ASX closes higher as Aussie dollar remains near seven-months lows and Bitcoin passes $US100,000 — as it happened

Bitcoin has pushed through the $US100,000 barrier for the first time, while the Australian currency languishes near seven-month lows and the ASX ekes out modest gains.

Meanwhile, strong earnings from US tech companies drove Wall Street's main indices, the S&P 500 and Nasdaq Composite, to their highest levels ever, as investors shrugged off political turmoil in France and South Korea.

Here's how the day's trade unfolded, with insights from our business reporters, on the ABC News markets blog.

Disclaimer: this blog is not intended as investment advice.

Submit a comment or question

Live updates

Market snapshot

- ASX 200: +0.15% to 8,474 points

- Australian dollar: +0.1% to 64.33 US cents

- Nikkei: +0.4% to 39,443points

- Hang Seng: -1.1% to 19,552 points

- Shanghai: Flat at 3,367 points

- S&P 500: +0.6% to 6,086 points

- Nasdaq: +1.3% to 19,735 points

- FTSE: -0.3% to 8,336 points

- EuroStoxx: +0.4% to 517 points

- Spot gold: Flat at $US2,649/ounce

- Brent crude: Flat at $US72.23/barrel

- Iron ore: -0.9% to $US105.20/tonne

- Bitcoin: +5.6% to $US103,426

Prices current around 4:23pm AEDT.

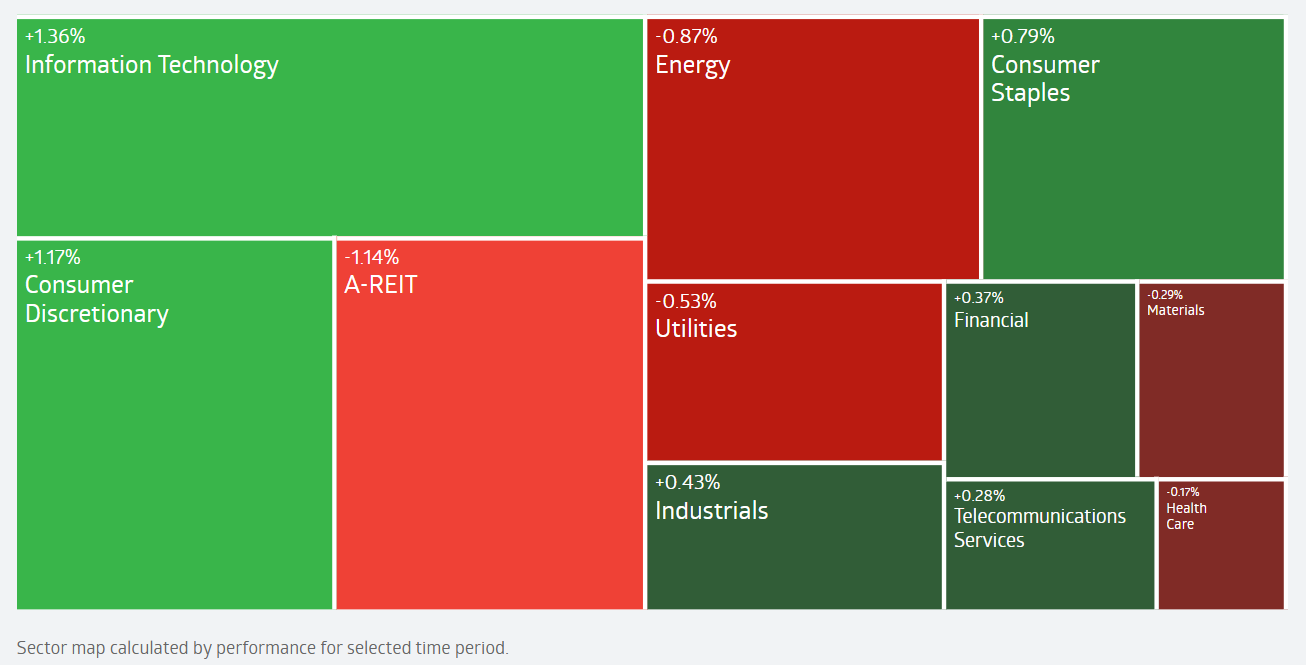

ASX closes higher, tech and consumer discretionary boost index

For those not so interested in bitcoin, here's an update on where things landed on the ASX 200 today.

The main index gained 12.30 points or 0.15% to 8,474.

The All Ordinaries rose 0.2 per cent.

The top performing stocks on the ASX 200 were Genesis Minerals and Ramelius Resources, up 9.13% and 8.53% respectively.

The ASX is currently 0.47% off of its 52-week high.

Six of the 11 sectors closed higher, with tech coming out on top.

On the tech front, Data#3 jumped 4.2% TechnologyOne jumped 2.8%, while WiseTech added 1.9%.

Consumer discretionary gains were led by Tabcorp, up 4.6%. Breville (+3.7%,) while Premier Investments climbed 3.6%.

Taking a look at the day's biggest gains and declines, miners dominated.

Update

Good afternoon,

The trading day may be coming to an end, but there's no end to our business coverage!

Tonight at 8:45pm on The Business, host Kirsten Aiken is speaking with Flight Centre boss Graham Turner who says a lack of competition in the domestic aviation market means no cost-of-living relief when it comes to airfares.

We discuss ticket prices, who's at the front of the plane, where they're going and who's not boarding at all.

And the program has ASIC Commissioner Alan Kirkland in the studio on why the regulator's got an eye on the insurers' complaints handling procedures.

Plus, Rachel Clayton on how the popularity of a new generation of weight loss drugs is reshaping entire industries.

It's a good one! Make sure you tune in on the ABC News Channel at 8:45pm or catch us on ABC iview .

Sorry Australia, you aren't getting clear plastic coins anytime soon

Hi team, just jumping in to pull back the curtain on how journalism sometimes works.

Governments buy (procure is the preferred term) lots of products and services.

Over a certain level of cost, departments have to go to a competitive tender, meaning the AusTender is a daily wild mix of opportunites for business.

Here are some of just the topline options today of what they're looking for:

- Cleaners for the CSIRO in Victoria

- A Gas Chromatograph High Resolution Mass Spectrometry (GC-HRMS) for the Department of Industry, Science and Resources

- The Defence Department wants tenders for the procurement of Human Target Lifters (HTL).

(I have absolutely no idea what that is, but is certainly sounds dangerous).

So I was excited to see an approach to market for "the provision of optically clear injection moulded plastics for coins".

Clear coins! Or bits of clear in coins!

That would be very different and certainly interesting to people, even as the use of cash declines.

Sadly, it's duller than that - it's for the plastic holders that go around collectable coins to keep them in best condition.

But I hope that gives you a sense of some of the dead ends we're sprinting down as we look for interesting and important news to bring to you.

Why Australia has a spike in mental health claims

There has been a sharp rise in the number of younger Australians leaving the workforce permanently because of mental health related diagnoses.

New research from the Council of Australian Life Insurers (CALI) and KPMG looked at a decade of life insurance data analysing both permanent and temporary disability claims.

The data shows an exponential rise in the number of people who are leaving the workforce for good because of their mental health.

More from the ABC.

Bill shock

Tried Bitcoin once mining dug a hole in the power bill not interested

- Pat

Hi Pat, what kind of numbers are we talking for the power bill?

Get Fabio on the line

In moments like these, one wonders what Fabio Panetta, a member of the European Central Bank's executive board, would be thinking.

In recent years Mr Panetta has delivered a series of speeches about cryptocurrencies.

He's not a fan.

Last year, he delivered a speech in Switzerland with the title: "Paradise lost? How crypto failed to deliver on its promises and what to do about it."

These were some of the points he made, quoted verbatim:

"Crypto has relied on constantly creating new narratives to attract new investors, revealing incompatible views of what crypto-assets are or ought to be.

"Crypto valuations are highly volatile, reflecting the absence of any intrinsic value. This makes them particularly sensitive to changes in risk appetite and market narratives.

"Due to their limitations, cryptos have not developed into a form of finance that is innovative and robust, but have instead morphed into one that is deleterious. The crypto ecosystem is riddled with market failures and negative externalities, and it is bound to experience further market disruptions unless proper regulatory safeguards are put in place.

"Unbacked cryptos lack intrinsic value and have no backing reserves or price stabilisation mechanisms. This makes them inherently highly volatile and unsuitable as a means of payment. Bitcoin, for instance, exhibits volatility levels up to four times higher than stocks, or gold.

"Such high volatility also means that households cannot rely on crypto-assets as a store of value to smooth their consumption over time. Similarly, firms cannot rely on crypto-assets as a unit of account for the calculation of prices or for their balance sheet.

"The very instability of unbacked cryptos does make them appealing as a means of gambling.

"Besides gambling, crypto assets are also being used for bypassing capital controls, sanctions and traditional financial regulation. A prime example is bitcoin, which is used to circumvent taxes and regulations, in particular to evade restrictions on international capital flows and foreign exchange transactions, including on remittances."

In July this year, he spoke at the Italian Banking Association's annual dinner, and he repeated some of those arguments in a condensed form:

"Crypto-assets are held by operators whose main objective is to sell them on at a higher price and, in some cases, to dodge tax rules or the regulations in place to counter money laundering and terrorist financing.

"In many cases, these crypto-assets are in effect akin to a gamble, a speculative high risk contract, whose value is not tied to fundamentals. For these reasons, their value fluctuates very sharply.

"Clearly, they do not possess the characteristics that make them suited to perform the three inherent functions of money: a means of payment, store of value and unit of account."

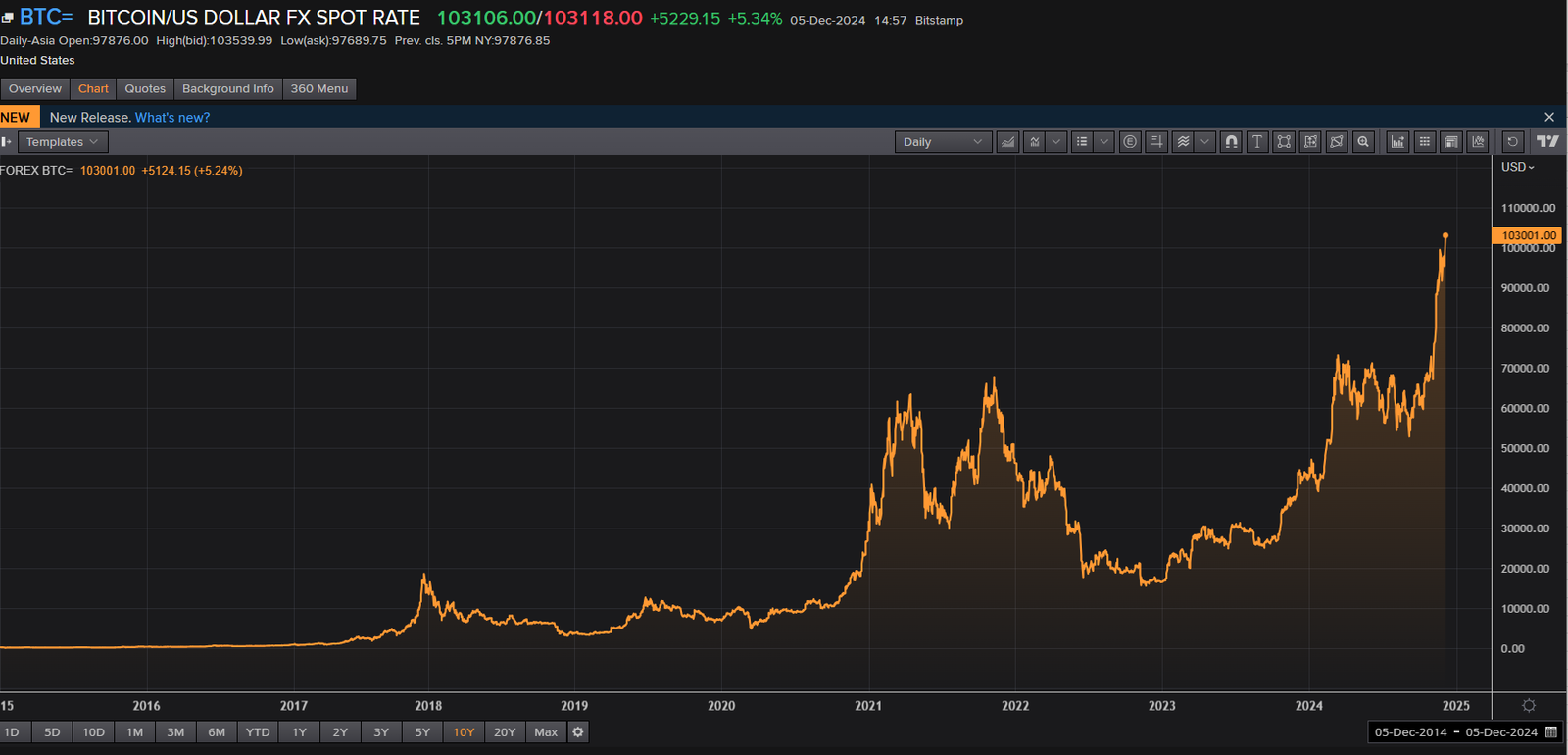

When Mr Panetta delivered that speech in Switzerland last year, the price of Bitcoin was sitting around US$30,000 (having fallen from its then-peak of almost US$70,000 in late 2021).

When he delivered his speech in July this year, the price of Bitcoin was sitting around $US65,000.

And now, five months later, the price of Bitcoin has cracked US$100,000 for the first time, after an almighty surge in value since Donald Trump's election win.

Here's a chart of Bitcoin's price stretching back more than seven years.

BHP Australia boss argues for environmental law overhaul

A story out from the ABC's chief digital political correspondent Jacob Greber about BHP Australia president Geraldine Slattery calling on the government to push ahead with new environmental laws.

In a speech at a Melbourne Mining Club function, Ms Slattery said a regulatory overhaul was needed, but it should start "with streamlining permitting, making it easier to deliver major projects."

Rio Tinto has been making similar calls for an overhaul of the existing Environment Protection and Biodiversity Conservation Act, which is 25 years old.

However, it is reported that neither global mining giant agrees with Labor's plans to establish an independent Environmental Protection Agency (EPA), and would prefer a system that keeps decision-making subject to intervention by governments rather than decided by bureaucrats.

On the one hand, ministers making decisions are subject to democratic accountability, which bureaucrats aren't (at least directly).

On the other, a cynic might observe that it's easier to (legally) influence politicians, such as through political donations, than it is to do so bureaucrats.

You can read Jacob's story via the link below:

Bitcoin's path the last 5 years is rocky but upwards

The path the last year has been pretty clear.

Worth noting that US$100,000 is worth $160,288 in Australian dollar terms.

More of our interview with Woolworths' CEO

You can watch it here on Instagram.

Sense of 'euphoria' and 'schadenfreude' from the Bitcoin community

This just in from Swyftx, which is an Australian crypto exchange.

“Bitcoin will pass other major milestones but $100,000 is a moment of history," the company's Jason Titman said in a press release.

"There is a sense of euphoria among local investors right now. This is a momentum rally. Pure and simple.

Local spot volumes are running at mid-pandemic levels and I suspect a lot of early Bitcoin adopters in Australia will be enjoying this moment of schadenfreude.

"In the end, the nomination of Paul Atkins as SEC chair was enough to tip Bitcoin past $100k."

Do you hold some Bitcoin? Are you holding or selling? Drop us a comment or email me on terzon.emilia@abc.net.au

Bitcoin is booming as a crypto crackdown looms

As Bitcoin hits US$100,000, take a look at this recent piece by our reporter Rhiana Whitson.

Bitcoin cracks $US100,000 as Donald Trump announces a pro-cypto regulator pick

The catalyst for the latest leg of Bitcoin's recent surge, which has carried the value of each bitcoin above $US100,000 for the first time, is Donald Trump's pick of Paul Atkins to head the Securities and Exchange Commission.

Mr Atkins, who is seen as crypto friendly, will replace outgoing SEC chair Gary Gensler, who has previously cracked down on various cryptocurrency trading activities.

"This is a momentum rally," Jason Titman, chief executive of crypto brokerage Swyftx, told Bloomberg.

"Global spot volumes are above mid-pandemic levels and the nomination of Paul Atkins as SEC chair just added to the carnival atmosphere."

Bloomberg reports that the overall value of all cryptocurrencies has jumped by roughly $US1.4 trillion since Donald Trump's US election win a month ago.

To give you some context, that's pretty close to the value of Australia's total economic output over the past year.

Bitcoin passes $US100,000 for the first time

Bitcoin, and many other cryptocurrencies, have been on a tear since Donald Trump's election to the White House for a second term as US president.

A 3%+ gain so far today has taken Bitcoin above $US100,000 for the first time in its history.

The price is extremely volatile second to second, but as I type this post it's sitting at $US101,227.

Market snapshot

- ASX 200: +0.15% to 8,474 points

- Australian dollar: +0.1% to 64.33 US cents

- Nikkei: +0.4% to 39,443points

- Hang Seng: -1.1% to 19,552 points

- Shanghai: Flat at 3,367 points

- S&P 500: +0.6% to 6,086 points

- Nasdaq: +1.3% to 19,735 points

- FTSE: -0.3% to 8,336 points

- EuroStoxx: +0.4% to 517 points

- Spot gold: Flat at $US2,649/ounce

- Brent crude: Flat at $US72.23/barrel

- Iron ore: -0.9% to $US105.20/tonne

- Bitcoin: +5.6% to $US103,426

Prices current around 4:23pm AEDT.

Live updates on the major ASX indices:

Teals want small business definition lifted to 25 employees

Teal MPs are proposing to cut "red tape" for smaller businesses in a pitch to owners, as a federal election looms.

Eight independents have joined a push to change the definition of "small business" from 15 employees to at least 25.

While a Fair Work Ombudsman review of the definition is currently underway, the crossbench group has written to Employment and Workplace Relations Minister Murray Watt.

Leading the charge is Wentworth MP Allegra Spender, who previously ran businesses including her family's fashion label Carla Zampatti.

Currently, she said businesses with 20 employees had to abide by the same laws as those with thousands despite not having the same HR staff.

"That just doesn't make sense," she said.

Read more here:

'Is the February door still ajar' for an RBA rate cut after weak GDP data?

GSFM's investment specialist Stephen Miller asked this question in a note today, and his answer is "yes".

"A deterioration in the labour market remains a non-trivial risk and one to which the RBA would certainly need to respond," he wrote.

"If, as I suspect, labour market outcomes and inflation outcomes are broadly in line with RBA forecasts (or inflation a little better and the labour market a little more fragile), then the RBA could conceivably cut rates in February.

"That would certainly be the case if (trimmed-mean) consumer price inflation is below the RBA's 3.4 per cent projection for the December quarter.

"Markets have recently started to push out the likelihood of the first cut in the policy rate to as late as May.

"Fair enough maybe, but I wouldn't rule out February…yet!"

But financial markets have changed their mind since yesterday's very weak GDP numbers, and now see a February rate cut as better than an even money chance.

According to Bloomberg, futures markets have a 56% chance of the RBA cutting rates by February, and a rate cut fully priced in by the RBA's April meeting.

Gareth Hutchens had a really good summary of the September quarter GDP data in this article from yesterday.

ASX trading higher at 1pm AEST

The benchmark is up 0.3% while the All Ords is the same.

The top performing stocks in the ASX 200 are West African Resources and Ramelius Resources, both up almost 7%.

Insurance industry responds to ASIC's accusations they're not doing great on dealing with customer complaints

The peak body for general insurers, the Insurance Council of Australia has responded to the ASIC report noted in an earlier post.

Here's the statement:

"ASIC’s report ‘Cause for Complaint’ reinforces many of themes from the insurance industry’s own review undertaken by Deloitte in 2023, the recent Parliamentary inquiry report, and the independent review of the General Insurance Code of Practice.

"Insurers have been investing in system improvements – both human and digital – and as a sector has been very focused on uplifting performance, including for complaints handling, in the face of larger, more frequent and more costly events.

"The performance of some insurers in this regard is noted by ASIC but it is clear that others need to do better.

"Any case where customer harm has taken place is unacceptable and where that has occurred, those insurers will be focused on understanding why and how this took place and the system improvements that are needed in the face of these findings.

"An initial industry response to the recent recommendations of the independent review of the Code of Practice and the Parliamentary Inquiry will be provided in coming weeks and senior industry stakeholders will closely consider ASIC’s report. Deloitte’s progress report will also be finalised in coming weeks."

Australian dollar at seven-month low

The Aussie dollar experienced a significant fall after yesterday's weaker-than-expected GDP figures.

Lately it's also been under pressure from a stronger greenback (which has surged ahead of Donald Trump's US election win).

Basically, markets are pricing in slower rate cuts from the US Federal Reserve (so rates will remain higher for longer in America).

Also, US inflation is expected to remain elevated (as Trump's policy to impose widespread global tariffs is likely to increase prices for American consumers).

The local currency is currently trading at 64.3 US cents, its weakest level since April 19.