Australian dollar hits four-month low, ASX falls as third-quarter GDP data disappoints — as it happened

Australian stocks have ended lower and the local currency has fallen sharply to a four-month low after third-quarter GDP came in lower than expected.

Here's how the session unfolded, plus insights and analysis from our business reporters, on the markets blog.

Disclaimer: this blog is not intended as investment advice.

Live updates

Market snapshot

- ASX 200: -0.4% to 8,462 points (live values below)

- Australian dollar: -0.6% to 64.44 US cents

- S&P 500: Flat at 6,049 points

- Nasdaq: +0.4% to 19,480 points

- FTSE: +0.6% to 8,359 points

- EuroStoxx: +0.5% to 504 points

- Spot gold: +0.3% to $US2,650/ounce

- Brent crude: +0.3% to $US73.82/barrel

- Iron ore:+ 0.5% to $US105.10/tonne

- Bitcoin: +0.4% to $US96,423

Price current around 4:35pm AEDT.

Live updates on the major ASX indices:

That's a wrap

Thanks for staying with us today… that was a pretty busy one!

So I'd highly recommend tuning into The Business tonight for your 15 minute summation of what went down today.

And we have lots of stories for you on the business page as always, including on Commonwealth Bank's fee backdown and economic growth disappointing.

David Chau will join you bright and early tomorrow as your blogger!

LoadingComing up on The Business

A busy, busy show coming up!

We'll feature senior leaders from two of Australia's biggest publicly listed companies:

- Woolworths' CEO Amanda Bardwell with an apology to customers for empty shelves

- and CBA's Retail Banking Group boss Angus Sullivan announcing a temporary reversal of plans to charge some customers a $3 fee to withdraw cash from bank branches.

Also:

- Rhiana Whitson will take an in-depth look at the national accounts and how the economy's further slowdown is impacting Australians

- The Minderoo Foundation commits $100 million to the nation's first all-women investment trust

- and Finance Minister Katy Gallagher ahead of MYEFO with hints on further cost of living relief

Tune in! ABC News channel at 8.44pm, after the late news on ABC TV, and anytime on ABC iView.

ASX ends lower, led by real estate and bank stocks

The local share market has ended in the red, with the ASX 200 losing 0.4 per cent.

Most sectors lost ground, led by falls for real estate and financials. Materials and energy rose.

Here are the biggest percentage moves on the benchmark index:

Top 5

- Lynas (+5%)

- Guzman Y Gomez (+5%)

- Champion Iron (+2.9%)

- Newmont (+2.8%)

- Evolution Mining (+2.5%)

Bottom 5

- Star Entertainment (-6.7%)

- Fletcher Building (-5.5%)

- Audinate Group (-5.3%)

- Coronado Global (-4.4%)

- Mineral Resources (-4.2%)

Woolworths CEO apologises to its customers as strike drags on

Good afternoon!

Woolworths CEO Amanda Bardwell has been doing TV interviews today as the workers' strike impacting stock levels (on everything from nappies to tofu!) particularly in Victorian stores drags on into two weeks.

Now even the company's liquor arm is impacted, with some Dan Murphy's stores having issues getting booze.

And the company has disclosed it's so far lost $50m in sales.

Here's a section of my interview with Ms Bardwell today, where she apologised to customers and said Woolworths didn't expect this situation to drag on so long.

Loading..."We were certainly hopeful that we could reach an agreement with the UWU and that we'd be able to get those products back on the shelves for our customers earlier than we've been able to. We're working day and night, to be able to find a pathway through so that we can have our team back to work and those products back on the shelves for customers."

"We're continuing to work really hard to try and manage those product availabilities for our customers. We've got truck deliveries coming to our stores. We're servicing from our 20 DCS across the country into Victoria in particular, we do know that our customers are experiencing shortages in many of those products, those everyday essentials, and we're incredibly sorry for the disruption that this has caused for our customers in their everyday lives.

"We're certainly hopeful that we can reach an agreement with the UWU. It is three weeks to Christmas. It's an important time for many families, and rightly so, we want to be able to make sure that all of those Christmas favorites are on our shelves."

You can watch more of the interview on ABC's The Business tonight.

'Not all bad news' from GDP: ANZ

GDP per capita fell for the seventh straight quarter, the latest ABS figures show.

But ANZ senior economist Adelaide Timbrell said it wasn't all bad news, with households saving more and disposable income rising.

She spoke with Nadia Daly:

Loading...Aussie dollar continues to slump, hits 4-month low

The disappointing economic growth figures have continued to pack pressure on the Australian dollar through the afternoon.

It's down around 0.9 per cent to 64.2 US cents at the moment, and at one point was down as much as 1.2 per cent.

According to Reuters, market pricing has shifted to a first interest rate cut in April instead of May, while the chance of a move in February shifted to 44%, from 27%.

Finance Sector Union responds to CBA charge changes

The Finance Sector Union (FSU) on the Commonwealth Bank's decision to hold off on changing some customers to accounts that would've seen them hit with a $3 fee to withdraw cash at branches.

90 per cent of customers who have legacy 'Complete Access' CBA accounts (new accounts haven't been offered since 2016) will be migrated over by January as planned, as the bank says they will be better off or in the same position, based on their banking behaviour.

However, 10 per cent of customers will now remain in Complete Access accounts until CBA consults with them.

"Today's partial backflip from the Commonwealth Bank on their $3 fee for over the counter cash withdrawals confirms the need for stronger regulation on banks, especially to recognise that accessing cash is an essential service," FSU national secretary Julia Angrisano said.

"To even consider charging a fee for branch withdrawals is offensive and should never be implemented.

"While the bank claimed this decision would have only impacted 10% of their customer base, experience has shown that fees get introduced to one group and then ramped up to affect more people over time, which is what we still fear will happen here."

Govts 'lone heroes' of Q3 GDP: Moody's Analystics

It was government spending and investment that propped up economic growth in the third quarter.

Household spending was flat and the savings rate rose.

Here's what Harry Murphy Cruise, the head of China and Australia economics at Moody's Analytics made of it:

"The Aussie economy remains in the slow lane as sky-high borrowing costs and structurally higher prices zap spending…

"Governments were the lone heroes of the September quarter.

"For starters, a surge in defence-related spending pushed new public investment up 5.3% q/q—the strongest jump since 2018.

"What's more, governments across the country picked up the tab for a chunk of household spending, notably via electricity rebates and cuts to public transport.

"Those cost-of-living measures helped push government consumption up 1.4% from the June quarter.

"All up, public demand added 0.6 percentage points to the quarter's growth.

"The government spending splurge kept household consumption a little lower than it otherwise would be.

"In effect, the cost-of-living measures took a chunk of what would usually be considered household spending (paying electricity bills and public transport fares) and put it on governments' books.

"That switcheroo, combined with tax cuts, freed up finances that could have been used on other goods and services.

"But households chose not to loosen the purse strings; instead, they funnelled the savings into bank accounts and paid down mortgages.

"That kept household spending flat through the September quarter and pushed the household saving ratio to its highest since the end of 2022."

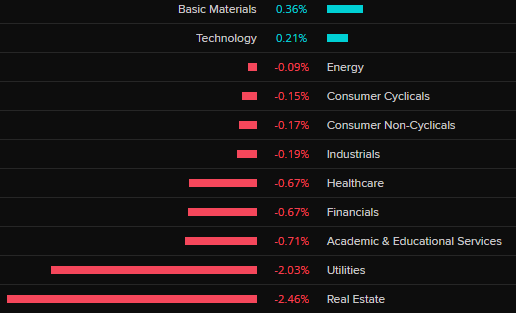

ASX remains in the red mid-session

After touching record levels above 8,500 points during yesterday's session, the ASX 200 has retreated today, down around 0.6 per cent at the moment.

Here's a look at how the sectors are tracking mid-way through the session:

The top-performing stocks so far are:

- Lynas (+4.3%)

- Guzman Y Gomez (+3.7%)

- Zip Co (+3.5%)

- Champion Iron (+3.1%)

- Pro Medicus (+2.6%)

On the flipside, the biggest falls are for:

- Star Entertainment (-4.4%)

- Audinate Group (-4.1%)

- Fletcher Building (-4%)

- Coronardo Global Resources (-3.9%)

- AUB Group (-3.8%)

Market snapshot

- ASX 200: -0.7% to 8,438 points (live values below)

- Australian dollar: -0.5% to 64.52 US cents

- S&P 500: Flat at 6,049 points

- Nasdaq: +0.4% to 19,480 points

- FTSE: +0.6% to 8,359 points

- EuroStoxx: +0.5% to 504 points

- Spot gold: -0.04% to $US2,642/ounce

- Brent crude: -0.1% to $US73.55/barrel

- Iron ore:+ 0.5% to $US105.10/tonne

- Bitcoin: +0.2% to $US96,300

Price current around 1pm AEDT.

Live updates on the major ASX indices:

Australia's economy growing at slowest pace in decades

Ok, back to some non-bank programming:

Australia's economy grew by 0.3 per cent in the September quarter, and 0.8 per cent over the year, according to the Australian Bureau of Statistics (ABS).

It means the economy's annual growth rate has weakened even further from the extremely weak growth recorded in the June quarter.

Some economists were expecting the annual rate of growth to pick up from 1 per cent, but Wednesday's figures show the economy has continued to slow down since the middle of the year, to an anaemic 0.8 per cent.

As recently as three months ago, Treasurer Jim Chalmers was warning that the Reserve Bank's 13 interest rate rises were "smashing the economy".

Gareth Hutchens has all the details:

CBA pauses $3 fee plan for some customers

The Commonwealth Bank has paused its plans to charge some additional customers a $3 fee to withdraw their own money at bank branches around the country.

In a media conference called on Wednesday afternoon, the bank's head of retail banking services, Angus Sullivan, apologised for poorly communicating the decision.

Loading..."We feel that we didn't get the communication right on this, and we want to take a more individual approach," he said.

Mr Sullivan said the bank would pause the migration of its customers over to its 'Smart Access' accounts for six months for around 10 per cent of its customer base who are using the assisted fee withdrawal service, or would be "worse off" from the changes.

Read more from Kate Ainsworth here:

CBA recognises communication failure

Ok it's taking a few minutes to figure out exactly what CBA is announcing… but they have acknowledged they should have communicated with customers better.

As it stands, they have said

- Around 10 million customers have transaction accounts

- Only about 10 per cent or 1 million of those have a legacy 'Complete Access' account

- Approximately 90 per cent of those with 'Complete Access' accounts would be better off or in the same position if they moved to 'Smart Access' accounts — which charge the $3 assisted withdrawal fee

- Whether people would be better off was based on their banking behaviour in the last 6 months

- Those 90 per cent will still be moved as planned, but can call the bank if they want to discuss their options

- 10 per cent of 'Complete Access' customers who would have been in a worse position as a result of the migration will not be migrated in the next 6 months and will be contacted by the bank to discuss their options

What's the point of the $3 fee?

Business reporter and blog champion Kate Ainsworth has asked CBA what the business case was for the $3 fee in the first place, given the bank is emphasising that so few people use branches to withdraw cash anyway.

Angus Sullivan said the bank is trying to strike a balance between making sure those customers that bank digitally and use ATMs, which are lower cost services for CBA to provide, have lower fees, and providing services to people who want access to higher cost, assisted services.

6 month pause to CBA account changes

Ok it took a bit of clarification — but CBA's Angus Sullivan has confirmed that the bank will pause moving some customers out of "Complete Access" accounts for six months.

"We feel we could've done a better job communicating to customers," he said.

He said for around 10 per cent of transaction accounts that are "Complete Access", instead of migrating them to "Smart Access" accounts, which have a $3 fee for ""assisted withdrawal" through branches, Bank@Post or phone by January as announced yesterday, it will now be delayed.

Mr Sullivan said there would be other accounts with different fee options that may suit some people better, but most would've been better off moving to Smart Access accounts.

CBA will pause account migration for some customers

CBA's Mr Sullivan says the bank will pause the account migration it announced yesterday for some customers, but continue for others.

CBA speaking to the media about its account changes

You can watch it here:

CBA updating on $3 withdrawal fee

Commonwealth Bank retail banking executive Angus Sullivan is speaking on the account changes announced yesterday.

More details here from yesterday:

GDP growth is falling below the RBA's forecasts

The RBA's latest forecasts predict GDP would be 1% annually by June 2024 and reach 1.5% by December.

But going off today's numbers, Australia is trailing behind the June forecast with annual GDP growth to September sitting at just 0.8%.

Unless there is a bumper surge over Christmas, it is looking very unlikely the nation will reach 1.5% by end of 2024.