0.3 percentage points); and public final demand was stronger than expected, contributing 0.7 percentage points to GDP growth in the quarter versus ANZ's expectation of 0.4 percentage points.

Therefore: "Our forecast is still for 0.5% quarter-on-quarter GDP growth, but with some upside risk."

Could growth in September quarter GDP be stronger than expected?

The ABS is releasing Australia's September quarter GDP numbers tomorrow.

Citi economists Josh Williamson and Faraz Syed have just circulated a note saying the number could be stronger than expected.

Here's their summary:

Our running estimate of tomorrow's GDP growth has been upwardly revised from 0.2% quarter-on-quarter to 0.7% thanks to a large public sector contribution to growth stemming from increased subsidies for households, ongoing capital works and spending on green energy projects.

If our view is correct, there is likely some upside risks to RBA's year-end growth forecast of 1.5%.

Tomorrow's result is also expected to show a rebound in household consumption growth.

And along with strong public sector growth, it would suggest that the RBA's soft landing would remain intact and rule out chances of a near-term rate cut.

The use of fees to change customer behaviour

Commbank seems to be going back to charges that were common back in the 1990s & 2000s (my Gran used to play the little 'ole lady when heading into her local Bank of Melbourne branch...she wasn't charged the branch fee when ATMs were free. BTW...it wasn't like she couldn't use the ATM, it's just she didn't want to). But this time the ATM is excluded. Oh well....it's easy enough to move your bank accounts around.

- allan

Thanks Allan.

Why are Metcash shares surging today?

Shares in Metcash are up 6.9 per cent at the moment, which is their best gain since last June, according to Reuters.

The reason appears to be positive analyst reaction to the grocery distributer's half-year results, released yesterday.

Citi has upgraded its view on the stock to a "buy" and increased its price target.

Jefferies says Metcash's food margin was "very strong despite disinflation and increasing competitive intensity".

In the update yesterday, Metcash said it had maintained its market share in food and hardware (it supplies IGA and Mitre 10, among others) and increased its share of the liquor market (its brands include The Bottle-o and Cellarbrations).

Here's how Metcash shares have tracked since the start of 2024:

Why some CommBank customers will have to pay $3 to withdraw their own cash

Hello from me! I'm popping in with an interesting update from Australia's biggest bank, the Commonwealth Bank.

They've quietly announced some changes to their "Complete Access" accounts that will see all customers transferred over to "Smart Access" accounts instead.

The biggest change that will involve? Customers will be charged a $3 fee to withdraw cash from their own accounts, should they get cash out at a bank branch or a post office.

(Getting cash out at an ATM will avoid the fees altogether.)

The changes will come into effect from January 6 next year. For more, you can read the full story below:

Delaware judge rejects Musk's $US56 billion Tesla pay again (and meanwhile, the pay has almost doubled)

Here's an interesting story from Reuters:

A Delaware judge ruled on Monday that Tesla CEO Elon Musk still is not entitled to receive a $US56 billion [$86 billion] compensation package despite shareholders of the electric vehicle company voting in June to reinstate it.

The ruling by the judge, Chancellor Kathaleen McCormick of the Court of Chancery, follows her January decision that called the pay package excessive and rescinded it, surprising investors and casting uncertainty over Musk's future at the world's most valuable carmaker.

Musk did not immediately respond to an emailed request for comment. Tesla in a statement on X said, "The ruling is wrong, and we're going to appeal," saying that the judge had overruled a supermajority of shareholders.

Musk and Tesla can appeal to the Delaware Supreme Court as soon as McCormick enters a final order, which could come as soon as this week. The appeal could take a year to play out.

Tesla has said in court filings that the judge should recognise a subsequent June vote by its shareholders in favour of the pay package for Musk, the company's driving force who is responsible for many of its advances, and reinstate his compensation.

McCormick said Tesla's board was not entitled to hit "reset" to restore Musk's pay package.

"Were the court to condone the practice of allowing defeated parties to create new facts for the purpose of revising judgments, lawsuits would become interminable," she said in her 101-page opinion.

She said a ratification vote like the one used by Tesla had to be conducted before the trial and a company cannot ratify a transaction involving a conflicted controller. She had determined Musk controlled the pay negotiations.

She also said Tesla made multiple material misstatements in its proxy statement regarding the vote, and could not claim the vote was a "cure-all" to justify restoring Musk's pay.

Tesla shares fell 1.4% in after hours trade, after the ruling.

Gary Black, managing partner of The Future Fund, which owns Tesla stock, said on X that he believed the Delaware Supreme Court was more pragmatic than McCormick. "I doubt this ruling will be resolved anytime soon, and it will likely be overturned by a more moderate court along the way," he wrote.

The pay package had awarded Musk stock options if the company hit performance and valuation goals.

While the award originally was valued at up to $56 billion, Tesla's shares have surged 42% since Nov. 5, when Republican candidate Donald Trump, supported by Musk, won the U.S. presidential election.

Following that rally, the pay package is worth about $US101 billion.

Total value of residential dwellings surpasses $11 trillion

The Bureau of Statistics has released September quarter data on Australia's residential dwellings.

It says the value of Australia's residential dwelling stock increased by $156.3 billion in the quarter.

That means the total value of our residential dwellings has increased from $10.9 trillion (June quarter) to $11.09 trillion (September quarter).

It's the first time that the total value of residential dwellings has surpassed $11 trillion.

The number of residential dwellings rose by 53,100 in the September quarter (to 11,252,600).

The mean price of residential dwellings rose by $9,300 (to $985,900).

The mean price of residential dwellings in New South Wales ($1,233,600) remains the highest in the country, followed by the Australian Capital Territory($951,800).

Queensland ($915,700) now has the third-largest mean price in the country, while the lowest mean price remains in the Northern Territory ($531,100).

Strike has cost Woolworths $50M in sales? That's just a start

Here's where the pressure builds.

Woolworths wants to sell food.

But it's failed to reach an agreement with one of the unions that represents workers at its distribution centres (DCs), the United Workers Union.

The UWU has stepped through the onerous legal hoops to begin industrial action, an indefinite strike that is now in its 12th day.

(Workers on strike are not paid, but have legal protections from being sacked or targeted later for their action).

In a statement to the stock exchange, the supermarket giant says it has lost $50 million in sales to December 2.

Each of the DC has a separate enterprise agreement, and part of the union's claim is for pay increases in excess of 25% over three years, well above inflation, that would get workers paid the same for similar work - no matter what site they're at.

They're also seeking an end to what's called the "framework". It's a set of algorithm-designed rules that dictate how fast staff should be, for example when picking online orders.

The union says the speed required will lead to safety issues in a busy centre filled with trucks, forklifts and heavy loads.

The supermarket disagrees:

"The UWU is also demanding there be 'no enforceable performance standard or rate' which would preclude Woolworths Group's ability to manage productivity. The use of labour standards to manage productivity is common practice in supply chains globally and in Australia."

As the dispute continues, Woolworths customers are seeing empty shelves, particularly in Victoria. An emerging issue for the company is that shoppers in the Christmas period tend to spend up. Many of the items they purchase have a greater margin than normal products.

So if shelves look empty, people are more likely to take their entire shop to a competitor, and $50M starts to look like a small amount compared to mounting future losses from an indefinite throttling of Woolworth's ability to keep products in stock.

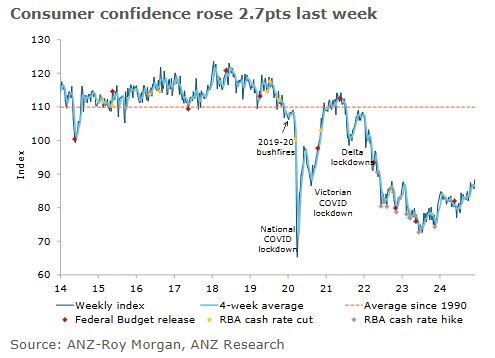

Consumer confidence highest since May 2022... is the Christmas spirit kicking in?

New data suggests consumer confidence is up.

But there's a but.

First, here's ANZ economist Sophia Angala on the new info.

"ANZ-Roy Morgan Australian Consumer Confidence rose +2.7 points last week to 88.4 points, its highest level since May 2022. The rise in confidence was seen across most sub-indices."

There are different questions asked to see how people feel.

Households’ economic outlook over the next year declined 0.8 points, but the '[is it] time to buy a major household item' sub index ticked up 7.5 points off the back of Black Friday related sales.

However, we're off a very weak base as this graph of the data shows.